The recent successful registration of IOTA’s foundation in Abu Dhabi and subsequent nearly 48% increase in IOTA’s price yesterday has positioned it among the best crypto to buy now.

Aside from IOTA, Radix and Theta Network are making impressive market gains recently, and the crypto presales for Bitcoin ETF Token and TG.Casino are attracting a lot of attention as November comes to a close.

Best Crypto to Buy Now in the News

Following the successful registration of its foundation in Abu Dhabi, IOTA’s native token surged, reaching a peak of $0.2899 yesterday. This new 2023 high marks the token’s highest valuation so far this year, setting a fresh year-to-date record.

IOTA is the first #DLT Foundation regulated with @ADGlobalMarket in #AbuDhabi 🇦🇪! The new #IOTA Foundation will be seeded with over $100 million in $IOTA tokens to support and accelerate the growth of the IOTA ecosystem.https://t.co/7NYe2L5RFs

🧵⬇️ pic.twitter.com/DZUHjcm2sV— IOTA (@iota) November 29, 2023

The foundation’s establishment is part of a broader strategy to promote the adoption of IOTA’s Distributed Ledger Technology on a global scale.

Despite retracing 11% so far today, IOTA has gained nearly 38% in the last month.

If the cryptocurrency can bounce back and subsequently consolidate successfully at current levels, this could open the doors for further upside.

Bouncing off its 100-day EMA and breaking past immediate resistance, Radix’s price saw an 11.31% surge yesterday to close out the daily candle to the upside.

This momentum comes as short-term forecasts predict potential for a Radix rebound and retest of the token’s 0.786 Fib resistance at $0.06269 following this upside price action yesterday.

Theta Network’s THETA is seeing a 5.50% increase so far today, currently trading at approximately $1.017.

The token’s monthly performance reflects a notable near 50% rise, attributed in part to the project’s recent community airdrops.

Technical indicators, however, point to a possible downturn with the RSI and MACD suggesting a bearish short-term outlook.

The resistance at around $1.06 could signal impending selling pressure.

Meanwhile, Bitcoin ETF Token and TG.Casino’s ongoing presales present opportunities for potential investment strategies, so investors may want to look into them as part of a diversified crypto portfolio.

As the market presents a mix of risks and opportunities, investors are closely monitoring these tokens for their upside potential.

Read on for an in-depth analysis of these cryptocurrencies’ technical and fundamental outlooks to determine if they may be the best crypto to buy now.

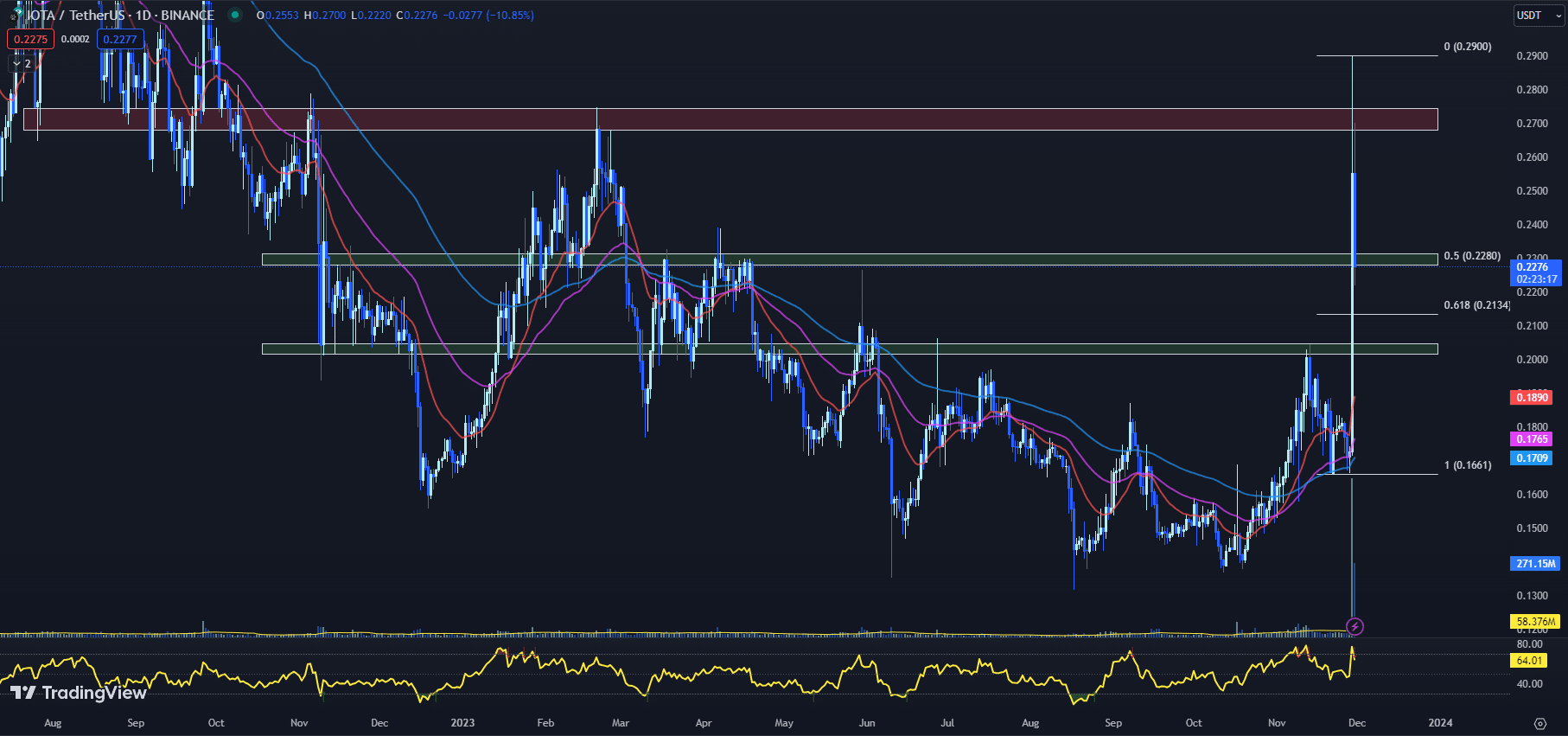

IOTA Price Consolidates After Yesterday’s Near 48% Surge

The IOTA price has recently caught the attention of traders following the successful registration of its foundation in Abu Dhabi. The cryptocurrency exhibited substantial gains, although it encountered a significant resistance zone that led to a retracement.

The IOTA price is currently striving to stabilize around the Fib 0.5 level of $0.2280, with a 10.85% downturn so far today.

The IOTA price is currently charting a path above its 20-day ($0.1890), 50-day ($0.1765), and 100-day ($0.1709) EMAs.

This positioning is typically a bullish signal, suggesting that buyers are dominating the market. If maintained, this could pave the way for the continuation of the uptrend in the near term.

The RSI has decreased from yesterday’s 77.04 to today’s 64.01. It shows that the IOTA price is cooling off from the overbought territory, indicating a potential period of price consolidation or even a slight price decline.

Meanwhile, the MACD histogram has increased from yesterday’s 0.0030 to a current value of 0.0044. This positive shift suggests that bullish momentum is picking up in the market, despite the recent decline in the IOTA price.

The IOTA price currently faces a robust horizontal resistance zone of $0.2680 to $0.2746. This resistance level was notable in the recent price rejection, and a successful break through this region could indicate a bullish trend continuation.

On the flip side, immediate support for the IOTA price is found in a horizontal zone of $0.2280 to $0.2313. This area also aligns with the Fib 0.5 level of $0.2280, making it a critical zone for price stabilization.

If the price breaches this support level, further dips could be expected, which might offer an ideal buying opportunity for investors aiming for long-term gains.

The current technical indicators paint a picture of uncertainty for the immediate future of the IOTA price. Despite positive momentum as per the MACD, the price is still hovering around critical support levels.

Traders should carefully monitor these levels and adjust their trading strategies accordingly.

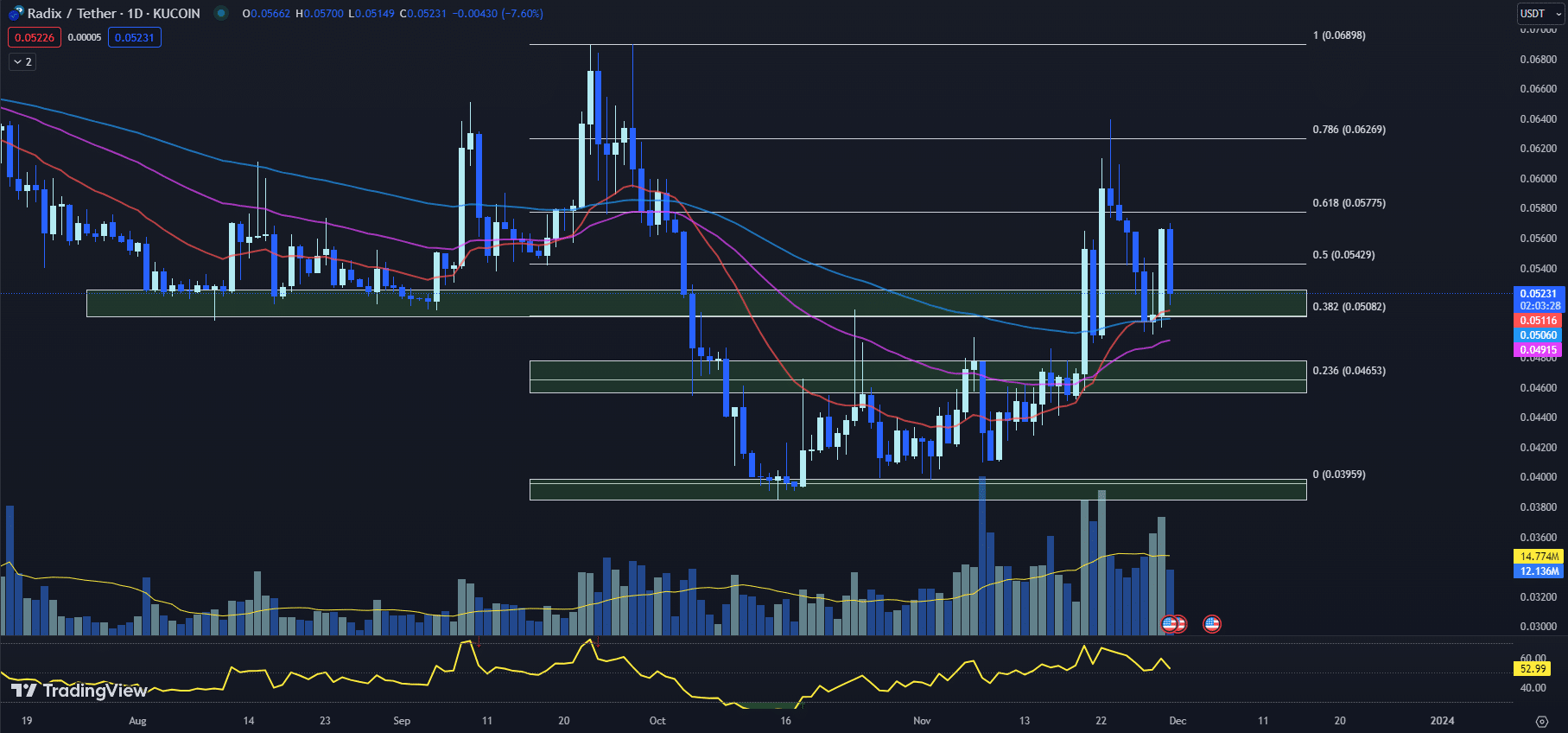

XRD Price Prediction: Resistance Levels and Potential Trading Zones

The XRD price, after an 11.31% increase yesterday, has retraced and is trading around immediate support levels.

This price action indicates a potential need for further consolidation before Radix can make its next upward move.

The 20-day EMA for the XRD price is currently at $0.05116, with the 50-day EMA at $0.04915 and the 100-day EMA at $0.05060.

Although the short-term EMA is above the long-term EMA, which is often seen as a bullish sign, the slight difference suggests caution.

The proximity of these EMAs indicates volatility and unpredictability in the XRD price, signaling traders to be cautious.

The RSI has dipped from yesterday’s 59.72 to 52.99, residing in neutral territory.

This suggests a balanced market sentiment, with neither the bears nor the bulls in firm control.

The MACD histogram, however, shows a decrease from yesterday’s 0.00024 to 0.00001, hinting at a potential bearish MACD crossover.

Such a crossover could intensify selling pressure on the XRD price.

The XRD price is currently faced with a Fib 0.618 resistance level at $0.05775. A breakthrough past this level could signal a bullish resurgence.

However, today’s downtrend of 7.60% and the proximity to the immediate Fib 0.5 support level at $0.05429, which was unable to hold today’s selling pressure, suggests that the XRD price may first need to consolidate around the next support zone.

The immediate horizontal support zone lies between $0.05079 and $0.05254, which is in alignment with the 20-day EMA at $0.05116.

This confluence strengthens the potential support at this level. If the selling pressure continues and this support fails to hold, traders might anticipate a deeper correction.

The future of the XRD price seems to hinge on its consolidation around the current support levels.

While the neutral RSI suggests a balanced market sentiment, a potential bearish MACD crossover could increase selling pressure.

Traders should watch for a bounce off the $0.05116 level for potential buying opportunities.

On the other hand, a break below this level could set the stage for further declines.

Ultimately, the XRD price appears to be in a critical phase of consolidation before it can embark on its next potential upward journey.

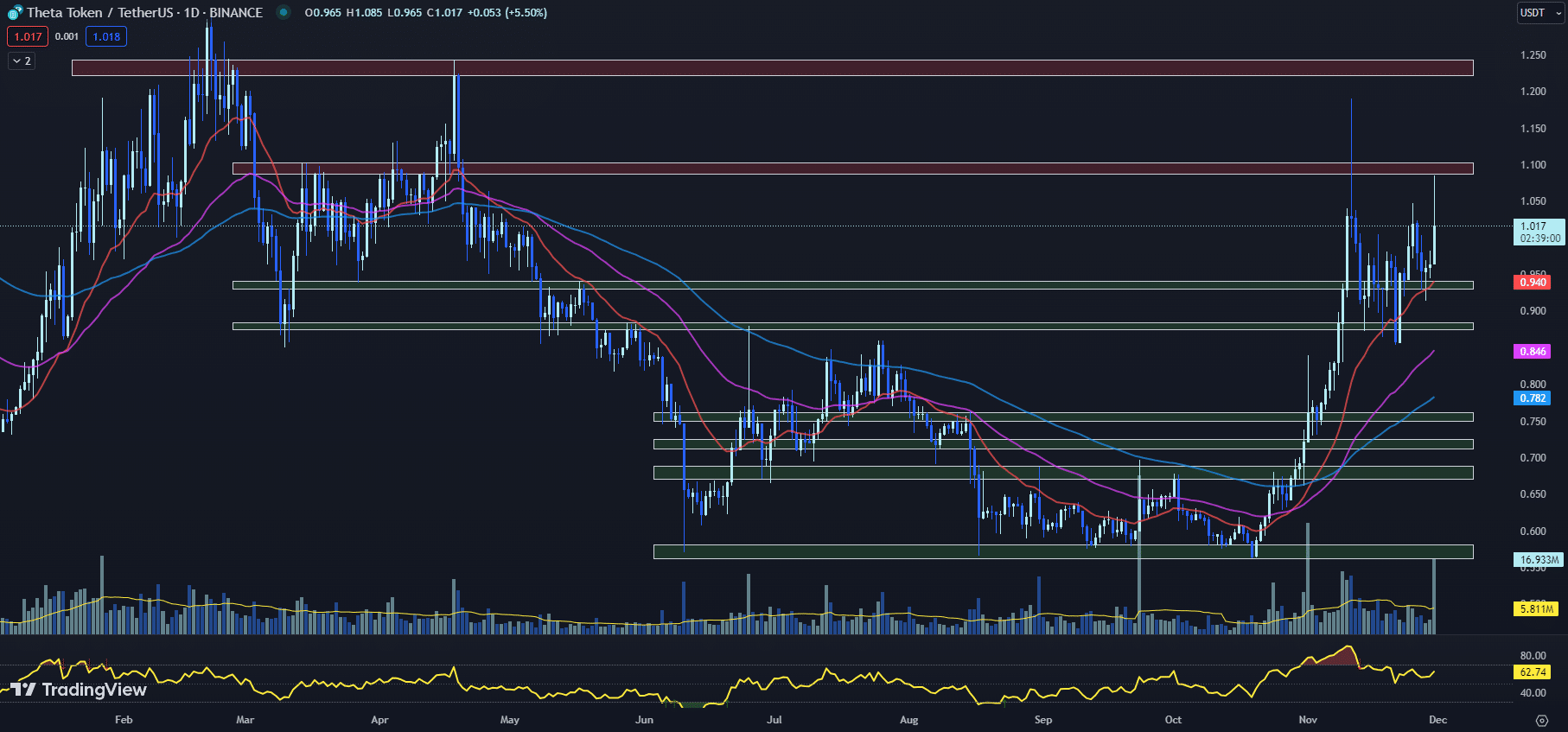

THETA Price Prediction: Can the Bullish Trend Continue?

The THETA price has been displaying a promising trend for the past few days, with the coin continuing its consolidation above the 20-day EMA.

As it edges closer to its immediate resistance level, the THETA price currently stands at $1.017 – an increase of 5.50% so far today.

Looking at the EMAs reveals a compelling narrative.

The 20-day EMA for THETA stands at $0.940, comfortably outperforming the 50-day and 100-day EMAs at $0.846 and $0.782, respectively.

This paints a robust picture of bullishness in THETA’s immediate future.

Looking at the RSI, it has risen to 62.74 from yesterday’s 57.51.

An RSI above 50 often suggests that a stock or coin is in a bullish phase, meaning the THETA price might see further upward movement.

The MACD histogram has also shown a positive change, moving to -0.006 from yesterday’s -0.009.

The narrowing of the MACD histogram indicates that the bearish momentum is slowly losing its grip and a bullish crossover could be expected soon, which would likely propel the THETA price further.

Examining the immediate resistance, the horizontal resistance zone is between $1.087 and $1.103.

This level was retested earlier today when THETA traded around its intraday high of $1.085.

A break and close above this resistance could potentially spark a new uptrend for the THETA price.

On the flip side, immediate support is found in the horizontal support zone of $0.931 to $0.943, aligning closely with the 20-day EMA of $0.940.

Holding this support is crucial for THETA to maintain its upward journey.

A break below this could lead to a retest of the 50-day EMA at $0.846, potentially opening up a more bearish phase for the THETA price.

While the THETA price shows strong bullish sentiment, traders should keep a close eye on these technical indicators and key support and resistance levels.

The coming days will reveal whether THETA can sustain its upward momentum or if a reversal is on the horizon.

As IOTA, Radix, and Theta Network show signs of momentum, attention is turning to overlooked crypto presales like Bitcoin ETF Token and TG.Casino.

These fresh projects seek to capitalize on the hype surrounding the potential approval of a Bitcoin ETF and the growing excitement around crypto gambling.

Their early traction suggests these may be smart investments for those seeking viable Bitcoin alternatives.

Overlooked Bitcoin Alternatives With Upside Potential in 2023

As Bitcoin continues to lead the cryptocurrency market, investors are starting to explore lesser-known alternatives that have yet to gain mass adoption.

While risky, investing in select new crypto projects early allows you to acquire tokens at a fraction of their possible future price.

The key is identifying platforms that are on the verge of solving unmet needs or current problems before widespread awareness kicks in.

Two ongoing crypto presales that offer excellent investment potential in 2023 are Bitcoin ETF Token and TG.Casino.

Both projects are bringing fresh ideas to the table and seek to disrupt their respective sectors.

Getting in early with these promising crypto alternatives provides an opportunity to get exposure to what may end up being major innovations down the line.

Looking past crypto juggernauts, these unnoticed crypto presales offer the ability to invest in new Bitcoin alternatives seeking to shake things up.

Bitcoin ETF Token Presale Raises Over $2 Million as Investors Rush to Buy One of the Best Crypto to Buy Now

As the crypto community awaits a decision on spot bitcoin exchange-traded funds (ETFs), a new project called Bitcoin ETF Token (BTCETF) aims to capitalize on the hype.

With major players like BlackRock and Grayscale seeking approval for bitcoin ETFs, excitement is building around these potential new investment vehicles.

BTCETF has timed its roadmap and tokenomics to align with key milestones in the spot Bitcoin ETF approval process.

🇨🇭 Switzerland’s @PandoAsset enters the US spot #Bitcoin #ETF race among a surge of applicants, including @BlackRock and @Fidelity, hinting at a potential shift in the #Crypto landscape. 💭#BitcoinETF also achieves a groundbreaking milestone, raising more than $2 Million! 🚀 pic.twitter.com/NyGzDQIMkf

— BTCETF_Token (@BTCETF_Token) November 30, 2023

The BTCETF presale has raised over $2 million so far, offering early investors a chance to buy tokens at a discount.

The pre-sale utilizes a tier-based pricing structure, with the price per token increasing through 10 stages from an initial $0.005 to $0.0068.

According to the BTCETF whitepaper, the approval of a spot bitcoin ETF could unlock billions in institutional investment.

To capitalize on this opportunity, BTCETF incorporates a deflationary mechanism that seeks to increase token scarcity and value.

Specifically, it will burn 5% of the total supply each time an ETF milestone is reached.

In addition to burning tokens, BTCETF also uses a staking system to incentivize users, gradually decreasing token circulation over time.

Through these dual tactics of token burning and staking rewards, BTCETF intends to reward long-term holders by decreasing transaction taxes from an initial 5% to 0% after all ETF milestones have been achieved.

The presale rush reflects crypto investors’ strong appetite to capitalize early on the prospective launch of Bitcoin ETF products.

With demand accelerating ahead of regulatory approval, participants may want to position themselves advantageously for what could be one of the best crypto to buy now.

Visit Bitcoin ETF Token Now

TG.Casino Presale Hits $3.1 Million, Is it the Best Crypto to Buy Now?

The ongoing presale for TG.Casino, a new crypto casino built on Telegram, has hit the $3.1 million raised milestone so far.

With less than $2 million left until the presale’s completion, the project continues to generate a lot of hype.

TG.Casino enables anonymous crypto gambling directly within Telegram, bringing privacy and efficiency to the messaging app.

Over 2,300 gamblers have tried it, wagering over $30 million total already.

🧵 While we’ve always had an internal roadmap for the business and casino development, we’ve always played our cards close to our chest while we became established. We feel now is the right time to share a public facing roadmap to share our plans for the next 6-9 months. 👇 pic.twitter.com/D5A24wRDPS

— TG Casino (@TGCasino_) November 27, 2023

TG.Casino has recently shared its post-presale roadmap which includes expanded marketing, team growth, product enhancements, and a goal of $225 million total wagering volume.

Several prominent crypto influencers have endorsed TG.Casino, including analyst Little Mustacho, who believes the project has the potential to directly compete with the popular crypto gambling site Rollbit.

Seasoned analysts forecast the token’s price may rapidly increase following the project’s introduction to the broader cryptocurrency market.

TG.Casino’s ingenious tokenomics further incentivize long-term holding of its $TGC token.

Owners can benefit from perks like cashback to offset losses, reward programs for activity, and an intuitive buyback system designed to make $TGC deflationary over time.

As the presale nears its finish line, some believe TG.Casino could be a leading crypto opportunity given its novel platform and early traction indicators.

Additionally, the presale price increases in less than two days, so interested investors may want to review soon before token prices rise.

With crypto gambling picking up steam, TG.Casino’s Telegram-based model and presale traction signal its strong potential as the presale heads toward its finish line.

For investors seeking the best crypto to buy now, TG.Casino appears to be one to watch closely.

Visit TG.Casino Now

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Be the first to comment