Most major coins were trading in the green on Tuesday evening at press time, with the global cryptocurrency market cap rising 4.5% to $1.9 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 3.5% | 7.8% | $42,379.75 |

| Ethereum (CRYPTO: ETH) | 1.6% | 12.16% | $2,970.15 |

| Dogecoin (CRYPTO: DOGE) | 3% | 9% | $0.12 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Dash (DASH) | +13.75% | $130.62 |

| Algorand (ALGO) | +11.75% | $0.83 |

| ApeCoin (APE) | +11.4% | $11.36 |

See Also: How To Buy Bitcoin (BTC)

Why It Matters: Yields on U.S. benchmark 10-year Treasury bonds rose to 2.38% on Tuesday, which is the highest level since 2019, according to a report from Reuters.

As of Tuesday, the market is pricing in a 72.2% probability that the U.S. Federal Reserve will raise the fed fund rate 50 basis points in its May meeting. On Monday, this number stood at a little over 50%, according to Reuters.

U.S. equities markets closed higher on Tuesday. The S&P 500 was up 1.13% at 4,511.61, while the Nasdaq ended the day 1.95% higher at 14,108.82. At press time, U.S. futures traded largely flat.

Cryptocurrency bears remained frustrated on Tuesday as the market was buoyant alongside equities.

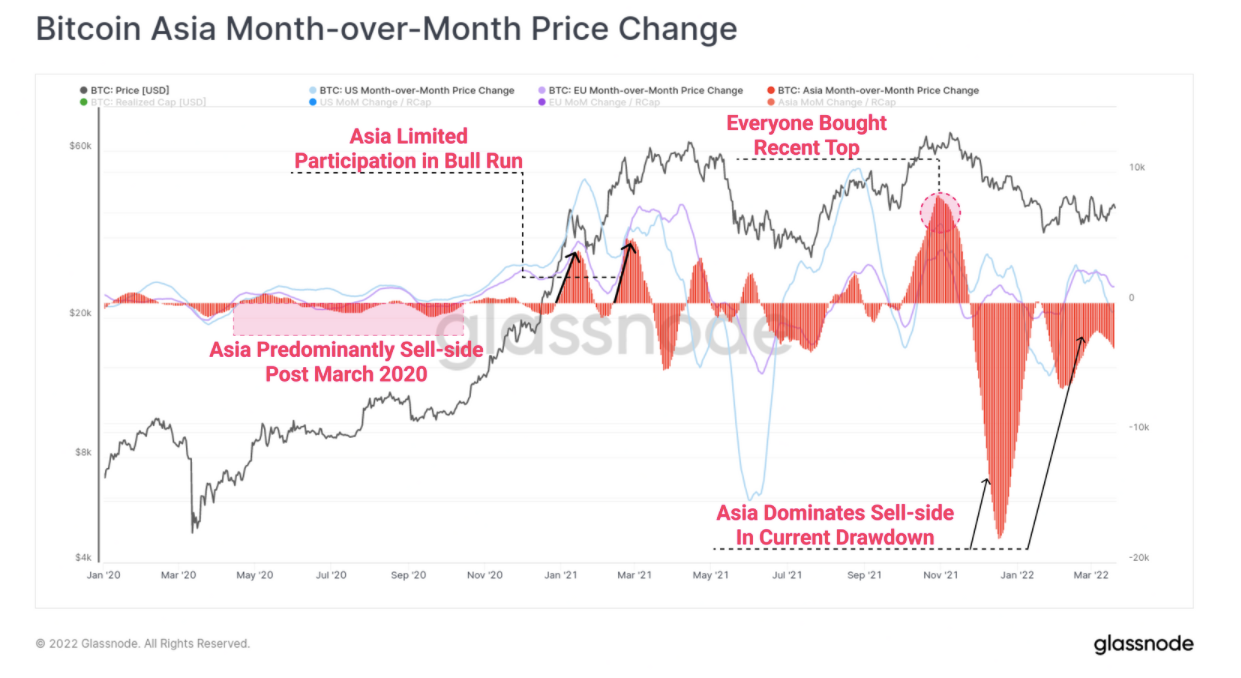

The buy-side demand for Bitcoin appears to be driven by the United States and the European Union markets, while the majority of sell-side pressure originates during Asian trading hours, according to a note from Delphi Digital.

The geographical story has remained consistent from 2020 to 2022. Currently, Europe is providing the largest bid support, as per Delphi Digital. Conversely, Asia has sustained a heavy sell-side dominance since December 2021.

Bitcoin US/EU Month-Over-Month Price Change — Courtesy Delphi Digital

Bitcoin Asia Month-Over-Month Price Change — Courtesy Delphi Digital

Bitcoin Asia Month-Over-Month Price Change — Courtesy Delphi Digital

Cryptocurrency investor Lark Davis tweeted that the price of Bitcoin has now been under the 200-day moving average for longer than the big correction seen in 2021.

The price of #bitcoin has now been under the 200 day moving average for longer than the big correction of 2021.

I’ll just keep accumulating. pic.twitter.com/lZdTeN6L6f

— Lark Davis (@TheCryptoLark) March 22, 2022

Edward Moya, a senior market analyst with OANDA, said in an emailed note that Bitcoin lacks the catalysts to break beyond the $45,000 barrier.

“Bitcoin is once again nearing the upper boundaries of its $37,000 to $45,000 zone, but still doesn’t have a clear catalyst to break it.”

Read Next: Bitcoin Lookalikes Are Soaring This Week: What’s Going On?

Be the first to comment