- VeChain’s RSI and Stochastic were oversold, which was a bullish signal.

- Metrics were supportive of price surge, but the market indicators suggested otherwise.

VeChain [VET] failed to make its investors happy as its performance last week was not very satisfactory.

According to CoinMarketCap, VET’s price decreased by more than 12% in the last seven days. At the time of writing, it was valued at $0.01628 with a market capitalization of over $1.18 billion.

Nonetheless, investors now have a reason to raise their expectations as a major bull signal was revealed by CryptoQuant’s latest data.

How many VETs can you get for $1?

A new bull run soon?

VeChain’s Relative Strength Index (RSI) and Stochastic were both in oversold positions, at press time. The reading of the leading indicators underlined the fact that there is a high chance for a trend reversal in the coming days.

Moreover, Santiment’s chart also painted a bullish picture for VET. Consider this- VET managed to maintain its demand from the derivatives market as the Binance funding rate was relatively high. Its social volume also remained consistent over the last week, reflecting its popularity.

Source: Santiment

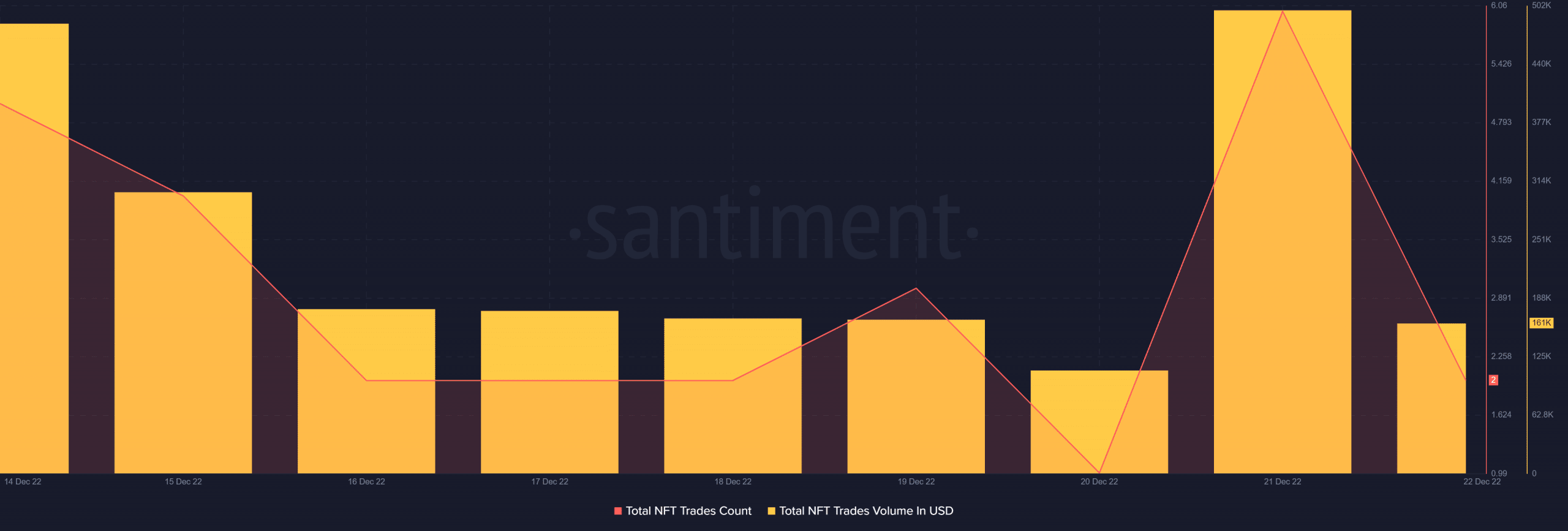

Surprisingly, while the token took a blow as its value decreased, VeChain’s NFT ecosystem witnessed growth. The total NFT trade counts and trade volume in USD registered a spike.

Source: Santiment

VeChain’s roadmap looks promising

Interestingly, the VeChain Foundation recently published its VeChain x B.R.E.W. 2022 event recap, which mentioned a few important highlights.

The current technical and sustainability roadmap, which can be generally divided into sustainability-related tools, developer tools, and “digital ecosystem” tools, was updated by Dimitris Neocleous, Head of Ecosystem Build at the VeChain Foundation.

Head of Ecosystem Build, Dimitris Neocleous, recently attended B.R.E.W 2022 to present #VeChain‘s tech & #sustainability roadmaps & advancements in healthcare applications.

Participants had own $VET-related updates to share, too. See the update for info!https://t.co/YmUaFWjHkG pic.twitter.com/aLvXHi5x0v

— VeChain Foundation (@vechainofficial) December 21, 2022

Moreover, it was disclosed during Messari Mainnet 2022 that VeChain will release a new whitepaper in the first quarter of 2023 with a focus on sustainable digital ecosystems. All these new updates looked optimistic for VeChain and could serve as the foundation for its next bull run in the near future.

A 272.02x hike on the cards if VET hits Bitcoin’s market cap?

Don’t get hyped yet!

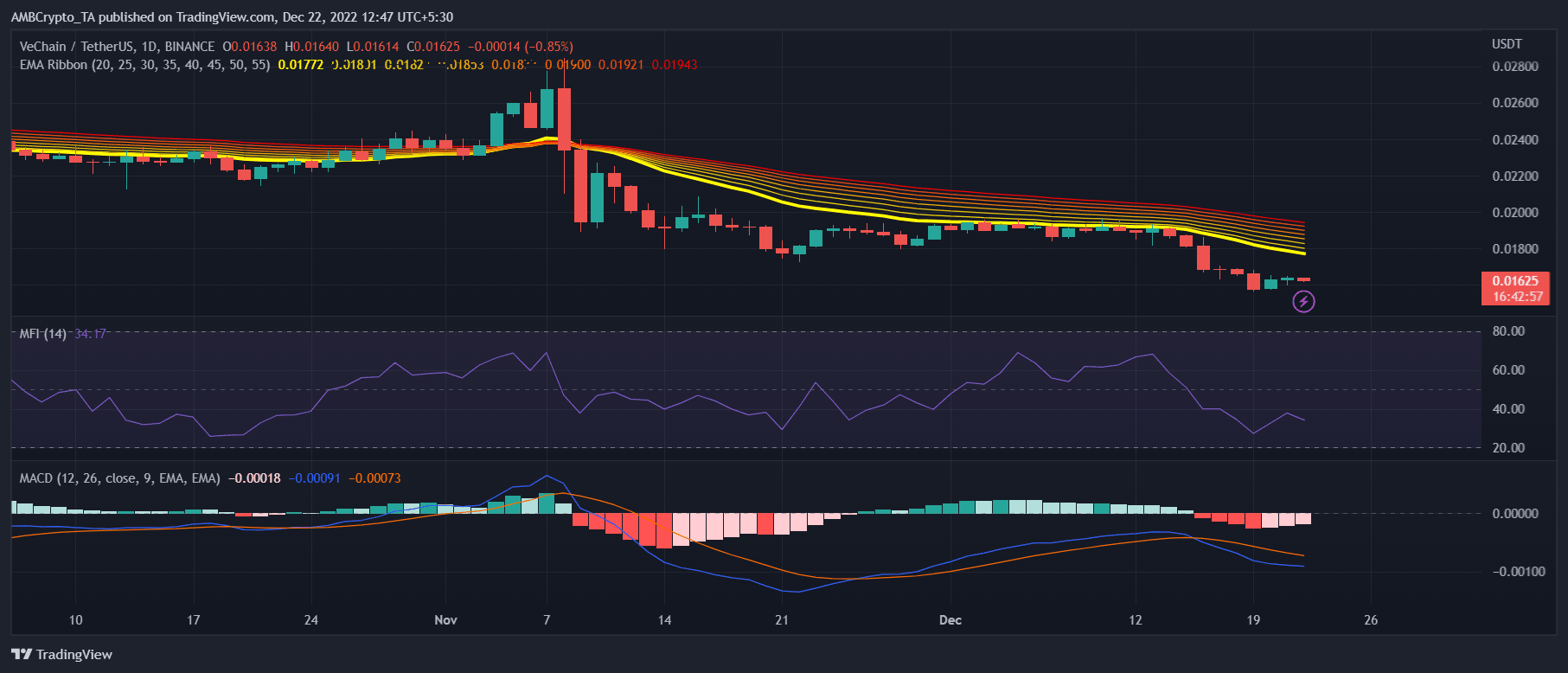

Though the metrics and updates were supportive of a price surge, VET’s daily chart painted a bearish picture. For instance, the Exponential Moving Average (EMA) Ribbon revealed that the 20-day EMA was below the 55-day EMA. Thus, suggesting sellers’ advantage in the market.

The MACD’s data complemented that of the EMA ribbon. VET’s Money Flow Index (MFI) was also resting below the neutral mark, which too was a bearish signal, increasing the chances of a further downtrend.

Source: TradingView

Be the first to comment