Crypto staking allows you to earn rewards on your digital assets without having to cash out. Put otherwise, you can put your idle cryptocurrencies to work and generate a passive income stream while still maintaining ownership of your coins.

This guide explores the 10 best staking coins for 2022. We also discuss the concept of staking in detail and list the top platforms in the market right now for this purpose.

Best Staking Coins for 2022

There are dozens of cryptocurrencies that you can utilize to earn staking rewards.

After considering the interest rates and market conditions on offer, we found that the best staking coins for 2022 are those listed below.

- Lucky Block – Overall Best Staking Coin in 2022

- Ethereum – Top Staking Coin for Long-Term Investors

- Cardano – Best Sustainable Staking Coin

- Uniswap – Top Decentralized Staking Coin

- Solana – Best Staking Coin with Long-Term Growth

- Polkadot – Staking Coin Using NPoS Algorithm

- Polygon – Top Staking Coin for High APY

- Algorand – Best Staking Coin for PPoS Mechanisms

- Chainlink – Popular Staking Coin to Invest Blockchain Interoperability

- The Graph – Top Staking Coin with High Growth Potential

Cryptoassets are a highly volatile unregulated investment product.

As you read on, you will find out why these particular digital assets made our list of top staking coins.

We will also show you how you can buy cryptocurrency and start staking them while paying low fees.

A Closer Look at the Best Staking Tokens

From an investment perspective, the best crypto staking coins are those that offer a high yield. That said, how much you earn will depend on factors such as your chosen platform as well as the staking period.

With this in mind, below we analyze the best staking coins for 2022.

1. Lucky Block – Overall Best Staking Coin in 2022

Lucky Block is a relatively new addition to the cryptocurrency market. As an open-source protocol, it allows developers to build and run high-performing blockchain applications. However, Lucky Block primarily targets the gaming community, especially online lottery players. The more Lucky Block tokens you hold, the better your chances are to win and earn greater rewards.

Lucky Block operates via smart contracts, which in turn guarantees randomness, credibility, and transparency to the lottery games it offers. Moreover, payouts are also processed in this manner, to ensure that there is no room for error. Given its scope in the online gaming sector, Lucky Block is expected to perform exceptionally well in the lottery sector.

Lucky Block was launched in early 2022 and has already seen its price go up by over 6,000%. Since this DeFi coin employs a proof-of-stake system, you will also be able to earn income on this digital coin. The network also has plans to reward LBLOCK holders who hold their coins in a wallet connected to the Lucky Block app.

These payouts come in the form of dividends, with the amount depending on the number of lotto players. As per a press release, Lucky Block estimates that this yield to be as high as 19.2% per annum for those who hold $1,000 worth of LBLOCK tokens for at least a year – which makes it one of the best crypto staking coins to consider for passive income.

All in all, the digital asset is still in its early stages and has plenty of upside potential.

Cryptoassets are a highly volatile unregulated investment product.

2. Ethereum – Top Staking Coin for Long-Term Investors

The Ethereum ecosystem continues to grow by leaps and bounds, attracting both developers and investors. However, the world’s second-largest cryptocurrency initially deployed a proof-of-work consensus. This meant that in order to validate any transactions, computers had to perform complex tasks which demanded enormous energy as well as time.

However, as per a recent development upgrade, Ethereum has shifted to the PoS mechanism and thus – is now one of the best staking tokens to consider for generating passive income. That said, in order to start staking Ethereum by yourself, the requirements are somewhat high – not least because you will need to put up at least 32 ETH coins.

The easiest alternative to this would be to hold your Ethereum coins in a staking pool. In simple terms, this means that you lend your tokens for other validators to use. This way, you do not have to commit such a huge amount of ETH. In terms of the payouts, this will ultimately depend on the staking platform you choose and for how long you lock in your coins.

Cryptoassets are a highly volatile unregulated investment product.

3. Cardano – Best Sustainable Staking Coin

Cardano is one of the best-known proof-of-stake (PoS) cryptocurrencies of today, with a focus on scalability and sustainability. The network attempts to solve the energy usage issues involved in mining Bitcoin, thus tagging itself as an eco-friendly choice when compared to other digital assets.

Since hitting the crypto markets, this digital asset has performed exceptionally well – translating to gains of over 4,500% in value. Moreover, with the network launching its own smart contract facility, Cardano is well-positioned to witness further growth in the future.

Due to its popularity, you will find that several staking platforms list Cardano – such as the likes of Crypto.com and eToro. That being said, for the very same reason, you might find that the interest offered varies widely, from one provider to another.

Cryptoassets are a highly volatile unregulated investment product.

4. Uniswap – Top Decentralized Staking Coin

If you are looking at the best DeFi coins for staking, then Uniswap is a worthy candidate to consider. In fact, Uniswap accounts for around 25% of daily transactions on the Ethereum network. With its latest version Uniswap V3, the protocol has managed to reduce its transaction fees even further, making it one of the top cryptocurrencies to purchase in 2022.

When it comes to staking, Uniswap is highly preferred by passive crypto investors. Not only that, based on its potential, Uniswap is considered one of the most undervalued cryptocurrencies of 2022. By investing in Uniswap, you might benefit from the rising value of UNI coins and will also be able to participate in the decisions on how the network operates.

If you already own UNI coins, you can stake them on Uniswap’s liquidity pools, or earn rewards by depositing your tokens on a platform such as Crypto.com. While staking on the Uniswap network requires you to lock in your assets, third-party providers allow you to withdraw your UNI tokens whenever needed.

Cryptoassets are a highly volatile unregulated investment product.

5. Solana – Best Staking Coin for Long-Term Growth

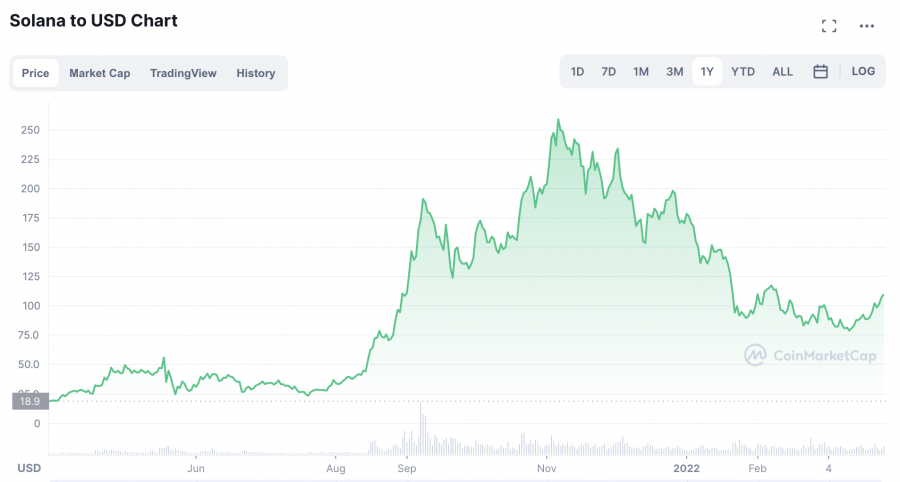

Solana is yet another DeFi token that was designed with scalability in mind. The blockchain facilitates quick transactions and low fees – which subsequently boosted its market performance in 2021. The price of Solana went from around $18 to over $100 in the course of just one year.

Although the value of Solana has dropped since the beginning of 2022, the coin continues to hold its momentum among developers. When you stake this crypto asset, you can expect annual returns in the range of 7 to 11%, depending on the platform you choose.

You can either more your Solana tokens to a wallet that supports staking or deposit your coins to a crypto interest account – such as those offered by Crypto.com. To get started, you can buy Solana from a user-friendly broker like eToro.

Cryptoassets are a highly volatile unregulated investment product.

6. Polkadot – Staking Coin with NPoS Algorithm

Unlike the conventional PoS consensus, Polkadot is built on a nominated proof-of-stake mechanism. In this system, nominators back multiple validators as a show of faith of their behaviour. And as such, if you choose a malicious validator, you are likely to incur a loss.

However, since being a delegator for Polkadot is cumbersome and comes with unfavourable requirements, many investors choose to be nominators or deposit their assets into staking pools. On top of this, Polkadot also pays out attractive token rewards. This is because the rewards are offered in proportion to the work and not to the size of the stake.

On platforms such as Crypto.com, you will be able to obtain an APY as high as 14.5% on Polkadot. In terms of prospective capital gains, Polkadot seems to have strong growth potential because it allows developers to link blockchains and even create new protocols.

Cryptoassets are a highly volatile unregulated investment product.

7. Polygon – Top Staking Coin for High APY

Polygon is a cryptocurrency that was developed as a means to add scalability to Ethereum. This blockchain provides compatibility for Ethereum-based applications, facilitating interconnectivity. This also makes this digital coin a good option for long-term investment. Over the past year, Polygon has witnessed a token price increase of over 350%.

Polygon is also one of the best staking coins to be preferred by validators. It only requires one MATIC token to take part in the network and a minimum of two to start staking. If you do not want to become a validator yourself, you can also use platforms such as Crypto.com to generate attractive returns on Polygon.

At the time of writing, Crypto.com offers a high APY of 10% for those holding Polygon tokens for three months. This will, of course, vary depending on the lock-in period and whether or not you decide to stake CRO tokens – which is native to Crypto.com.

Cryptoassets are a highly volatile unregulated investment product.

8. Algorand – Best Staking Coin for PPoS Mechanism Systems

The majority of the best staking coins we have discussed so far follow a conventional PoS consensus. However, Algorand goes one step further to follow a Pure PoS system that makes this protocol even more efficient. As a result, the Algorand blockchain does not fork but can still facilitate instant transactions.

ALGO is deemed one of the top staking coins because the protocol has very minimal requirements for validators. In fact, unlike its Ethereum counterpart, you only need one ALGO token to start staking. This means that you will find several staking pools for this asset, however, it can also be tricky for platforms to offer high APYs.

Nevertheless, your total returns will ultimately depend on the staking platform you choose. If you buy Algorand and hold the tokens in an interest-earning account, you can expect to make annual returns in the range of 3-10% of your total investment.

Cryptoassets are a highly volatile unregulated investment product.

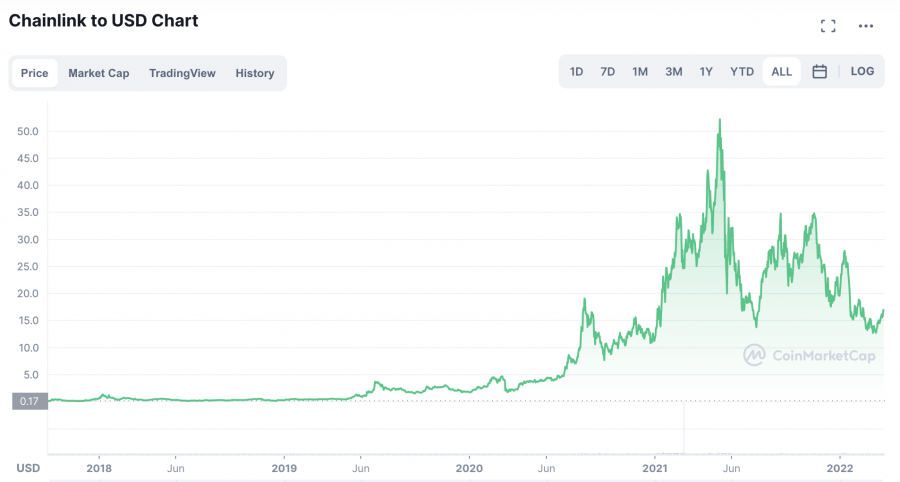

9. Chainlink – Popular Staking Coin to Invest in Bliockchain Interoperability

Chainlink is considered one of the best cryptocurrencies to invest in right now. It serves as a link between blockchains and real-world data. Among other oracle systems out there, Chainlink appears to be the most advanced since it offers a plethora of integrations and partnerships.

Although staking is yet to be supported within the Chainlink Network itself, you can deposit this cryptocurrency into third-party platforms to generate income on your tokens.

If you choose to buy Chainlink and hold the coins for the long-term while waiting for capital appreciation, you can invest your assets in a crypto interest account and earn up to 9% APY – depending on your chosen platform.

Cryptoassets are a highly volatile unregulated investment product.

10. The Graph – Top Staking Coin with High Growth Potential

The Graph is an up-and-coming cryptocurrency that aims to create an index system for blockchains. This will make the data available on blockchains easier to access. Moreover, it will also help blockchains be more efficient by moving any unnecessary data to an off-chain protocol.

As is evident, The Graph has sufficient opportunities to rise in value, especially in the long term. The digital coin was released towards the end of 2021 and is still finding its way to popular cryptocurrency exchanges. However, you will still be able to buy The Graph at low fees via the eToro platform.

Since this blockchain leverages the PoS mechanism, this coin can also be staked at a number of prominent platforms – some of which offer double-digit APYs on GRT tokens.

Cryptoassets are a highly volatile unregulated investment product.

Where to Stake Coins

There are dozens of platforms that allow you to generate a passive income on the top staking coins discussed above.

To get the ball rolling, you can consider the three top crypto staking platforms reviewed below. These are not only user-friendly but also let you buy and stake cryptocurrencies at low fees.

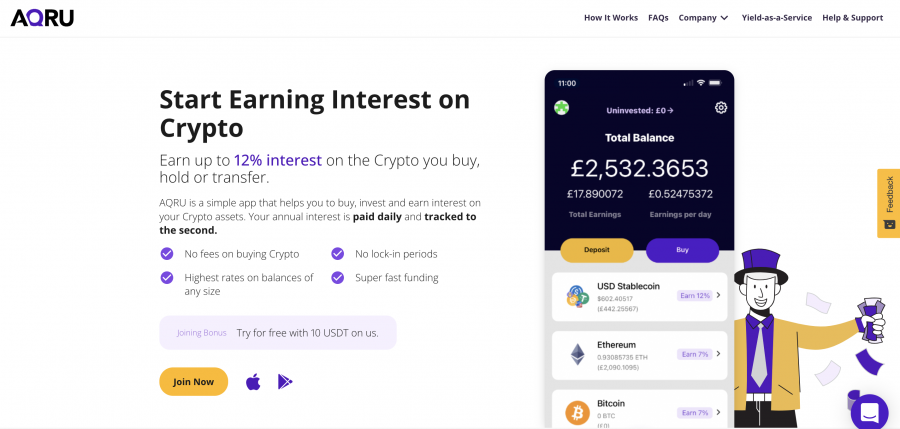

1. AQRU – Overall Best Crypto Staking Platform

![]() If you are a newcomer to the concept of cryptocurrency staking, then AQRU will likely catch your attention with its simple and straightforward interface. This popular crypto lending platform presents you with a user-friendly means to start earning passive income on your digital assets.

If you are a newcomer to the concept of cryptocurrency staking, then AQRU will likely catch your attention with its simple and straightforward interface. This popular crypto lending platform presents you with a user-friendly means to start earning passive income on your digital assets.

This is without having to understand the technicalities or navigate through complex jargon. AQRU is also available in the form of a mobile crypto app, making it easy for you to buy and stake crypto on the go. AQRU lets you earn an APY of 7% on Ethereum, which is one of the best staking tokens that we discussed in this guide.

On top of this, the platform also supports crypto interest accounts, offering the same APY. Furthermore, you will be able to attain up to 12% per year on stablecoins such as Tether, USD Coin, and Dai. It goes without saying that the rates on offer are highly competitive.

AQRU is able to offer a high yield to its users by lending your digital assets to borrowers, however, only after conducting a thorough audit of their resources and assets. You will be able to track your earnings directly from your AQRU dashboard and collect payouts on a daily basis.

When it comes to making a withdrawal, you even have the option to choose between cryptocurrency or fiat money. The best part is that there is no lock-in period involved with AQRU. This means that you can withdraw your digital coins whenever you want.

However, you need to make note of a few conditions. First and foremost, you will need to deposit a minimum of $100 to open an account. Second, although there are no deposit fees charged, you will be liable to pay the equivalent of $20 when withdrawing your money. Moreover, the main drawback is that the platform supports only five digital assets at the time of writing.

| Available Staking Coins | Bitcoin, Ethereum, Tether, USD Coin, and Dai |

| Staking Rewards on Cryptocurrencies | BTC and ETH – 7%

Stablecoins (USDT, USDC, DAI) – 12% |

| Min & Max Staking Amounts | $100 (or equivalent) minimum; no maximum |

| Lock-In Period | Flexible withdrawals |

| Payout Frequency | Daily |

Pros:

- High interest rates offered

- Can earn passive income on stablecoins and cryptocurrencies

- Withdrawals are possible in both crypto and fiat money

Cons

- A limited number of cryptocurrencies supported

Join AQRU Now

Cryptoassets are a highly volatile unregulated investment product.

2. eToro – Best Crypto Staking Platform for Low Trading Fees

eToro is one of the most popular cryptocurrency brokers in this industry – with over 20 million clients on its books. This trading platform is regulated on multiple fronts – namely by the SEC in the US, the FCA in the UK, CySEC in Cyprus, and ASIC in Australia. On top of this, eToro ensures a smooth experience for crypto investors of all levels.

eToro is one of the most popular cryptocurrency brokers in this industry – with over 20 million clients on its books. This trading platform is regulated on multiple fronts – namely by the SEC in the US, the FCA in the UK, CySEC in Cyprus, and ASIC in Australia. On top of this, eToro ensures a smooth experience for crypto investors of all levels.

It is particularly user-friendly and lets you buy all of the best staking coins that we discussed in this guide. When it comes to staking, eToro offers support for three digital assets as of writing – which includes Cardano, Ethereum, and Tron. The interest rates you receive depend on the eToro Club you belong to, which is determined by your realized equity on the platform.

For instance, Diamond and Platinum+ members are eligible to earn 90% of the monthly staking yield, whereas Silver, Gold, and Platinum users receive 85%. All eToro users are Bronze members by default and will gain 75% of the monthly yield in return.

As you can see, eToro offers some of the highest rewards when it comes to staking. Although supported staking coins are limited right now, you can use this platform to buy dozens of digital currencies. Moreover, eToro comes with an in-built wallet that you can use to store your digital assets for free.

When you want to sell your crypto investments, eToro makes facilitates this at super-low fees. To buy crypto, you can deposit funds into your eToro account using a bank transfer, credit/debit card, or e-wallet.

Importantly, as long as you are funding your account in US dollars, eToro does not charge any deposit fees. Apart from cryptocurrencies, eToro is also a great broker to use to invest in stocks and ETFs, as well as trade commodities and forex. This platform further shines by offering a beginner-friendly mobile app.

| Available Staking Coins | Cardano, Tron, Ethereum |

| Staking Rewards on Cryptocurrencies | Starts at 75%. Varies depending on the eToro Club you belong to |

| Min & Max Staking Amounts | Investment should generate at least $1 of staking rewards |

| Lock-In Period | No lock-in period. Should hold an open position for at least nine days for Cardano, and seven days for Tron |

| Payout Frequency | Monthly |

Pros:

- Regulated by the SEC, FCA, CySEC, and ASIC

- Nearly 60 cryptocurrencies supported

- Minimum deposit amount is only $10

- Free crypto wallet

Cons

- Only three cryptocurrencies are available for staking

Cryptoassets are a highly volatile unregulated investment product.

3. Crypto.com – Best Crypto Staking Platform for High-Interest Rates

![]() Launched in 2016, Crypto.com has emerged to become one of the best crypto exchanges globally. In fact, Crypto.com has launched an entire ecosystem that supports a variety of crypto-related services, including loans, interest accounts, trading, credit cards, and more. It also lets you buy over 250 digital assets at low fees and via a simple-to-use interface.

Launched in 2016, Crypto.com has emerged to become one of the best crypto exchanges globally. In fact, Crypto.com has launched an entire ecosystem that supports a variety of crypto-related services, including loans, interest accounts, trading, credit cards, and more. It also lets you buy over 250 digital assets at low fees and via a simple-to-use interface.

If you are looking to buy digital assets, Crypto.com facilitates payments via its app. You can pay for your digital assets with over 20 fiat currencies using your credit/debit card or by making a bank transfer.

When it comes to its interest accounts, Crypto.com lets you earn rewards on 50 digital assets – which includes nine of the best staking coins listed in this guide. Once you deposit your tokens into these accounts, Crypto.com will use the funds to faciliate loans for other verified users.

Borrowers will repay the loan with interest, which is paid out to you on a daily basis. Furthermore, Crypto.com compounds the interest, giving you the opportunity to boost your long-term gains. In terms of the rates on offer, this depends on the coin as well as the lock-in period you choose.

For example, if you choose to buy Ethereum worth $1,000 and hold the tokens in an interest account for three months, you will receive an APY of 5.5%.

On the other hand, if you hold Polkadot under the same conditions, you will receive 10%. Flexible plans are also available – however, these are likely to yield much lower interest rates. You can also boost your returns by holding CRO – which is the native digital token of Crypto.com.

| Available Staking Coins | Earn rewards on 50+ different cryptocurrencies |

| Staking Rewards on Cryptocurrencies | Up to 14.5%. Depends on the digital coin, the lock-in period, and the CRO tokens you hold |

| Min & Max Staking Amounts | Minimum – depends on the coin. Maximum – equivalent of $500,000 |

| Lock-In Period | 1 month, 3 months, and flexible plans |

| Payout Frequency | Daily |

Pros:

- Earn interest on 50 different cryptocurrencies

- Up to 14.5% APY

- Buy 250+ cryptocurrencies

Cons

- Requires CRO tokens to unlock higher rewards

- Flexible plans yield low interest rates

Cryptoassets are a highly volatile unregulated investment product.

What are Staking Coins?

In simple terms, staking coins are cryptocurrencies that allow you to earn rewards for supporting the PoS process of the respective blockchain. You can do this by opening a node yourself, or by simply depositing your digital assets in a third-party platform that facilitates staking.

By adopting this staking strategy for your idle cryptocurrencies, you will be able to earn interest instead of simply holding them in your wallet until you are ready to sell.

Here is a quick example of how you can earn rewards via staking:

- Suppose that you wish to stake Ethereum

- On your chosen staking platform, Ethereum staking yields an APY of 10%

- You decide to stake $1,000 worth of ETH tokens for six months

- This means that by the end of one year, you will get $100 in rewards

- For six months, this translates to a return of $50

Remember that the returns will be paid out in ETH tokens. On top of this, the value of Ethereum might also increase during the course of staking – which will yield additional gains.

As you can see, staking can be an incredibly effortless way to generate passive income – especially when considering the high interest rates offered on crypto assets.

Benefits of Staking Crypto

If you have read our guide up to this point, you know that staking can indeed be very advantageous. To offer you some more clarity on the subject, below, we have rounded up the benefits of staking:

- Staking crypto allows you to generate a return on your digital assets that might be otherwise sitting idle in your wallet

- It also allows you to store your digital coins while making a return

- Many investors also look at staking as a means to hedge against declining crypto prices

In other words, when you stake cryptocurrencies, you will generate returns regardless of how the digital asset is performing in the market. Moreover, if you do not lock up your coins, you can retrieve them at any point and cash out at your convenience.

How to Choose the Best Staking Crypto for You

When it comes to picking the right cryptocurrency to the stake, the decision is not entirely dependent on the APY you receive.

If you are wondering which options represent the best staking coins for you, consider the following factors to arrive at your decision.

Lock-In Periods

Perhaps one of the first considerations to make is whether you will have to lock in your chosen staking coin for a certain period to receive rewards.

As you can imagine, the ideal way would be to choose a flexible plan, which will give you access to your digital assets at all times.

While fixed plans might present you with higher APYs, locking in your digital coins could prevent you from taking advantage of a sudden market opportunity.

Fixed Supply

Cryptocurrencies that come with limited circulation might also encourage demand in the market. This can be a useful trait to look for in top staking coins, especially if the token has demonstrated an upside potential.

This follows the basic concept of supply and demand. That is to say, when there is a limited number of digital tokens available, demand will potentially rise, which can drive up prices and thus – the staking rewards.

Among the best staking coins we noted here, many digital assets, including Chainlink, Algorand, and Uniswap have a limited supply.

Utility of the Coin

As we mentioned earlier, you also stand to benefit if the value of your staking coin increases. And this means that you should do your due diligence to find out which cryptocurrencies have the possibility to grow in the future.

If a particular digital coin has various applications in the real world, it might be well-positioned to gain more value in the coming years.

And as such, the cryptocurrency will continue to attract both demand and rising prices.

This way, even if the APY you receive is relatively low, you will still be able to generate profits from the capital appreciation when you are ready to cash out your investment,

How to Buy Stake Coins on AQRU

Although many cryptocurrency platforms offer support for the best staking coins, the processing of buying these digital assets can be challenging, especially for beginners.

To help clear the mist, we are now going to walk you through the process of how to buy staking coins via the user-friendly platform AQRU.

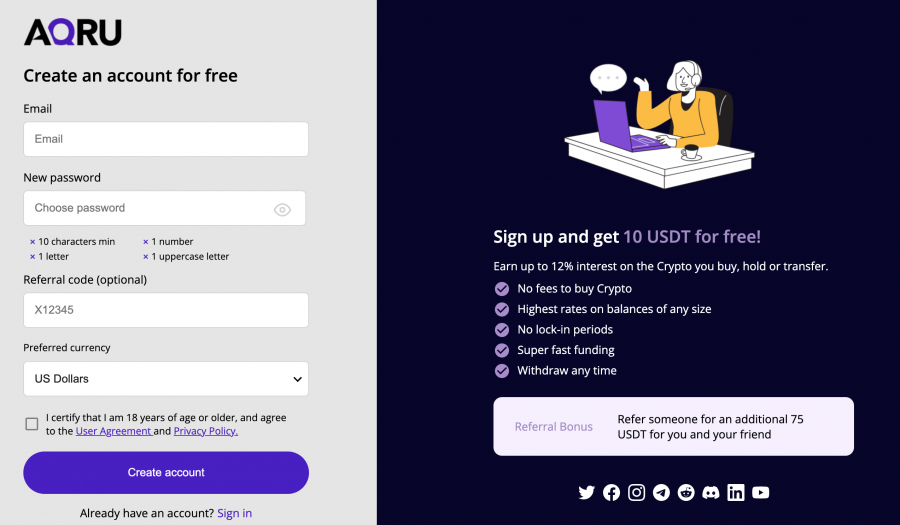

Step 1: Create an Account

To begin earning interest on the best staking crypto at AQRU, you will first need to create an account with this platform. To do this, you can head over to the AQRU website and find the ‘Sign Up’ button.

As you can see from the image above, you only need to provide your email address and choose a suitable password.

You can then use the ‘Create Account’ button to move to the next step.

Step 2: Verify Identity

As a licensed platform, AQRU takes the security of your assets seriously. This means that you will have to provide proof of identity before you can access the best crypto staking coins.

While the process might seem complicated, it only means that you have to submit the following:

- Government-issued ID card

- Utility bill or bank statement

AQRU has the entire process automated – so you should receive confirmation in a matter of minutes.

Step 3: Add Funds

Next up, you can add funds to your AQRU account. For this, you can deposit fiat money – such as US dollars, British pounds, or euros. The platform supports two fiat payment methods – bank transfers and credit/debit cards.

Moreover, there are no fees charged when making a deposit.

Alternatively. if you already own a supported digital asset, you can also perform a crypto transfer. As of writing, AQRU accepts deposits in Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USD Coin (USDC), and Dai (DAI).

Step 4: Access Staking Crypto Coins

Once you have funded your account, you can buy the best staking tokens that you are interested in. AQRU displays the different investment options and the associated percentage of returns.

Let’s suppose you want to buy Ethereum and earn returns on your ETH coins.

You only have to choose Ethereum and specify the amount you want to invest. After you have confirmed the purchase, your AQRU dashboard will instantly start to show the interest you are earning – second by second.

As you can see, AQRU lets you accumulate a passive income on the best staking coins with minimal effort from your end.

Conclusion

By staking your cryptocurrencies, you will earn passive returns without having to cash out your investments.

To point you in the right direction, this guide has discussed the 10 best staking coins for 2022 – and which platforms to consider for this purpose.

If you are somewhat new to the crypto space and wish to start accumulating rewards on your digital coins right now, then we suggest that you consider AQRU. This platform is easy to use and lets you get started in less than 10 minutes.

Moreover, you will be able to earn 7% on Bitcoin and Ethereum and 12% on stablecoins.

![]()

Cryptoassets are a highly volatile unregulated investment product.

Be the first to comment