John Ray III, the guy brought in to attempt to sort through the wreckage of FTX, has said that actually reviving the exchange as a functioning entity isn’t entirely off the table.

This may come as a surprise to many but according to a Wall Street Journal report, Ray has been considering turning on the switch back at FTX (which is in the midst of the Chapter 11 bankruptcy proceedings Ray is overseeing) in an effort to make users whole.

It would actually be very welcome news to those with funds stuck in limbo and have all but written them off.

FTX reported on Jan 17 that it had identified about US$5.5 billion of liquid assets in its investigations, with more than US$3 billion owed to its top 50 creditors.

The new FTX CEO is reportedly considering feedback from some stakeholders who still see the exchange as a “viable business”.

Here’s what the FTX founder and former CEO Sam “Does This Guy Ever Shut Up?” Bankman-Fried had to say about it…

I’m glad Mr. Ray is finally paying lip service to turning the exchange back on after months of squashing such efforts!

I’m still waiting for him to finally admit FTX US is solvent and give customers their money back…https://t.co/XjcyYFsoU0https://t.co/SdvMIMXQ5K

— SBF (@SBF_FTX) January 19, 2023

Bankman-Fried is facing eight criminal charges in the FTX case, including for alleged violations of campaign finance laws and wire fraud.

In any case, how’s the once highly successful FTX exchange token FTT faring on the news? Yep, it’s up – by 28% over 24 hours on the news. In fact, over a seven-day and fortnight timeframe, it’s up 71% and 126% respectively. What the?

Top 10 overview

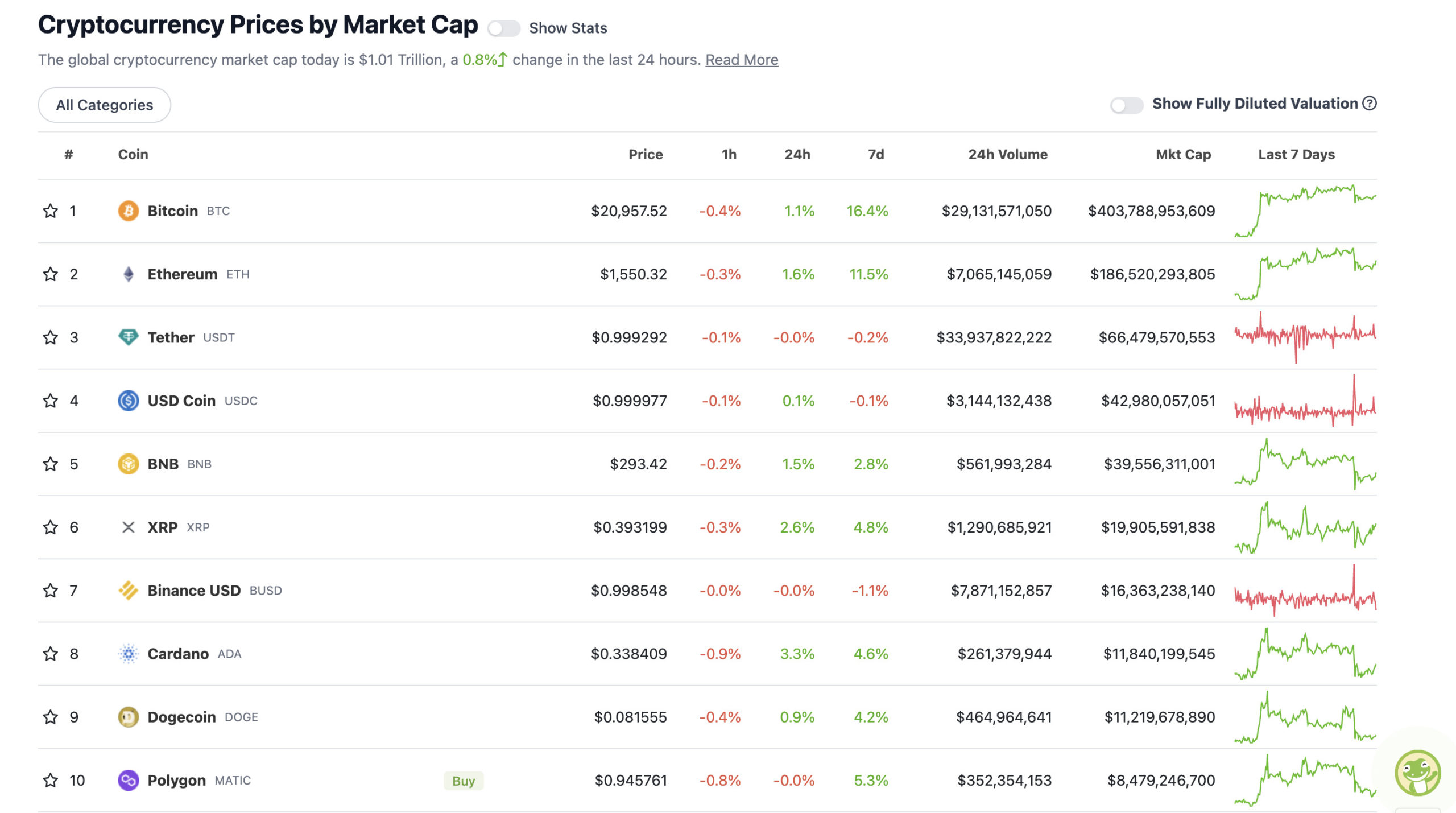

With the overall crypto market cap at US$1.01 trillion, up almost a percentage point since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So, somewhat surprisingly overnight (AEDT), given the fairly limp performance on Wall Street, the overall crypto market is up and back over US$1 trillion again, with most of the majors in the green (just).

No, it’s not a spectacular daily move from Bitcoin (which was back up over US$21k just a minute or so ago) and co, and it doesn’t inspire loads of confidence in a further run just yet… but it’s something.

There’s been a lot of negativity floating around Davos from big banker types turning up their noses at what they consider to be premature or overenthusiastic trading positions this year.

Case in point, ECB president Christine Lagarde here, as @MacroAlf points out…

Lagarde: “I Would Advise Market Participants To Revise Their Positions”

The ECB means business, and European assets seem wildly mispriced here.

— Alf (@MacroAlf) January 19, 2023

And Stockhead‘s Christian “Frenchy” Edwards has more on that here, actually.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.96 billion to about US$383 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Frax Share (FXS), (market cap: US$723 million) +13%

• Enjin Coin (ENJ), (mc: US$420 million) +12%

• Synthetix (SNX), (mc: US$547 million) +9%

• Hedera (HBAR), (mc: US$1.5 million) +8%

• ApeCoin (APE), (mc: US$1.76 billion) +5%

DAILY SLUMPERS

• Helium (HNT), (market cap: US$402 million) -6%

• Aave (AAVE), (market cap: US$1.14 billion) -4%

• Aptos (APT), (mc: US$1.26 billion) -3%

• Lido DAO (LDO), (mc: US$1.63 billion) -2%

• Decentraland (MANA), (mc: US$1.17 billion) -1%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterver

Here’s JPMorgan CEO Jamie Dimon again, calling Bitcoin, bizarrely, a “pet rock”. Works for gold, not sure about a digital asset.

It’s a confusing stance from Dimon, a long-term and seemingly unwavering crypto hater, considering his bank is actively exploring crypto payment services and the creation of a crypto wallet.

Jaime Dimon thinks there will be more than 21,000,000 BTC.

The halving is officially not priced in.

— Joe Burnett (🔑)³ (@IIICapital) January 19, 2023

“How do you know it’s gonna stop at 21 million? Maybe it’s gonna get to 21 million and Satoshi’s picture is gonna come up and laugh at you all.” -Jamie Dimon on bitcoins supply 🧐

— Crypto Crib (@Crypto_Crib_) January 19, 2023

Guys I was stupid with my custody practices and lost all of my bitcoin therefore this means that bitcoin cannot be held safely.

— GANDALF (@BTCGandalf) January 19, 2023

AYFKMRN? Lobster, bacon, and cheddar cheese?! pic.twitter.com/e0XAaQtkOJ

— David “JoelKatz” Schwartz (@JoelKatz) January 19, 2023

Be the first to comment