Bitcoin price analysis reveals a continuous upsurge in prices, as expected. The major resistance level at $17,000 was crossed with relative ease, as the upward momentum continues to build. However, a sharp retracement toward $16,700 has been witnessed, with the price trading close to $16,798.45 at the time of writing.

The key level to watch is $16,300, as this represents a crucial support level for the Bitcoin price. If prices break below this level, we can expect a sell-off toward $15,500 and possibly even lower. On the other hand, if Bitcoin continues to climb higher and breaks above $17,500, we can expect a new all-time high in the not-too-distant future.

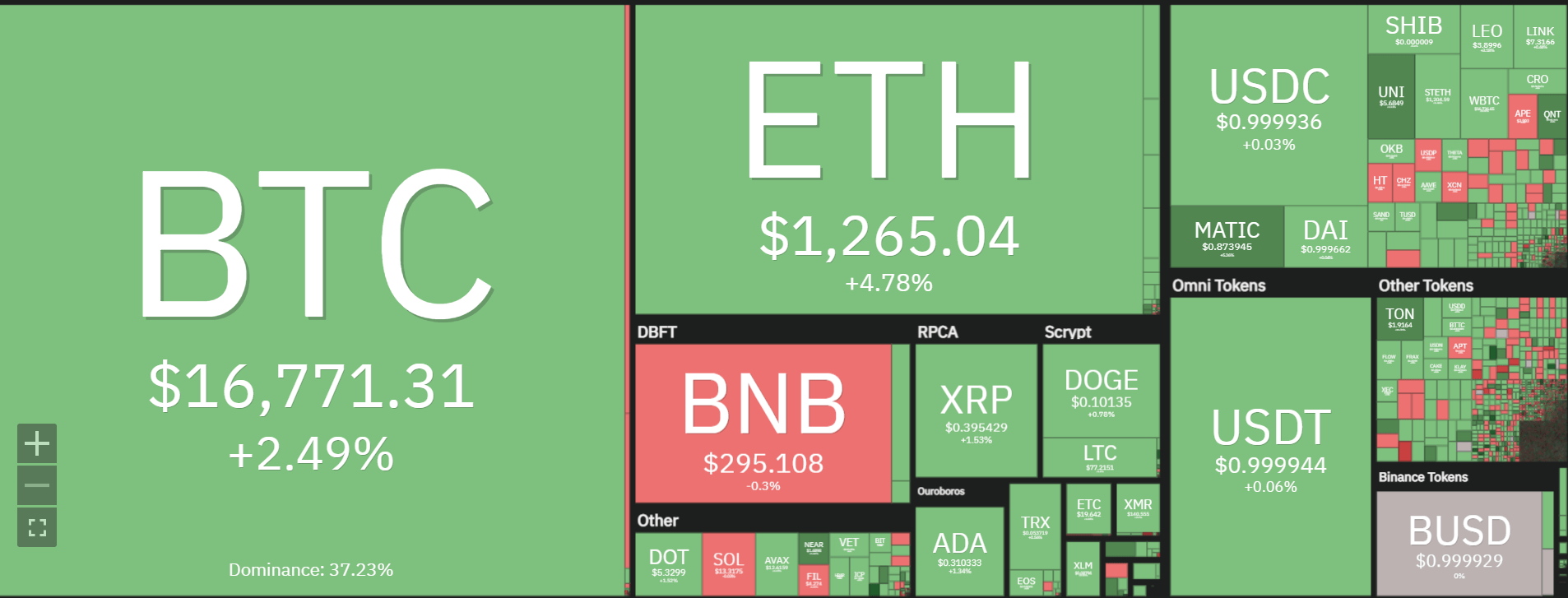

With Bitcoin prices continuing to rise at an incredible rate, investors are wondering where it is going next as the month of December looms. Looming volatility could cause the price to swing dramatically in either direction, so it will be important for traders to keep a close eye on key support and resistance levels.

Bitcoin price analysis in the last 24 hours shows BTC has moved from an intraday low of $16,369.37 to an intraday high of $17,021.67 with a current price of $16,798.45. The coin is showing signs of strong support around $16,300 and resistance approaching the psychological level of $17,500.

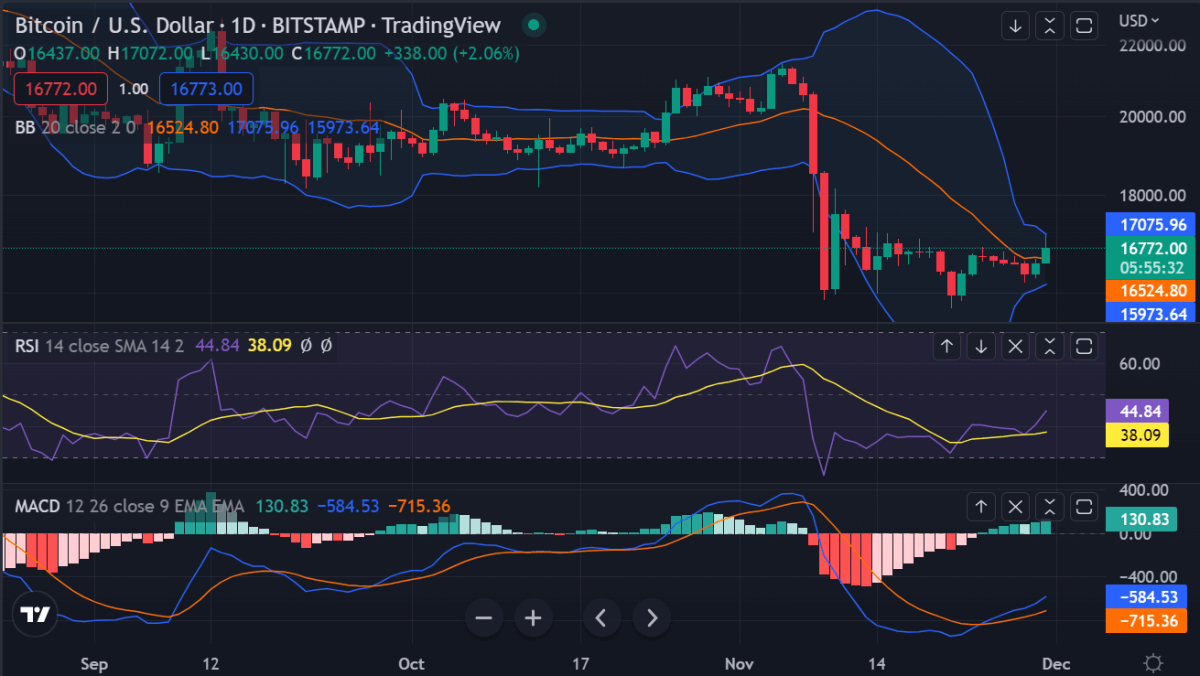

The technical indicators are currently neutral, as the MACD is showing positive momentum and is well placed above the red signal line while the RSI line is at 44.87 indicating that Bitcoin is experiencing moderate buying momentum.

The Bollinger bands have widened to show increased volatility, and the SMA is about to cross over the EMA to indicate that BTC may be headed for a bullish trend. If Bitcoin can hold steady at $16,300, we could see it continue its current uptrend, possibly reaching new highs in December and beyond. However, if there are any sharp retracements or reversals, support levels will be key in determining where the coin is headed next.

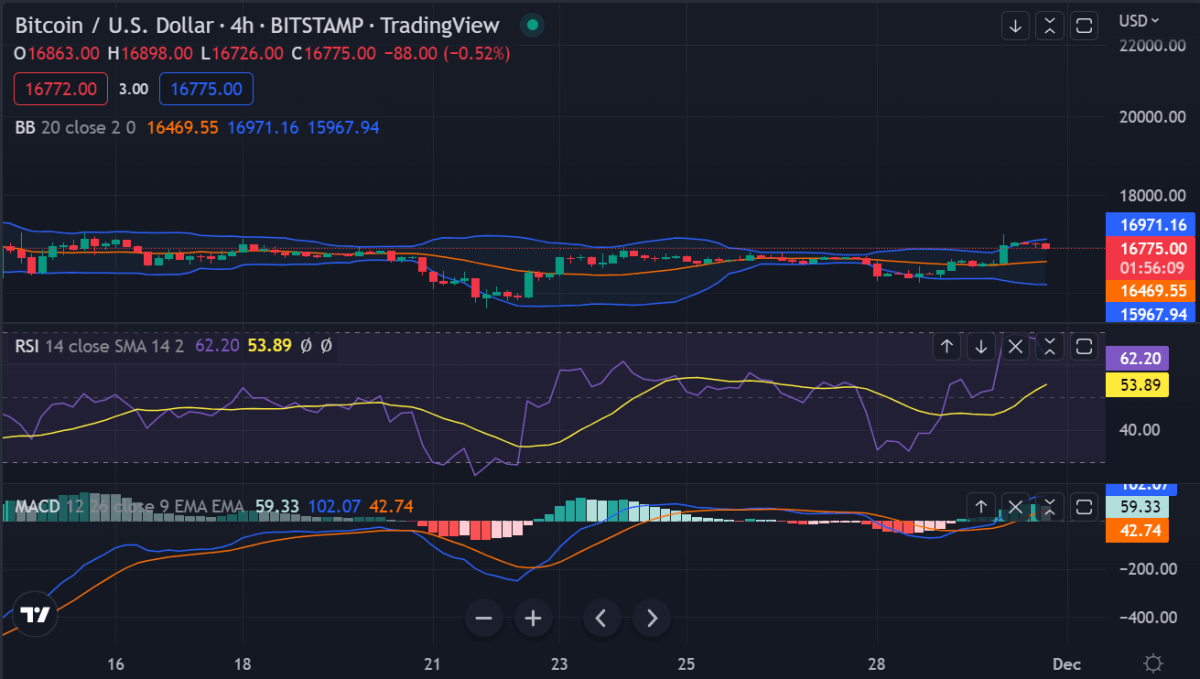

Bitcoin price analysis on a 4-hour chart: Bullish flag pattern

Bitcoin price analysis on a 4-hour timeframe shows that BTC is currently trading within a bullish flag pattern, which could indicate higher prices in the near future. The flag started forming after the strong surge earlier this week, and if Bitcoin can maintain steady levels above $16,300 we could see a breakout to test resistance at $17,500 and beyond.

Meanwhile, there is a possibility that the upward trend may be over for now as the coin shows signs of consolidation near current levels. The RSI indicator is at 67 levels, close to the overbought level of 70, indicating that Bitcoin may be due for a pullback.

However, as long as support at $16,300 holds, we can expect the bullish trend to resume and possibly break through $17,500 with enough momentum to test higher levels in December.

So it looks like Bitcoin is poised for further gains as long as it can maintain support levels. It will be important to watch out for any sudden changes in momentum, which could indicate either a bullish or bearish trend.

Bitcoin price analysis conclusion

Bitcoin price analysis shows that the coin is currently trading at $16,798.45 and appears to be holding steady near support levels. If it can break above $17,500 in the near future, we could see a continuation of the current bullish trend toward higher prices in December and beyond. Otherwise, Bitcoin will likely experience consolidation or pullback as it seeks new support levels.

While waiting for Bitcoin to move further, see our long-term price predictions on Chainlink, VeChain, and Axie Infinity.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Be the first to comment