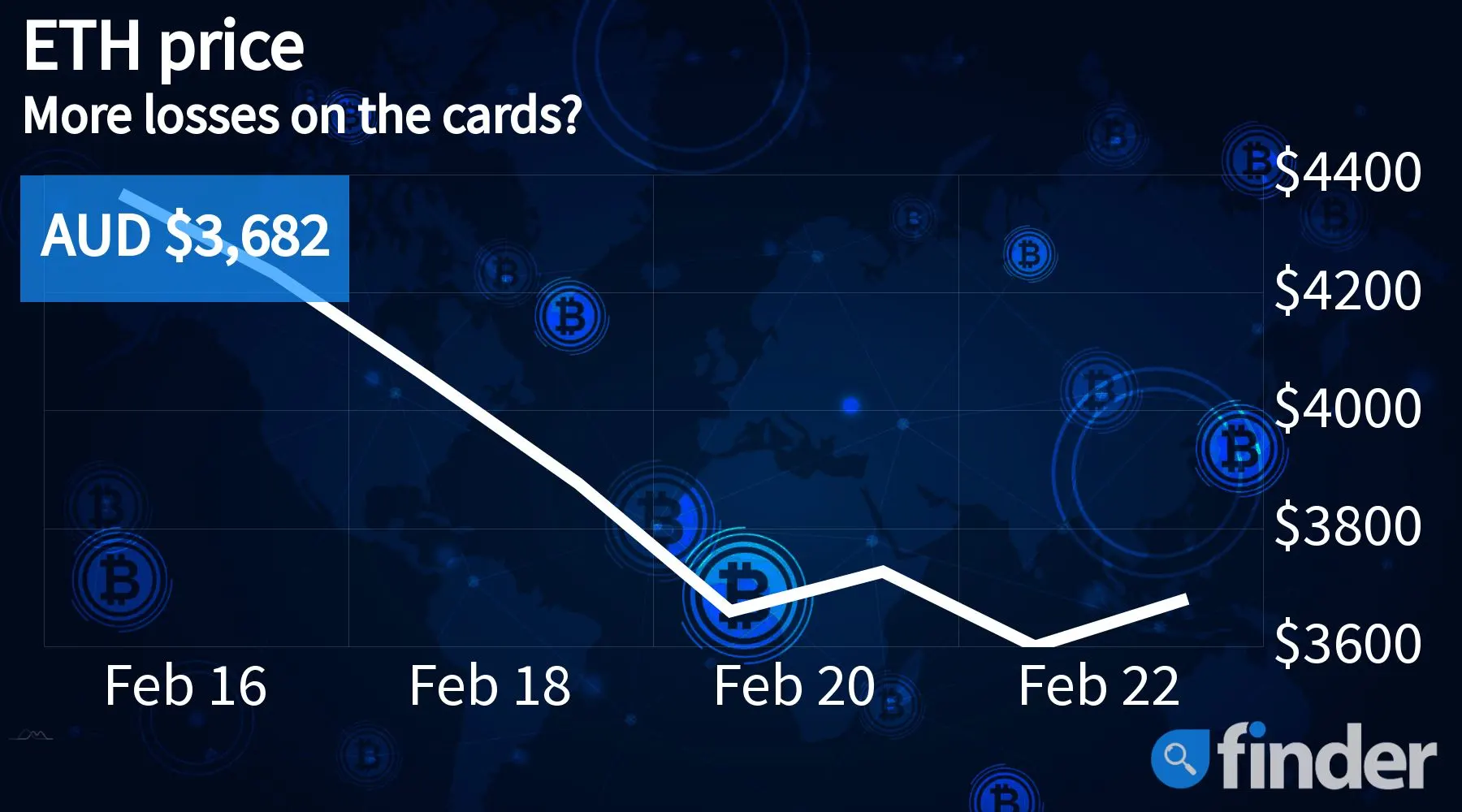

ETH’s weekly losses have risen to 17.5% as NATO continues to mobilize its forces around the Ukrainian border.

- Ethereum’s market dominance index has risen to 17.5% after most major altcoins registered losses in excess of 20% over the last 48 hours.

- Coinbase Wallet is now compatible with Ledger’s various hardware storage devices.

- Tether has slashed its USD reserves in favor of ‘commercial paper’ by a whopping 42% over Q4 2021.

Ethereum, the world’s second largest cryptocurrency by total market capitalization, has been on the receiving end of a lot of volatility over the last 24 hours, with the altcoin dipping as low as AU $3,460 (US $2,500) before surging and reaching a local high of AU$3,672 (US $2,653). At press time, the digital asset is trading at a price point of AU $3,630.

One of the main reasons for the ongoing volatility seems to stem from the uncertainty surrounding the Russia-Ukraine situation, with major political entities across the board — including the United States, Great Britain, India — mobilizing their troops in fear of any unwarranted action emanating from either party.

That said, crypto adoption has continued to surge ahead as usual globally, with Coinbase Wallet, the prominent cryptocurrency exchange’s native wallet offering, now offering full compatibility with Ledger’s existing hardware storage units (i.e. the Nano X and Nano S). The extension is available via the Chrome Web Store, allowing users to store and transact via a whole host of cryptocurrencies and non-fungible tokens (NFT).

Not only that, by making use of the app extension, Coinbase customers also have the option of using their physical Ledger devices to maintain a record of their private keys in a completely offline fashion.

How to buy Ethereum

Tether reduces its USD reserve allocations

Tether, the company responsible for the issuance of popular stablecoin USDT, revealed that it has cut its USD reserve allocations to commercial paper by a whopping 42% over the course of Q4 2021 — dropping them from US $30.5 billion to US $24.16 billion.

Due to its recent legal woes — as a result of which Tether was required to pay an out-of-court settlement fee of AU $25.6 million (US $18.5M) — the firm has been mandated by the Office of the New York Attorney General to legally disclose its reserve data every quarter. As per its latest audit, Tether’s “consolidated assets exceed its consolidated liabilities,” but the difference between the two sums is not really substantial (i.e. US $78.67 billion and US $78.53 billion).

London Stock Exchange buys out cloud tech firm Tora

Earlier this week, the London Stock Exchange Group (LSEG) revealed that it had facilitated a deal worth AU $477 million (US $345M) so as to acquire American cloud technology provider Tora. The agreement will be completed by the latter half of 2021 and will allow the LSEG to harness the firm’s various software trading solutions (relating to stocks, forex, fixed income securities, derivatives and cryptocurrencies). On the matter, a representative for the LSEG pointed out:

“The addition of digital assets to LSEG’s trading capabilities strengthens its presence in this rapidly expanding asset class at a time when institutional market participants are increasing exposure to crypto and other digital assets.”

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, dive deeper by learning about Ethereum and see what blockchain can do with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

Be the first to comment