- BlockTower and MakerDAO partnership brought $220M of RWA to DeFi.

- Interest in MKR tokens declined as selling pressure increased.

In a recent turn of events, BlockTower Credit, an asset management firm, partnered with MakerDAO and Centrifuge to bring $220 million worth of real-world assets (RWA) into the DeFi ecosystem.

This partnership will allow BlockTower to issue DAI loans backed by these RWAs, and will bring transparency and new revenue streams for all parties involved.

1/ @BlockTower Credit looks to capitalize on an untapped asset class as the first institutional credit-fund to tackle DeFi through collateralized real-world assets (RWAs).

Execution begins in its partnership w/ @MakerDAO and @centrifuge, bringing $220M of RWAs on DeFi rails.🧵 pic.twitter.com/IEMsnfV0yP

— Messari (@MessariCrypto) January 11, 2023

Is your portfolio green? Check out the MKR Profit Calculator

Welcome to the “Real World”

Bringing these assets to DeFi involves MakerDAO issuing four separate vaults to fund RWA investments. Each of these four vaults will have varying debt limits: 20 million, 30 million, 30 million, and 70 million DAI, respectively. The choice of four vaults, each with a different debt ceiling and collateral, allows for diversifying risk and optimizing returns.

The assets proposed would be shorter-duration, easy-to-liquidate assets. Vault 1 will be focused on whole loans or receivables, which will be arranged by BlockTower and originated by leading consumer lenders. Vault 2 will focus on senior secured credit facilities, with an emphasis on FinTech and non-bank-originated traditional asset-backed strategies.

Vaults 3 and 4 will be investment-grade structured credit, primarily consumer and auto-loan-based assets, with different maturities.

For each party involved, this partnership promises potential benefits and revenue. For MakerDAO, this partnership will enable it to access a more varied range of assets, making its stablecoin, DAI more robust and helping the DAO in generating additional revenue streams.

Moreover, the focus on RWAs could be because these real-world assets bring a lot of revenue to MakerDAO. Despite accounting for only 12% of the overall assets, RWA handled 57% of the revenue generated by MakerDAO according to Messari.

Source: Dune Analytics

Meet your “MKR”

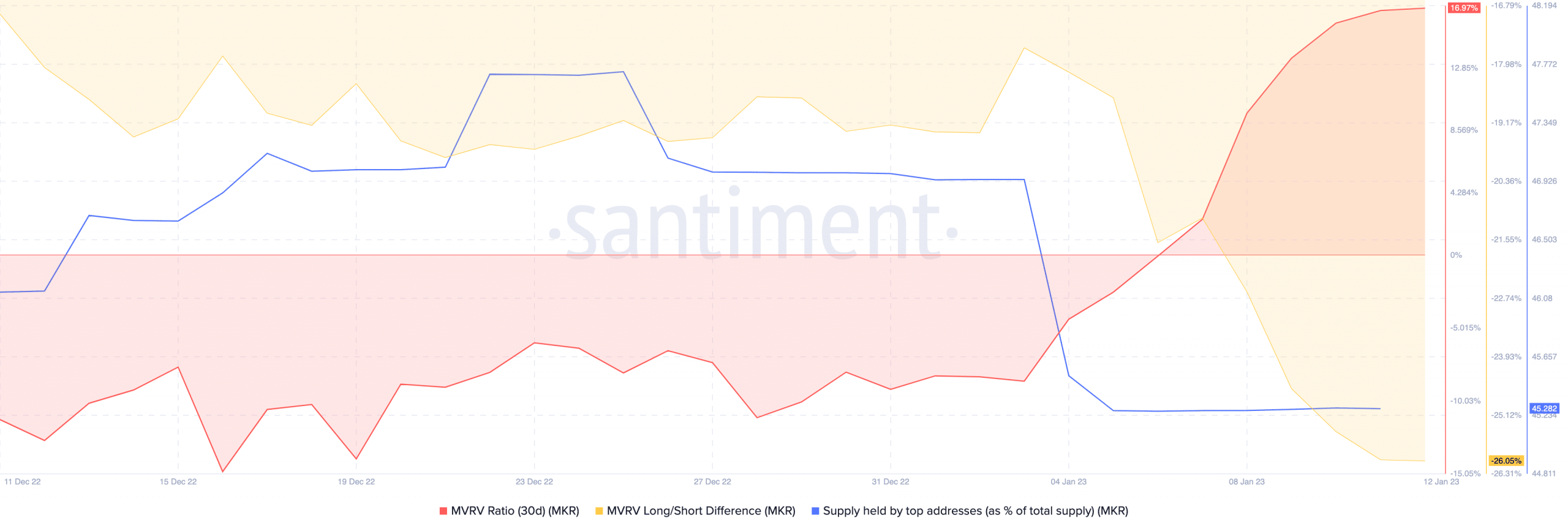

Despite MakerDAO’s constant efforts to increase revenue and diversify its assets, large addresses remained disinterested in the MKR token. One reason for the same could be the growing MVRV ratio and the negative long/short ratio.

The high MVRV ratio gives short-term holders an incentive to sell their positions at a profit, which could affect the price of the MKR token in the short term.

How many 1,10,100 MKRs are worth today?

Source: Santiment

Meanwhile, at press time, the price of MakerDAO was $634.39, growing by 1.84% in the last 24 hours.

Be the first to comment