The cryptocurrency market at the moment represents that of mixed trading. Bitcoin plunged to lows of $55,543 on Sunday. Bitcoin’s decline caused the majority of Altcoins to take a downturn. The declines in the crypto market extended into the earlier hours of Monday before a rebound occurred.

Three major reasons alluded to Bitcoin’s recent dip, first is the rise in treasury yields, then the bearish movements on Bitfinex and the struggle of the risk-on market contributed in a way to the lead asset’s declining momentum.

Amid the mixed trading reaction, selected Altcoins are posting impressive performances. XRP is up 12.85% in the last 24 hours as members of the XRP Army referring to supporters of the token have started an online movement to pressure crypto exchanges to relist the digital asset amid Ripple’s ongoing lawsuit with SEC.

DENT Surges 100% in One Day; Theta Flips Bitcoin Cash To Rank 11th Largest

Notable Altcoin gainers are THETA (+10.10%), IOTA (+6.91%), Solana (+8.67%), Kusama (+7.27%), Theta Fuel (+31.57%), Pancake Swap(+ 20.85%). Theta went ahead to set new all-time highs of $10.94 on Mar. 22. Theta’s market cap consequently rose to $10.28 billion to flip the$10 billion market valuation of Bitcoin Cash. Theta now ranks 11th largest cryptocurrency by market valuation and the biggest NFT token by market capitalization.

Another top Altcoin performer is Dent (DENT). DENT Coin, launched by DENT Wireless Limited is a cryptocurrency that promises to disrupt the mobile data industry in the world. Its sole aim is to tokenize the Mobile Data Industry and create a world-wide marketplace on Ethereum to sell and buy Mobile Data. The dent coin is a universal currency for data markets.

DENT/USD Daily Chart

DENT/USD Daily Chart

On March 22, Dent rose from lows of $0.0067 to highs of $0.01275 surging by nearly 100%. Dent subsequently entered the category of top 100 crypto assets by market cap. Dent is up by 215.82% weekly as it presently trades at $0.010.

Sideways Action Expected for Bitcoin Price

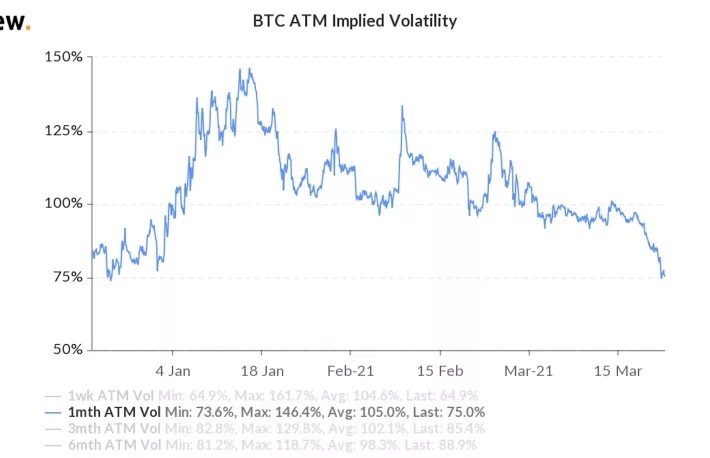

Bitcoin’s implied volatility, or expectations for price turbulence, dropped to an annualized 75% on Mar. 22, drawn from calculations using options premiums with a one-month horizon. Skew indicated that this marks the lowest seen since Dec. 25 after the implied volatility topped above 145% in mid-January.

Courtesy: Skew

Courtesy: Skew

Denis Vinokourov, head of research at Trade the Chain noted that this decreasing trend suggests that markets are expecting sideways price action.

Bitcoin is lingering in a narrowing price range, with indecisiveness dominating with both bulls and the bears. Data also indicates that while there has been short-term selling pressure, these moves are not large enough to suggest that the market is anticipating a prolonged correction.

Bitcoin is trading down by 2.45% at $55,990.

Image Credit: Shutterstock

Post Views: 17

Be the first to comment