Patrick Riviere/Getty Images Entertainment

In 2021, I asked what would happen to stocks when stimulus ran out in 2022. The answer was a bit startling, if predictable. Now, as 2022 comes to a close, the next question – what will happen to stocks in 2023 when the lagged effects of Fed tightening fully kick in? And what about the fact that Republicans are likely to “dismantle” the Biden administration’s student loan holiday as soon as February and then drop the ax on deficit spending later in the year? The last time Republicans controlled the House and Democrats controlled the White House, they knocked budget deficits down to the Obama-era levels of 2-3% of GDP annually. The stakes are high, as the FY 2022 budget deficit already came in worse than previous expectations at about ~5.5%. The key driver of the deficit wasn’t the war in Ukraine, which cost us about 0.2% of GDP. Actually, the biggest driver of the deficit was the massive losses sustained by the Department of Education from not collecting student loans and from student loan cancellation. DoE spending in 2022 was ~2.5% of GDP overall, almost as much as the military.

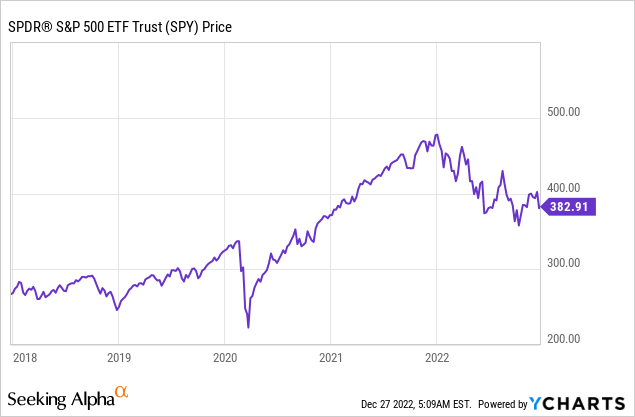

This is one of the highest budget deficits ever for the US economy when not in recession, leaving almost no room for stimulating the economy in the next downturn without causing a brutal wave of stagflation. This is one reason that the S&P 500 (SPY) is down about 20% for the year as of my writing this. While my research indicates that while the worst of the bubbles are gone, we still need to go back to pre-pandemic prices to get to fair value for stocks-down another 20% or more. In the post-war era, the S&P 500 has only fallen in consecutive years in 1973-1974 and 2000, 2001, and 2002. While this is historically rare, the markets seem to be set up again for another drop due to the massive hangover from too much money printing.

The Free Money Is Running Out

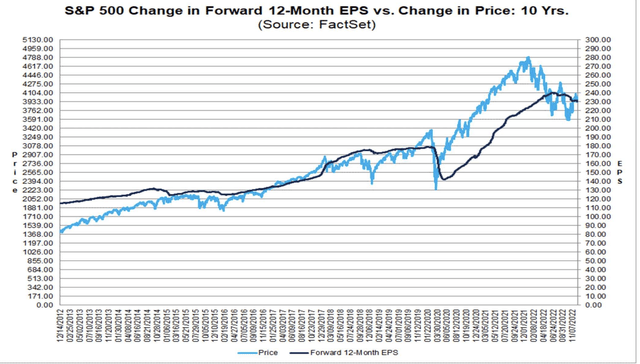

As the free money runs dry, it’s going to feel like a recession for households, even if nothing changes with the underlying productivity of the economy. Congress’s unruly spending plans have clashed with the plans of the Fed to bring down inflation, as the Fed hikes rates and sells $95 billion in bonds each month as part of its mission to bring down inflation. This means there’s about to be a ton of supply of U.S. Treasuries hitting the market, pushing prices down and yields way up (see the research on “crowding out” for what I mean by this). To get in front of this, blue-chip companies are expected to “storm” the investment-grade bond market with $40 billion in bond sales for the first week of January. When you combine the effects of budget deficits, quantitative tightening, and a divided government that will likely put an end to pouring fiscal stimulus into a tight economy, it creates the perfect storm for liquidity conditions in the markets. Stocks at large are already expensive compared with historical levels, and earnings estimates are shaky.

Earnings Estimates (FactSet)

For the economy, it’s pretty simple- if something isn’t sustainable it won’t last forever. That means fewer $4,000/month mortgages for starter homes, fewer $1200 payments for pickup trucks, fewer bachelor parties in Miami and Las Vegas, and fewer people buying $1,500 Apple (AAPL) iPhones every year. In short, the wild run of the U.S. consumer is about to meet an end. Consumer discretionary stocks are among the worst performers in 2022, and I expect them to continue to struggle in 2023.

To understand what’s going on with the economy, we need to unlearn some of what we’ve learned in our lifetimes. In a normal economy, labor productivity growth > wage growth > spending growth. But now:

- Prices are up more than wages. This means inflation is not yet under control.

- And wages are rising faster than labor productivity/value added. This is terrible for future profit margins.

- Personal savings rates are at the lowest level since the run-up to the 2008 recession.

What does this all mean?

- The Fed needs to raise rates higher than the market wants and keep them there longer to deal with the problems in the labor market and economy. It also means the Fed has no choice but to allow liquidity to rapidly drain out of the system. The budget deficit + Fed QT is about 10% of GDP, which is a huge amount of bonds for the private sector to absorb.

- The legislative and judicial branches in the US are poised to dramatically slow government spending back to sustainable levels, which is a huge problem for those who built their business models around permanent QE and stimulus.

- Because of these, stocks that lose money in search of growth or built their business models around government stimulus are in tons of trouble.

- Stocks are still overvalued.

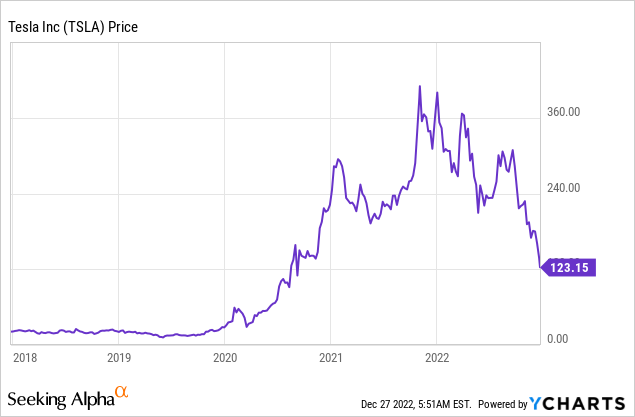

Ground Zero- Tesla

For the impact of draining liquidity, look no further than Tesla Motors (TSLA). Tesla has had a terrible year, with the stock down about 70% as of my writing this. TSLA hit a market cap of roughly $1.2 trillion in early 2022, but a mere $40 billion in Elon Musk’s share sales seems to have stretched the underlying liquidity in the stock to the max.

Tesla is the Nasdaq (QQQ) on steroids, with the stock surging nearly 20-fold in the early days of the pandemic. Tesla is a unique test of liquidity because Elon Musk has heavily used margin loans to finance his other ventures, has a huge stock-based compensation plan, and has sold nearly $40 billion in stock in 2022. These are all listed in Tesla’s financial statements as risks, but none of this mattered in 2020 and 2021 because the system was flooded with stimulus and Tesla was a prime beneficiary, so the market even cheered secondary offerings. Musk seems to be wisely avoiding worst-case scenarios around his Tesla borrowings, but even I’m surprised at how brutally the stock has reacted to continued share sales into a down market. Essentially, pulling $40 billion in equity out of a $1.2 trillion company seems to have caused the share price to fall 10x or more as much as the actual sales raised. Will Elon Musk get margin calls from his borrowing against Tesla stock? Has he already? I don’t know the answer, but it’s going to be fascinating to watch it play out.

Tesla does make money (albeit helped by some somewhat aggressive accounting), but the question investors should ask is how dependent the company is on continued access to liquidity. TSLA would need to fall another 60-70% before it truly becomes a value stock. Can Tesla’s business grow from here? It absolutely can, but without easy money sloshing through the system going forward, the success of Tesla shareholders is likely to be much more correlated with the underlying business. Tesla is in the right industry for growth, but their potential cash needs for expansion and the increasing price for capital may come back to bite the company. Amazon (AMZN) is in a tough spot under similar lines, trading for 51x 2023 earnings estimates and at the mercy of runaway inflation and the Fed’s interest rate hiking campaign. Amazon is arguably in a worse position than Tesla here because Tesla can hold onto current levels of profitability and eventually reward shareholders, while Amazon is dependent on a huge runway for growth just at the time the Fed has pulled the rug on liquidity. And beyond Tesla and Amazon, there are so many NASDAQ stocks that have issued tons of stock-based compensation-allowing the flood of overall liquidity to earn big compensation for their employees without costing the company anything in cash. But when liquidity goes away, stock prices go down, and growth rates slow, this can turn into a vicious cycle for tech companies as it crushes everyone’s incomes. And for companies like AMC Entertainment (AMC), the liquidity crush means that they’re out of chances to kick the can down the road, and bankruptcy will soon follow.

Planet Crypto

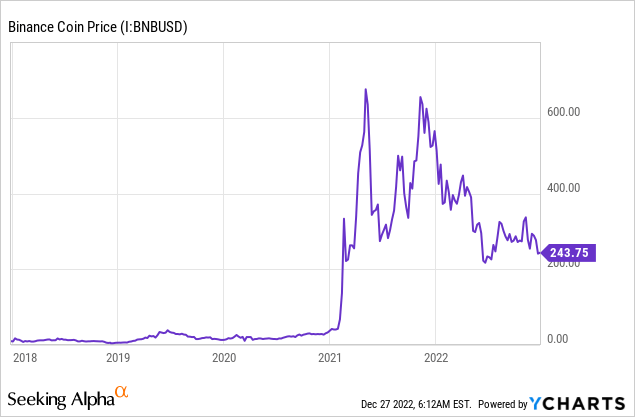

Another place where liquidity is likely to be problematic is the crypto world. If you study the history of Bitcoin (BTC-USD), this is completely against the founding ethos of early crypto adopters, but much of the crypto world today is highly financialized, collateralized, and soon to be capsized. Investors should keep an eye on Binance (BNB-USD) and Tether (USDT-USD) for the potential next shoes to drop in crypto.

Like FTX, Binance has a native token that correlates roughly to the health of the company. Unlike FTX, Binance has been able to navigate the crypto environment so far. As liquidity drains from crypto from Fed tightening, investors are likely to tap crypto assets for cash, and when this happens, legitimate projects will have the liquidity to cash people out. Dodgy projects won’t, which is where the next crypto blowup will come from. If Binance is exposed to the next blowup, it will be another serious test as to whether the exchange can sail through the current environment or whether they’ll also find themselves without enough liquidity to cover withdrawals. I think Binance could go either way, on one hand, it’s offshore and opaque, and on the other, it’s still in business after most of the crypto world has already blown up.

Where will the next blowup come from? I can’t say for sure, but there are a ton of rumors about Tether, from independent research to long-running investigative reporting from Bloomberg on the project. And then you have the fact that so many people at these crypto projects are under investigation for stuff like fraud and money laundering. I did my own report on Tether, concluding that the coin is a “time bomb”. I think Bitcoin has a ton of long-term potential, but more shoes are definitely going to drop in the crypto world in 2023. The Fed pulling more money out of the economy almost guarantees that the weakest ideas and projects in the financial system are going to hit the breaking point. Banks are now quietly starting to tap the Fed discount window, something that barely happened at all from 2010 to 2020. If banks are quietly experiencing some financial stress, I can’t imagine what is going on in crypto.

Quick Picks: Many Defensive Stocks Are Still Overvalued

The last thing I find interesting about the stock market bubble unwinding is just how resilient valuations have been for popular stocks, especially in the consumer staples space. These stocks were bid up in the zero-interest rate environment of the 2010s when investors could get 3-3.5% dividend yields rather than paltry bond coupons. But now I look at some of these valuations and scratch my head. I vote these as being liquidity dependent as well because their earnings yields are well below the rate of cash without enough likely earnings growth to justify it. When you’re paying 25-30x earnings for stocks, you need a fair amount of growth to justify the valuation unless you have 15-20 years to wait to get your initial investment back.

1. Coca-Cola (KO) trades for 26x 2023 earnings with only 2% growth expected for 2023. KO has a 2.8% yield, or you could just go and get 5% in Treasury bills!

2. Eli Lilly (LLY) trades for 47x 2023 earnings. The market is hyped up about their diabetes drug but will Congress let them make billions off of it? Maybe not!

3. Costco (COST) trades for 33x 2023 earnings with only 7% growth expected. Will consumer spending hold up though?

4. Walmart (WMT) trades for 24x January 2024 earnings after having flat earnings since 2021. Paltry 1.6% yield.

5. Procter & Gamble (PG) tells a similar story- 26x earnings and 1% growth. 2.4% yield.

6. McDonald’s (MCD) trades for 26x earnings with expected growth of around 5%.

I don’t think most of these earnings estimates are even likely to be hit, leaving many expensive blue-chip stocks needing to fall 30% or more to offer reasonable compensation for investors.

Instead of overvalued blue chips, look at some dividend stocks offering better value!

Three to consider:

1. Truist Financial (TFC) has a 4.9% yield and is a prime beneficiary of the Fed hiking rates. Moreover, they’re paying out less than half of their earnings in dividends, in stark contrast to some companies that lure investors in by paying out all of their earnings, leaving no money left for growth.

2. Altria (MO) is one of the most hated stocks around, but it yields 8.1% and has growth prospects equal to many of the flashier consumer discretionary stocks. Including dividends, Altria beat the market by nearly 30 percentage points in 2022.

3. EOG Resources (EOG) is an oil company with an A-rated balance sheet, a 2.5% yield, and none of the hype of bigger competitors like Exxon Mobil (XOM) or Buffett’s favorite, Occidental Petroleum (OXY).

Bottom Line

Times are changing, and investors accustomed to huge amounts of Fed-driven liquidity powering markets need a new playbook. Failing to recognize these changes will cause big losses for investors, while quickly adjusting to the new reality will help avoid the pain. Stocks that don’t make money, need to raise new capital on a regular basis, and those that have sky-high valuations are virtually uninvestable at the moment. On the other hand, companies with cash flow and dividends have held up well so far since the market topped in January 2022. At the very least, try to avoid the former and invest in the latter.

What are your thoughts? As always, feel free to add your take in the comments!

Be the first to comment