Disclaimer: The Industry Talk section features insights from crypto industry players and is not a part of the editorial content of Cryptonews.com.

With the release of smart contracts, new consensus mechanisms, and improvements to network efficiency, the cryptocurrency market has grown exponentially in recent years, leading many investors to ask, is Ethereum a good investment?

Throughout this guide, we’ll be taking an in-depth look at Ethereum, analyzing its utility and potential for growth to answer the question, is Ethereum a good investment? Let’s get started.

Is Ethereum a Good Investment? Our Verdict

With the asset growing by tens of thousands of percent since its launch, many investors are asking the question, is Ethereum a good investment? After conducting hours of detailed research into the topic, we’ve got an answer.

As the crypto market expands, there will likely be a sharp increase in the number of applications built upon the Ethereum network. This will naturally result in significantly boosted demand for the ETH token, in turn pumping the token’s price. Furthermore, the release of sharding in 2023 will boost the network’s performance immensely, further incentivizing developers to build on Ethereum.

With this in mind, we’ve reached a positive verdict on whether Ethereum is a good investment. While the coming months are likely to be rather rocky, over the long-term Ethereum could perform quite well.

How Ethereum Has Performed Since Launch & in 2022

Ethereum has been performing well since its official launch in 2014. Based on the asset’s past performance, it will have likely provided great returns to investors that gave it enough time to grow. Regardless of when an investor picked up ETH, historically, it’s been possible to turn a profit simply by waiting, making ETH a great long-term crypto investment.

Investors that bought into the asset during its 2018 highs, would’ve had to wait until at least 2021 just to break even. However, given that ETH was held to the bull run’s peak, investors could’ve netted themselves returns of around 275% or an annualized rate of 91.66%. Furthermore, anyone that invested during the 2017 high would’ve secured 482% in returns.

With this in mind, while it’s true that anyone that bought ETH at the peak of the 2021 bull would be down roughly 75% at today’s prices, given enough time they could end up securing huge returns, especially given the recent improvements to the Ethereum network, that massively boosted efficiency.

The same is true for investors that got involved during the January 2022 dip, while they would currently be down around 53%, given a few years in the market, it’s possible that ETH could yield annualized returns similar to its last run. As such, ETH could be the best crypto to buy in the crash right now.

- Since its launch, Ethereum has increased in value by thousands of percent

- Investors that stocked up on ETH during the 2017 run would be enjoying 482% returns

- Anyone that purchased ETH in 2018 would have earned an annualized return of 91.66%

- After hitting a new all-time high in 2021. ETH has been on a steady decline

- Throughout 2022, the price of ETH has fallen alongside the wider market.

Buy ETH with eToro

Crypto assets are a volatile investment product. Your capital is at risk.

Ethereum Price History

Launched back in 2014, Ethereum has grown from a humble initial coin offering (ICO) into a titan of industry and the second-largest cryptocurrency on the market. The asset, now boasting a price tag of around $1,200 was originally sold for just $0.311 during its ICO, a discount of 99.97% compared to today’s figure.

As Ethereum’s smart contract ecosystem grew and began to attract attention from developers, the price of ETH exploded, rising from a 2017 low of just $8.17 to a high of $820.24, an increase of nearly 10,000%. Naturally, this fast growth led many investors to wonder is investing in Ethereum a good idea.

This trend continued into 2018, with Ethereum growing massively. Likely helped along by the fact that the world’s largest blockchain game (at the time), CryptoKitties was built on the Ethereum network, leading many other developers to follow suit. At its peak price in 2018, the price of ETH soared, hitting $1270.47, higher than even today’s valuation.

However, what goes up must come down. Over the next couple of years the price of Ethereum, one of the fastest-growing cryptocurrencies on the market at the time, slowly declined. Throughout 2018 ETH fell as low as $90.60 and traded between $150 and $200 during 2019. Over this same period, the price of Bitcoin fell from $19,118 to a low of $3,460.55.

The ETH price stayed within this range until late 2020 promoting crypto enthusiasts everywhere to wonder will Ethereum go up. While things were looking bleak, the cryptocurrency market picked up significantly as thousands of investors entered the market, pushing ETH to new heights, first taking the asset to $4,174, then even further to $4,733.

Since its huge rise, the price of ETH has fallen amidst war, inflation, and the collapse of various crypto companies, leading Ethereum to its present-day valuation of $1,198.

Ethereum Highs and Lows

Below, we’ve summarized the highs and lows of Ethereum since its launch, putting the asset’s growth in perspective, and making it simpler to determine is Ethereum a good investment.

- Early 2014 – Ethereum was released as an ICO with ETH available for around $0.311

- Mid-2017 – Ethereum slowly grew, then exploded in 2017, rising from $8.17 to $820.

- Throughout 2018 – More investors piled into the market, pushing the price of ETH to $1270.47.

- During 2019 – After hitting a new high in 2018, ETH incrementally declined, falling to $175.

- Late 2020 to 2021 – The crypto market rapidly grew, causing ETH to surge to $4,733.

- Late 2021 to Present Day – The entire crypto market declined, taking Ethereum with it, with ETH trading at a current price of roughly $1,198.

Ethereum Price Forecast

We understand that a large number of investors are trying to decide ‘is Ethereum worth buying?’ To help make this process a bit easier, we’ve opted to include an Ethereum price prediction spanning from 2023 to 2030.

To ensure that our forecast is as accurate as possible, we’ve taken a huge variety of different factors into account. A few of these include the economy as a whole, the crypto market, potential competitors, and even Ethereum’s utility as well as any planned updates to the network. Let’s dive into our prediction.

- End of 2023 – Looking toward the end of next year, we could expect to see growth from Ethereum, however, the market will likely remain bearish as a reaction to uncertainty in the economy. As a result, we could see ETH test a previous support of $1,716.

- End of 2024 – Moving onwards, as long as nothing unexpected occurs, we’ll likely see the economy begin its path to recovery, something likely to have a very positive impact on the crypto and stock market. This will likely lead to Ethereum trading for an average of $2612, an increase of around 125% over today’s prices.

- End of 2025 – With more time to build positive traction, we could see some impressive moves from the price of ETH during 2025. It seems likely that a retest of the asset’s prior high will be required. This would place the value of ETH at approximately $4,733.

- End of 2030 – The Ethereum team will have had plenty of time to work on developing new features and any improvements to the network currently in the pipeline (like sharding) should have rolled out. Combined with the expected growth of the crypto market (11.1% annually), we could see ETH hit $7,985 with a high of $10,000 also possible.

Buy ETH with eToro

Crypto assets are a volatile investment product. Your capital is at risk.

Ethereum Utility – What Does the Future Hold?

When it comes time for an investor to answer the question, should I buy Ethereum now, it’s crucial to consider the project’s long-term utility. It’s impossible to predict the market’s movements with 100% accuracy, but investing in utility-centric projects drastically increases the chances of an investment paying off over the long term.

To make it more simple for investors to determine whether Ethereum holds enough utility to be considered a worthwhile investment, we’ve outlined a few of its top uses below.

Smart Contracts

Perhaps the most widely used feature of the Ethereum network is its smart contract capabilities. Developers can build their own decentralized applications known as dApps, directly on the Ethereum network. This helps to facilitate interoperability between applications and allows new projects to take advantage of the various benefits offered by an established network like Ethereum.

As applications created on the Ethereum network boost demand for the ETH, this could be phenomenal for the long-term growth of this innovative proof-of-stake crypto.

NFTs

The NFT sector is one of the most rapidly evolving areas in cryptocurrency and a large portion of the best NFTs are built on the Ethereum network. Naturally, this has drastically increased the number of transactions taking place on the network, booting its dominance. With NFTs quickly being picked up by mainstream companies this is very promising for Ethereum.

Staking

The recent update to the Ethereum network, known as the merge, switched Ethereum from the proof-of-work consensus mechanism to proof-of-stake. This has created a new economy on the network, with ETH holders able to earn rewards for validating transactions and adding to the network’s security. This incentivizes long-term holds and rewards the project’s top supporters.

Sharding

On top of introducing staking to the network, the merge has paved the way for sharding to be introduced to the network. This will allow transaction data to be split among the network, sharply increasing throughput and reducing congestion during periods of load. Sharding is expected to roll out during 2023.

Security

One of the greatest benefits of the Ethereum network is its security. Achieved through decentralization, Ethereum is considered to be one of the most secure networks on the planet. As a result, it’s commonly used for sensitive applications. With the rate at which crypto hacks are increasing, developers will aim to build on secure networks, boosting the demand for Ethereum.

Is Ethereum a Good Long-Term Investment or Short-Term Investment?

For investors considering is now a good time to buy Ethereum, it’s important to have an investing plan in place. This means determining which prices to buy and sell at and also deciding whether you want to hold Ethereum as a long or short-term investment. We’ll be discussing the merit of ETH with both strategies, making it simple for investors to choose the one right for them.

If you’re wondering should I invest in Ethereum over the short term, it’s important to take the performance of the wider economy into consideration. With assets across the board taking a beating and mass uncertainty being present in the crypto market, it’s probably best to avoid a shorter-term investment in ETH, until the market gets a clear directional bias.

On the other hand, as a long-term investment, Ethereum has excellent merit. The project boasts a wide array of utilities and a strong use case. Furthermore, a number of the world’s largest crypto-assets are built upon the Ethereum network, a clear indicator of longevity. As it stands today, anyone holding ETH for at least 2 years would be in profit, so ETH could work well as a long-term hold.

What Experts Say on Whether You Should Invest in Ethereum

Many experts have strong feelings on the topic is Ethereum still a good investment. While hundreds of prominent figures have shared their opinions regarding this top trending crypto.

- Capital.com, a popular broker discussed the potential of Ethereum saying that the improvements to the network’s scalability and throughput are likely to offer a sizable long-term boost to the asset. The broker summarized predictions from various outlets, almost all of which offered a positive outlook over a 6+ month period.

- Time, a well-known media outlet shared the thoughts of Mike McGlone, an intelligence analyst for Bloomberg. McGlone predicted that Ethereum could end 2022 trading for roughly $4,000 to $4,500. However, another market analyst, Wendy O expects ETH will drop to around $750, providing a mixed answer to the question is Ethereum a good investment.

- WalletInvestor a prominent price prediction platform, shared its rating for Ethereum giving the smart contract network an A+. The predictions platform also stated that according to their forecasts, an increase in the price of Ethereum is expected over the coming years making it a solid long-term pick.

Where to Buy Ethereum

Investors trying to determine is it a good time to buy Ethereum will also likely be wondering where they can pick up the digital asset. We’ve included a review of eToro, a leading broker and our top pick for the best exchange to buy ETH.

eToro – Regulated Broker with Educational Material and Low Fees

eToro is a regulated cryptocurrency and stock broker that first launched back in 2007. Since then, eToro has become an investing powerhouse, serving over 27 million customers around the world. Adding to eToro’s transparency and security, the platform is regulated by leading bodies like the FCA and CySEC.

eToro supports 70+ different cryptocurrencies as well as thousands of other assets, making it an excellent platform to build a diversified portfolio. Anyone that invests in crypto with eToro can rest assured that their funds are safe, as the broker keeps client funds separated from its own and utilizes cold storage to prevent hackers from gaining access to client holdings.

The broker offers a wide range of features suited to beginners, including social trading capabilities allowing users to automatically mirror the trades of others as well as a platform dedicated to educating investors. The eToro Academy offers a massive range of tips and guides covering everything from the basics to more advanced strategies.

Overall, eToro is one of the best platforms to buy Ethereum right now. With the broker offering a tiny $10 minimum deposit, and a cost-effective 1% commission on crypto purchases, it could be worth checking out eToro today.

Buy ETH on eToro

Crypto assets are a highly volatile investment product. Your capital is at risk.

Should I Buy Ethereum Now? Our Verdict

Now that we’ve covered the factors influencing our verdict, it’s time to answer the question, is it still a good time to buy Ethereum?

While the short-term outlook of just about every financial market leaves a lot to be desired right now, Ethereum seems to be very strong in a macro sense. Just about every long-term (2+ years) ETH holder would currently be in profit, with the only exception being those that invested right at 2018’s peak. As such, it’s clear that Ethereum provides a great long-term opportunity.

With Ethereum boasting strong utility and a clear plan for future developments, our Ethereum price predictions look rather promising. While 2023 might be a slow year for crypto, we expect that ETH could reach between $7,500 to $10,000 during 2030, an increase of 525% on the low end.

While the experts seemed mostly divided on how Ethereum might perform over the short term, one thing was clear, long-term growth was expected by most. It seems as though most people believe Ethereum will play a crucial role in the crypto space over the next few years, so it’s not an asset to overlook.

All in all, while its short-term potential is murky, Ethereum seems like a strong long-term investment. As such, it could be a good time to buy Ethereum, for investors focused on the macro perspective.

Coins to Consider Alongside Ethereum

Now that we’ve answered the question is Ethereum a good investment, it seems fitting to discuss a couple of smaller projects built on the Ethereum network, that could provide even greater returns than ETH.

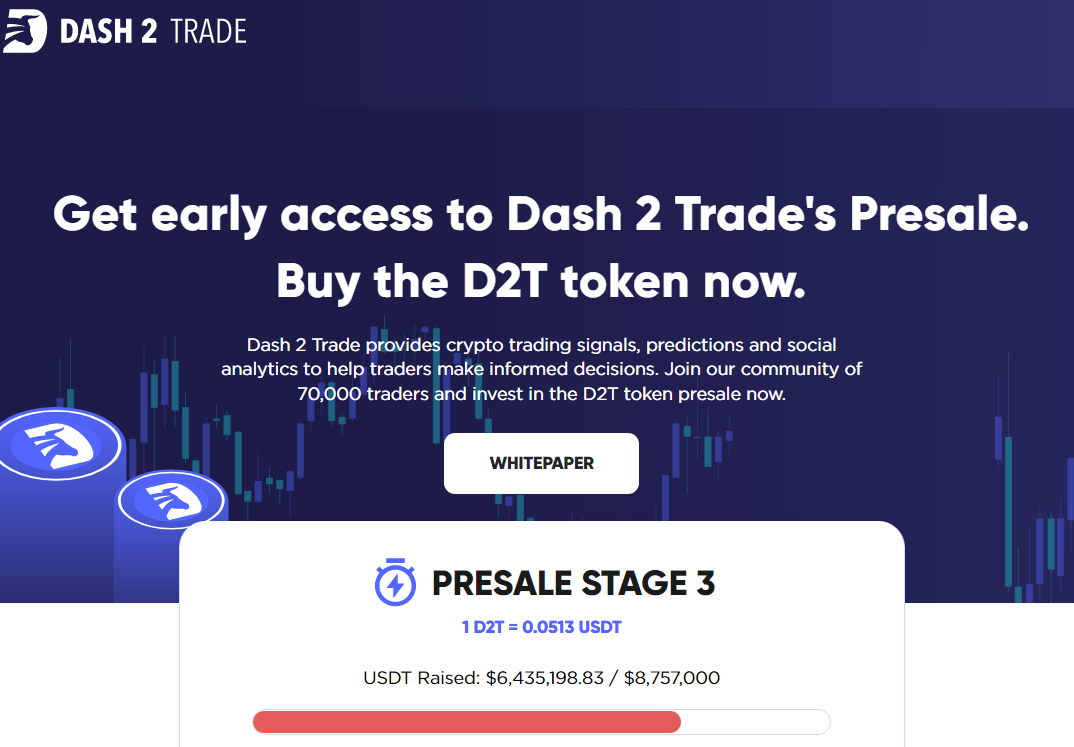

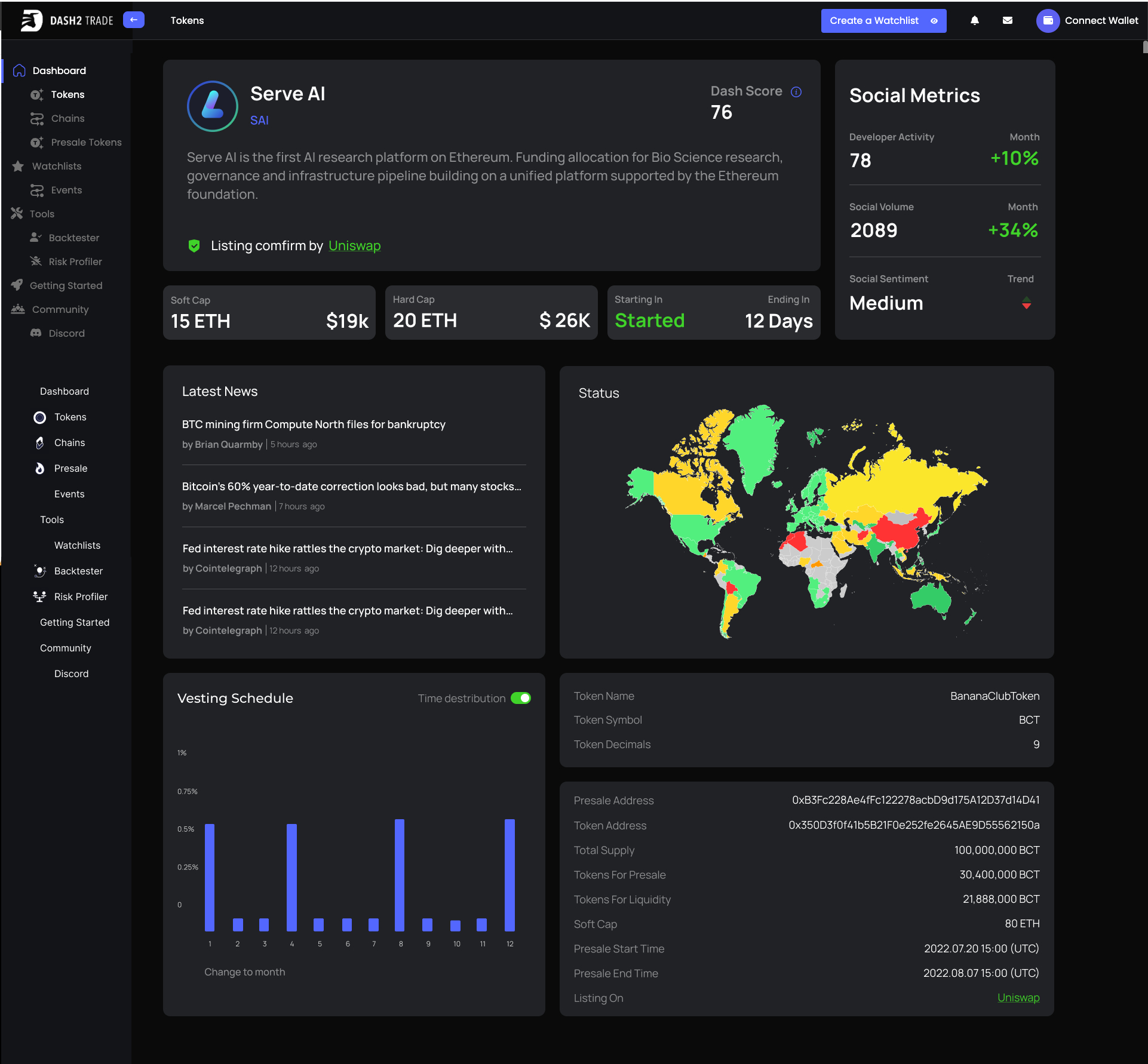

1. Dash 2 Trade – Crypto Analytics and Signals Platform with Presale Ranker

Dash 2 Trade (D2T) is a newly launched platform aiming to improve the success rates of traders and investors everywhere by providing analytical information designed to make spotting trends and opportunities in the market as simple as possible. The D2T token launched as a presale, raising over $6 million within less than a month, attracting massive attention from investors.

The D2T token is used to power the entire Dash 2 Trade ecosystem. It uses the ERC-20 standard and offers tax-free transactions making it one of the best cryptos to trade after its full release. D2T will be used to pay for access to the Dash 2 Trade platform and its vast array of useful features. Check out the Dash 2 Trade whitepaper to learn more.

Being a crypto intelligence platform, Dash 2 Trade boasts a large variety of features designed to benefit traders and investors. A few of our favorites include the in-built platform for building and backtesting strategies, the highly customizable auto trading API, the bespoke ranking system for upcoming presales/ICO, and the buyer sentiment tracker.

Dash 2 Trade tokens are currently available as part of a nine-stage presale. However, D2T will slowly increase in cost during each stage, meaning it’s advisable to check out the project as soon as possible to secure the best deal. Join the Dash 2 Trade Telegram group to stay informed regarding any updates to the project.

Visit Dash 2 Trade Presale

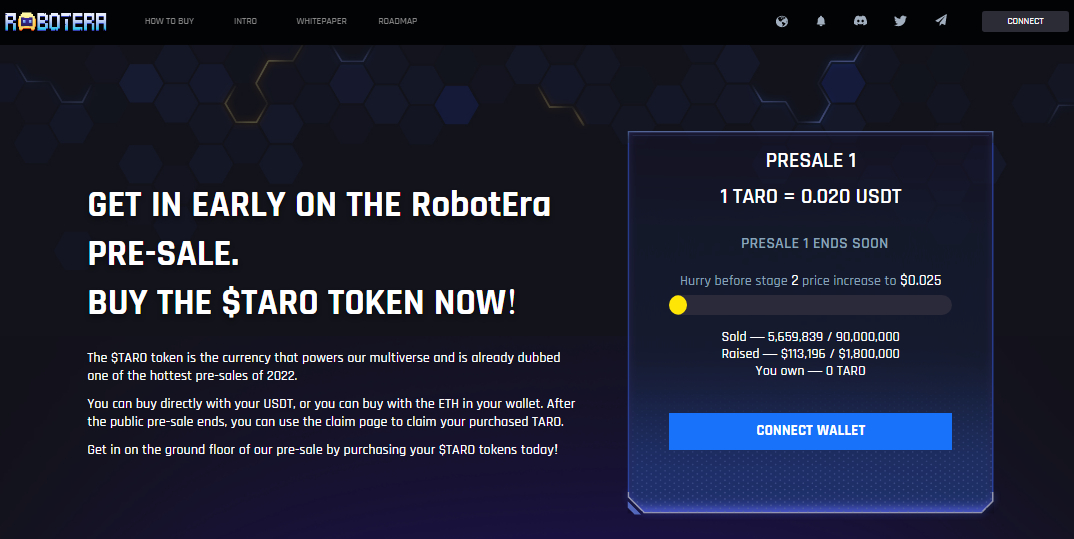

RobotEra – New NFT Game with Customizable Robot Companions

RobotEra (TARO) is a brand new NFT game that recently launched as a crypto presale. The project centers around an expansive metaverse world, in thick, players can explore, build, and find resources. The RobotEra presale went live in November 2022 and it’s selling out quickly, making it worth checking out sooner rather than later.

The TARO toke has a variety of uses within the RobotEra ecosystem. Primarily, the asset is used as a governance token, meaning that holders can pledge TARO to gain voting rights and have their voices heard regarding updates to the project. Furthermore, TARO can be staked to earn crypto rewards, benefiting both players and RobotEra. More details can be found in the RobotEra whitepaper.

RobotEra is set in a metaverse world divided into seven continents. Players can acquire plots of land that take the form of NFTs, building play-to-earn games and impressive structures. It’s also possible to mine for resources that can be used to craft highly customizable robot companions that can be sold on the in-built NFT marketplace or can accompany the player on their journey.

Currently, TARO is available to investors on the RobotEra presale website for just $0.020. However, this figure will slowly rise, first hitting $0.025, before rising to a maximum price of $0.032. As such, it could be worth checking out the project now, to stock up on TARO at the best price possible. Join the RobotEra Telegram channel to hear bout any updates early.

Visit RobotEra Presale Now

FAQs

Is Ethereum a good investment in 2022?

Every investor will have a different opinion of what constitutes a good investment. However, with Ethereum constantly working on developing new features and with most people expecting ETH to slowly increase in value, Ethereum could be a good investment in 2022.

What Ethereum be worth in five years?

It’s difficult to predict the value of an asset in the future, but based on the growth of the crypto market and the planned improvements to the Ethereum network, we could see the value of ETH at around $4,733 by 2025 and around $6000 in five years times.

Is it worth buying Ethereum now?

Is Ethereum a good investment? This is the question on the minds of thousands of investors. Right now, ETH can be purchased for around $1,200, a significant discount compared to 2021’s prices. As such, if you were debating buying ETH at $4,000+ it’s most probably worth buying today.

Is Ethereum a safe investment?

There is no such thing as a safe investment. Everything has risks. However, the general consensus among professional investors and traders seems to be that Ethereum will grow steadily over the coming years.

Be the first to comment