- Primal joined PancakeSwap’s Syrup Pool Farm

- Despite updates around the ecosystem, investor concerns still revolve around the future of CAKE

PancakeSwap [CAKE] recently announced that Primal, an athlete-fan token project, joined its syrup pool farm starting 28 December. With this new development, users will now be able to stake CAKE in order to earn PRIMAL.

For the first 48 hours, the farm will offer 0.2x CAKE prizes, followed by 0.1x rewards. To talk about PRIMAL, it integrates with activity trackers, such as Fitbit, Apple, Oura, and Whoop so that users can earn tokens while working out.

📢 @PancakeSwap welcomes @enterprimcral to Syrup Pool and Farm!

📅 Start time: Approx. 12 UTC on 28 Dec!

✅ Stake $CAKE to earn $PRIMAL!

✅ Stake #PRIMAL-BUSD LP to earn #CAKEMore details 👇 https://t.co/phu2x3gO4l#BNB #BSC #Web3 #Move2Earn #P2E $BNB #Crypto #DeFi #NFT #NFTs pic.twitter.com/vR3viPUVxw

— BNB Swap (@BNBSwap) December 28, 2022

Read PancakeSwap’s [CAKE] Price Prediction 2023-24

Did CAKE rise to the occasion?

CAKE’s reaction to this update was not up to par, as its daily chart was painted red. According to CoinMarketCap, CAKE’s price registered a decline of more than 4% in the last seven days. Furthermore, at press time, it was trading at $3.25 with a market capitalization of over $522 million.

Nonetheless, Santiment’s data provided some relief, as some on-chain metrics revealed that things might soon favor CAKE’s next price movement.

Source: Santiment

The token’s Market Value to Realized Value (MVRV) Ratio declined considerably over the past week, which might be a possible indicator of a market bottom. Moreover, CAKE’s velocity also registered an uptick, further increasing the chances of a trend reversal.

CAKE’s social dominance spiked quite a few times last week, reflecting its popularity. Not only its social dominance, but CAKE’s popularity was yet again proven. This was because it ranked second on the list of the top BNB Chain projects in terms of most mentions in the last 24 hours.

PancakeSwap’s burn rate also looked pretty optimistic for the network as it recently burned 6,808,702 tokens, which were worth more than $22 million.

Most Mentioned #BNBChain Projects last 24h❤️🔥🌍

🥇 $QUACK @RichQuack

🥈 $CAKE @PancakeSwap

🥉 #BABYDOGE @BabyDogeCoin$TTC @TechTreesSDG$FLOKIM @FlokiMooni@RealFlokiInu @safemoon @1inch @Marvin_Inu @bitgertbrise @Everdome_io @LakeviewMeta @CEEK @inu_boba @HODL_OFFICIAL #BNB pic.twitter.com/GFQcJMOtel— Crypto Insights (@CryptoInsightsX) December 27, 2022

A 611.31x hike on the cards if CAKE hits Bitcoin’s market cap?

The bulls still have a war to fight

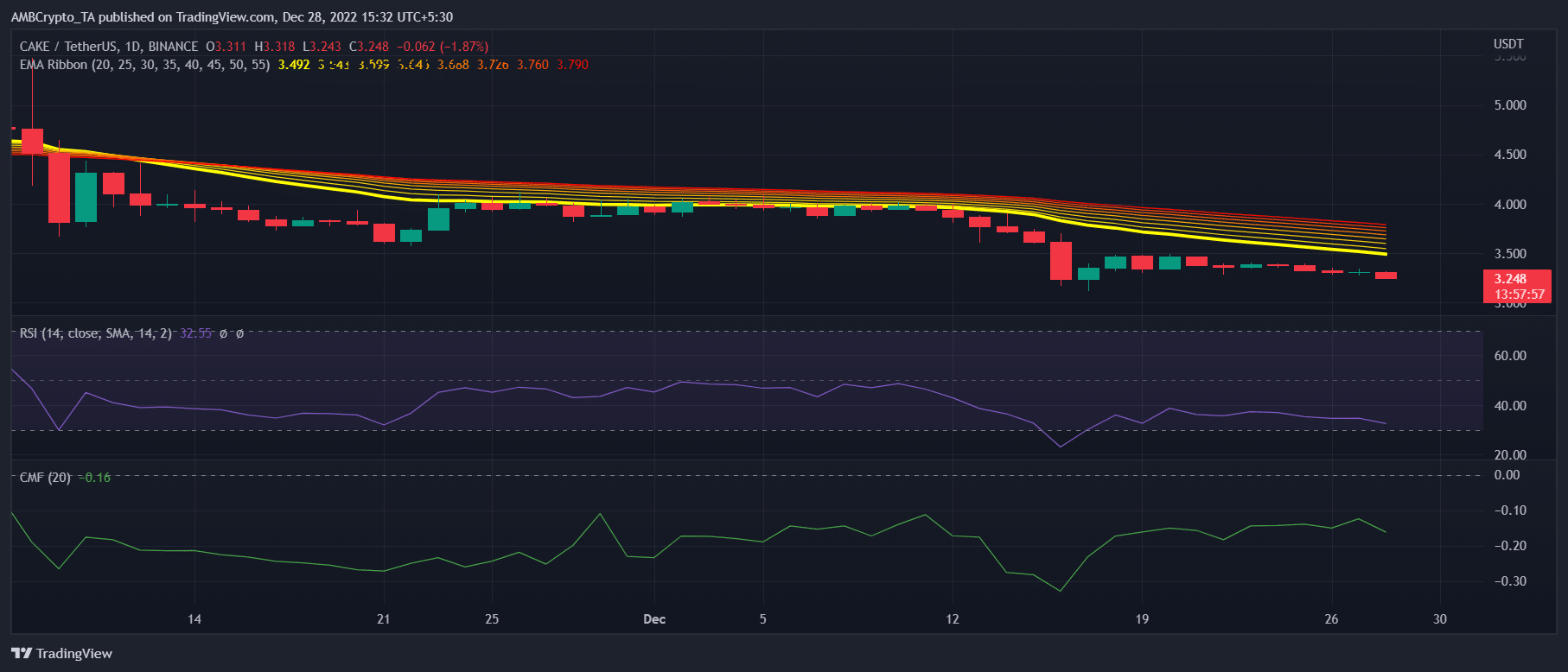

Though the metrics were in CAKE’s favor, market indicators painted a grim scenario that was in favor of the bears. The Exponential Moving Average (EMA) Ribbon revealed sellers’ advantage in the market as the 20-day EMA was resting below the 55-day EMA.

Furthermore, CAKE’s Chaikin Money Flow (CMF) also registered a downtick, which looked bearish. However, the Relative Strength Index (RSI) provided relief as it was just near the oversold zone. This could give investors some hope of an upcoming price pump.

Source: TradingView

Be the first to comment