Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

The cryptocurrency markets move in cycles, just like stocks. The industry remains in a bearish market, meaning that cryptocurrency prices have declined from their previous heights – most of which were realized during the bull run of 2021.

So that begs the question – Is cryptocurrency a good investment? Read on to discover whether cryptocurrency represents a viable addition to an investment portfolio in 2023.

Is Cryptocurrency a Good Investment? Our Verdict Summarized

When asking the question – Is cryptocurrency a good investment? investors should consider a range of factors – especially when it comes to the overall risk tolerance.

Below, we summarize our key findings that beginners should consider when asking themselves should I invest in cryptocurrency?

- Cryptocurrencies are still a new phenomenon, at least when compared to traditional assets like stocks. Although Bitcoin – the original cryptocurrency, was launched in 2009, many digital assets are considerably newer

- Cryptocurrencies are high-growth assets, with the industry consistently outperforming conventional trading markets. Some cryptocurrencies have generated unprecedented returns in recent years that traditional stocks cannot rival.

- It is important to be aware of the risks before investing in cryptocurrency, especially when it comes to volatility and fraud. This is why investors of all experience levels are advised to do their own research.

- Rather than asking “Is now a good time to buy cryptocurrency?”, a dollar-cost averaging strategy may be more suitable and risk-averse. This means that instead of going all in on cryptocurrency, investors might consider making small but regular purchases.

- Another tried and tested strategy to consider is diversification. This means investing in a broad range of cryptocurrencies in addition to traditional assets, like stocks and index funds.

- Those in the market for the highest returns and prepared to take on additional risk might consider crypto presales. This offers the chance to buy a cryptocurrency before it is officially launched, usually at a huge discount. MEMAG and Fight Out are two such examples – more on this later.

Ultimately, when asking the question – “Is investing in cryptocurrency a good idea”, investors should ensure they enter the market with their eyes wide open. This not only means being realistic with potential gains, but the enhanced risks involved.

Why Crypto is Still a Good Investment in 2023

In this section of our guide, we aim to answer the question – is cryptocurrency a good investment? in great detail.

Before exploring the risks, let’s start with the many benefits that cryptocurrency represents as an investment product.

Cryptocurrency is Still an Emerging Investment Product

Cryptocurrency valuations have skyrocketed in recent years. Bitcoin, for example, carried a market capitalization of over $1 trillion in late 2021, after hitting an all-time high of $69,000. This puts the valuation of Bitcoin in the same conversation as Apple, Microsoft, and Amazon.

However, in the grand scheme of things, many industry analysts argue that even at a market capitalization of $1 trillion, Bitcoin is still undervalued. This is the case across many of the 22,000+ cryptocurrencies that are currently in existence.

Some market commentators compare Bitcoin in its current form today with the internet in the 1990s. At the time, many were skeptical about the internet and what use it provided to the broader society. But, as we now know, the internet is a necessity.

This sentiment is similar to cryptocurrency, insofar as many people are still intimidated to enter the market for the first time. In many cases, this is simply due to a lack of understanding of what Bitcoin is and how it works.

Nonetheless, cryptocurrencies in general are a high-growth market. And like many high-growth markets of the past – whether that’s the internet, social media, or electric cars – getting in early can result in unprecedented gains in the future.

Huge Discounts on Offer During the Bear Market

We mentioned earlier that the cryptocurrency markets move in cycles. And as of writing, we are still firmly in a bear market.

While this doesn’t bode well for investors that entered the market at its previous peak in 2021, patience is often rewarded in the long run.

Crucially, those that are yet to invest in cryptocurrencies have the opportunity to take full advantage of the current bear market, considering that virtually all digital assets are down.

- For example, while Bitcoin previously peaked at $69,000 in late 2021, as of writing in early 2023, the cryptocurrency has since witnessed lows of $16,000.

- This translates into a decline of 75%.

- However, Bitcoin has been through many major declines such as this – and always recovered.

- As such, by purchasing Bitcoin now, there is essentially a 75% discount on offer for new investors.

This isn’t just the case with Bitcoin. On the contrary, some of the best altcoins in this marketplace are trading at significant discounts.

Ultimately, bear markets enable investors to build a diversified portfolio of digital assets at the most favorable entry price possible.

Diversification is Seamless

Another benefit to consider when asking “is cryptocurrency a good investment?” is that this industry makes it a seamless process to create a diversified portfolio.

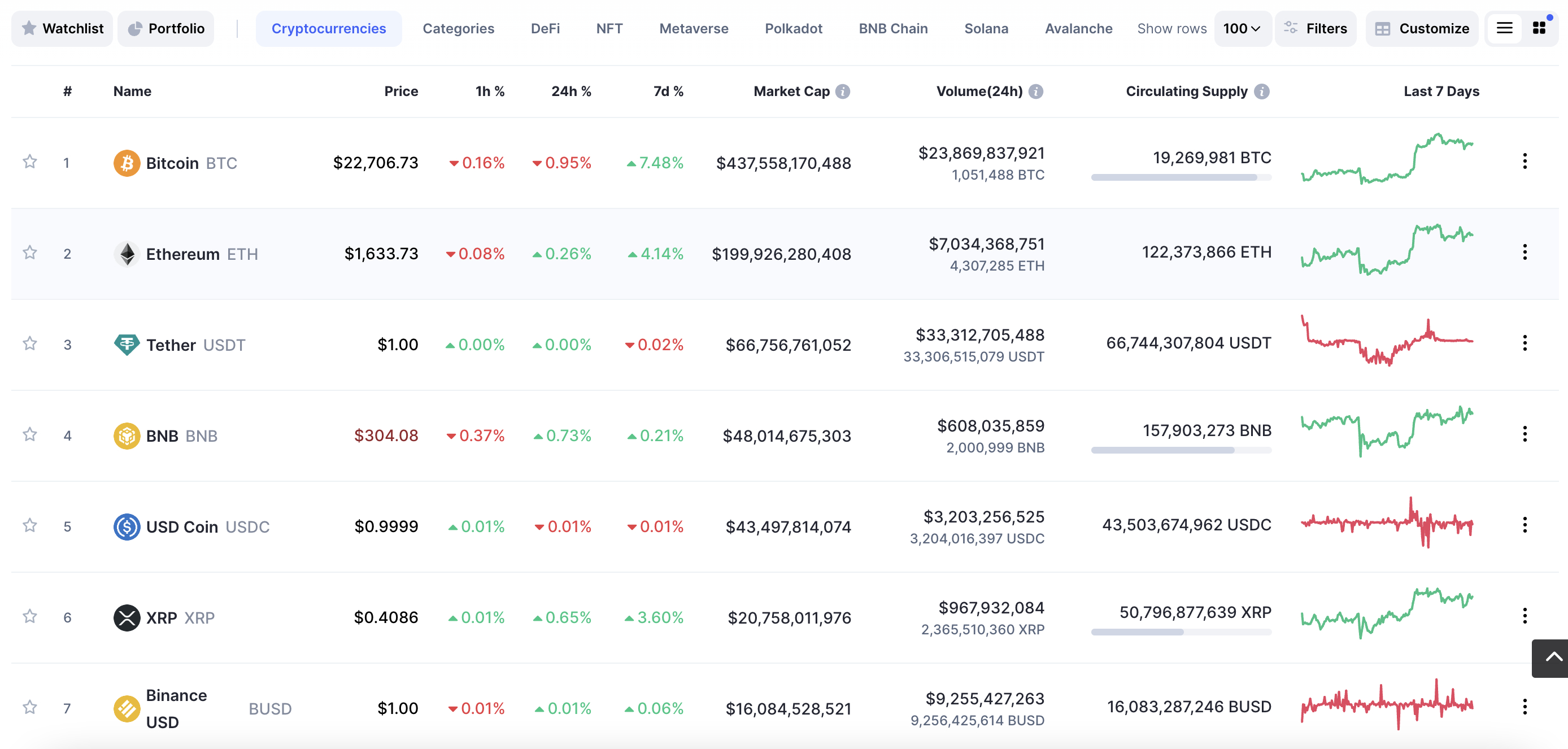

First and foremost, there are over 22,000 cryptocurrencies listed on CoinMarketCap. While this can make it a challenge to assess the best crypto to buy, at the very least, this enables investors of varying objectives to diversify with ease.

Second, unlike traditional assets – cryptocurrencies can be fractionated into tiny units. This is because cryptocurrencies are digital and hence, investors can buy a small fraction of their chosen token. In turn, investors only need to consider a small capital outlay of a few dollars should they wish to keep the risk to a minimum.

Moreover, not only do cryptocurrencies operate in a highly liquid industry, but trading remains open 24 hours per day, 7 days per week. This helps maintain a diversified portfolio, should the investor elect to sell a particular cryptocurrency.

Presales Offer an Immediate Upside

Another reason why cryptocurrency interest remains high with investors from across the globe is the establishment of an entirely new market – presales.

Presales are effectively the cryptocurrency alternative of a stock IPO (Initial Public Offering). Anyone familiar with IPOs will know that they enable investors to buy into a newly listed stock before it hits an exchange – usually at a sizable discount.

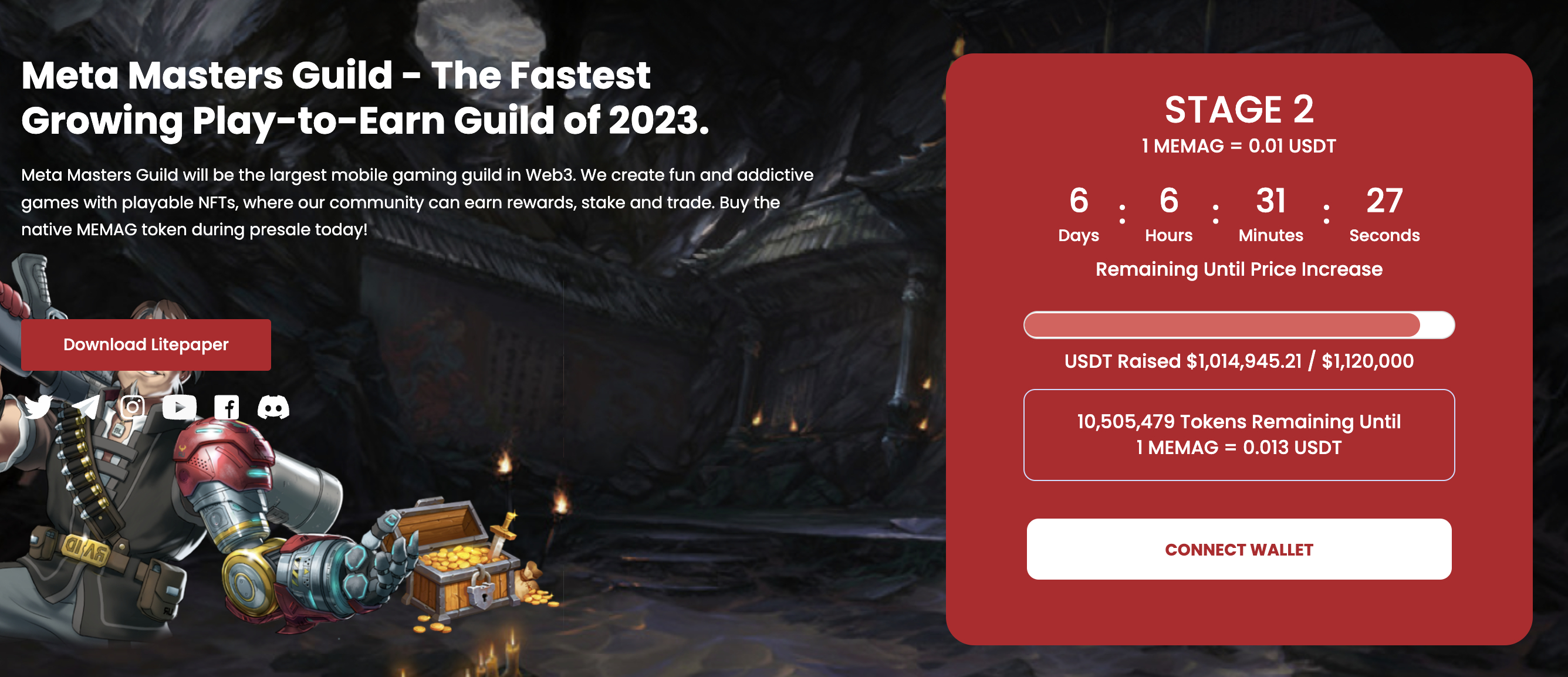

In this regard, presales are no different. For example, Meta Masters Guild (MEMAG) – a brand new project that is launching a portfolio of play-and-earn mobile games, has just launched its presale campaign.

This offers the MEMAG crypto token at a major discount, with early investors securing the lowest entry price.

Past Performance

It goes without saying that many investors will elect to buy cryptocurrency because they want to make returns that traditional markets cannot rival.

On the one hand, it should be remembered that past performance does nothing to influence the future price of a cryptocurrency. However, by taking into account the historical price action of the broader market, we can see just how lucrative cryptocurrencies have been in recent years.

- To offer some insight, the world’s second-largest cryptocurrency by market capitalization – Ethereum, was snapped up by investors in 2015 at approximately $0.30.

- In late 2021, Ethereum was trading at highs of $4,900 – an increase of over 1.4 million percent from 2015.

- Even during the current bear market, Ethereum is trading at over $1,500 – meaning growth of 440,000 percent from 2015 levels.

If and when the next bull market arrives, we could see similar instances where cryptocurrency valuations once again go parabolic.

Potential Risks of Crypto Investing & Things to Consider

Like any investment decision, understanding the potential risk of capital is crucial before proceeding.

As such, in order to answer the question – Is cryptocurrency a good investment? we will now consider some of the core risks that must be taken into account.

- First and foremost, cryptocurrencies are a lot more volatile than the likes of stocks and index funds.

- For example, in November 2022, the total market capitalization of the entire cryptocurrency industry was estimated at just over $1.05 trillion.

- Just one week later, the same industry was valued at $817 billion, a decline of 17%.

- Fast forward to January 2023 and the total market capitalization of the cryptocurrency industry has once again surpassed $1 trillion.

As per the above, this level of volatility might not suit overly risk-averse investors.

Another risk to consider when attempting to answer the question – Should I invest in cryptocurrency? is relevant to storage.

Put simply, cryptocurrencies are digital assets and as such, are generally stored in software wallets. If the owner of the wallet forgets their password or worse – witnesses an external hack, the cryptocurrency could be lost forever. Don’t forget, cryptocurrencies are decentralized, so an occurrence of loss or theft cannot be reversed.

Moreover, cryptocurrency scams remain present, just like in any other industry. Some cryptocurrencies turn out to be ‘rug pulls’, which means that the sole purpose of the project is to steal investor funds.

And of course, the most pressing risk is that investors can lose some or even all of their capital when investing in cryptocurrencies.

Ultimately, investors can reduce their risk in many different ways, for instance, through diversification, personal research, and an understanding of regulation and wallet security.

Cryptocurrency Prices & Volatility

When electing to invest in cryptocurrency, it is crucial for beginners to understand how money is made and lost. In its most basic form, cryptocurrency prices are based on demand and supply.

As such, when the overall sentiment on cryptocurrencies is positive, this results in huge waves of buying pressure. Not only from new retail investors but institutional houses too – as we saw in the prior bull market.

On the flip side, when the bear market arrives, this creates fear and ultimately – results in prolonged selling pressure. Those with a bit of prior experience in the traditional investment space will know that this is no different from how stocks, gold, ETFs, and most other assets operate.

In other words, cryptocurrencies, like all assets. experience good and bad times. But in the long run, there is an expectation that the trend will continue to move northward.

The industry standard is to price Bitcoin and other cryptocurrencies against the US dollar. This can be compared to commodity assets like gold and natural gas.

Those from outside the US can, however, buy cryptocurrency in their local currency. The rise and fall of cryptocurrency prices will remain the same nonetheless.

How to Handle Volatile Cryptocurrency Prices

From an investment perspective, the most effective way to avoid the stresses of cryptocurrency volatility is to create a long-term dollar-cost averaging strategy.

As we briefly covered earlier, this means the investments will be made in small but regular increments, rather than going all in through a single lump sum.

- The reason that dollar-cost averaging is so effective in the cryptocurrency space, as well as in the case of stocks, is that investors are riding the long-term trajectory of the market.

- This means that when the bear market arrives, the investor will increase their position with cheaper cryptocurrency prices.

- And when the bull market arrives, purchases will still be made, but the investor will begin to realize gains on their previous investments.

For instance, let’s say an investor purchased $1,000 worth of Bitcoin in late 2021 at its $69,000 peak. This means that until Bitcoin returns to its former all-time high, the portfolio will be at a loss.

But, had the investor instead opted for a $50 monthly investment, they would have a significantly more favorable cost price.

Cryptocurrency Utility & How it Impacts Investment Prospects

When exploring “is Cryptocurrency a good investment?”, utility is a term that will appear frequently. In a nutshell, this refers to the actual use case of the cryptocurrency in question.

- For instance, Bitcoin’s utility is that it is the de-facto cryptocurrency of choice and an excellent store of value, due to its limited and fixed supply.

- Ethereum’s utility is that it facilitates smart contract agreements for thousands of other cryptocurrencies, including many of the best metaverse coins.

- Similarly, Meta Masters Guild has utility, as its MEMAG token is distributed to those that engage with its play-and-earn games.

The reason that utility is so important is that it ensures the respective cryptocurrency actually has a use case in the real world and thus – some sort of measurable value.

In contrast, there are thousands of so-called meme coins that possess no utility whatsoever – contrary to what the underlying developers say. These coins should be avoided, as any potential price growth will be based on nothing but speculation and hype.

Instead, when assessing the question “Is crypto a good investment in 2023?”, investors should focus on high-quality projects that have a real use case. In many ways, this will give investors the best chance possible of seeing a return on the capital outlay, at least in the long term.

Short Term Crypto Investing vs Long Term Crypto Investing

The cryptocurrency industry is notorious for attracting investors that are simply in the market for easy and fast money. While this investor type has every chance of making notable gains in a short period of time, in the long run, they will usually lose some or even all of their investment capital.

Instead, the more suitable option to consider when exploring cryptocurrencies as a beginner is to create a long-term investment plan. As noted earlier, this should consist of a portfolio that is well diversified in addition to a dollar-cost averaging strategy.

By investing long-term, there is no requirement to keep tabs on short-term volatility. Checking the investment portfolio once per month is sufficient in this regard. As time goes by, bull and bear markets will no longer be relevant – considering that the chosen cryptocurrencies are high quality in nature.

To offer some insight into this theory, those that invested in BNB when the token was first launched in 2017 would have paid just $0.11. Even in the midst of a bear market in early 2023, BNB is trading above $300 – or over 272,000 percent higher when compared to 2017.

This shows that by investing in quality projects and being prepared to ride out bear markets, unprecedented gains can be made.

With that being said, there are still plenty of ways to make money from a short-term cryptocurrency investment, so this strategy shouldn’t be discounted completely.

For instance, one of the best crypto presales right now – Fight Out, is offering its FGHT token at a 50% discount before it lists on a centralized exchange for trading. This offers an immediate, short-term upside of 100% for those investing in the presale.

What Experts Say on Whether You Should Invest in Cryptocurrency

Listening to so-called experts when assessing the question – “Should you invest in cryptocurrency?”, is not a wise idea.

After all, the investment thesis of one investor will differ greatly from the next. As such, it’s best to get comfortable with personal research so that an informed decision can be made.

Nonetheless, we scoured the market for some key quotes from high-profile figures regarding cryptocurrency as an investment product.

Here’s what we found:

- In 2017, JPMorgan Chase CEO Jamie Dimon was quoted as saying that Bitcoin is ” a fraud” and “worse than tulip bulbs”. Fast forward to 2023, and Dimon not only believes Bitcoin has “significant upside” but JPMorgan has since gained financial exposure to the blockchain industry.

- Stock market legend Warren Buffet previously warned people to “Stay away from it. It’s a mirage”, in reference to cryptocurrencies. Buffet also warned people against Tesla, one of the best-performing stocks of all time.

- One of the most respected crypto analysts in the industry – Tom Lee, co-founder of Fundstrat Global Advisors, remains confident that Bitcoin will surpass $200,000 in the coming years. If this prediction does come to fruition, this is all but certain to drag the rest of the cryptocurrency industry up with it.

Of course, the above quotes represent the subjection sentiment of individual analysts and investors. Once again, investors should make their own minds up on cryptocurrency through in-depth research and learning.

What Cryptocurrency is Worth Investing in Now? Top 5 Coins for Beginners

As noted earlier, there are many thousands of cryptocurrencies to choose from when creating a diversified portfolio.

In this regard, complete newbies that require some inspiration might consider the following projects when asking the question – Is cryptocurrency worth buying?

1. Meta Masters Guild (MEMAG)

Meta Masters Guild (MEMAG) is lining up to become one of the best future cryptocurrency projects in this crowded marketplace. The project is building a play-and-earning ecosystem that will support mobile games, built by pre-vetted and proven developers.

Each MEMAG game will be accessible on both iOS and Android devices, and crucially, enable players to earn income. This is because of the play-and-concept, which rewards players with GEMS for progressing through the respective game.

GEMS have many use cases, such as being the currency of choice to purchase in-game assets and NFTs. Players can also swap GEMS for the native utility coin for Meta Masters Guild – MEMAG, which will trade on crypto exchanges.

In the meantime, MEMAG is running one of the best crypto ICOs in recent years. Stage one has already sold out, due to rapid demand. However, stage two is still ongoing and this prices MEMAG at $0.01. The next stage will increase the price by 30%, up to $0.013.

This enables investors to secure a super-low entry price on this top-rated project.

2. Fight Out (FGHT)

Another penny crypto that could be of interest to value investors is Fight Out. This project is building an entire ecosystem through crypto, blockchain, and the metaverse to create a move-to-earn framework for people that like to stay fit.

In fact, even those that do not have a prolonged relationship with exercise and workout routines will likely find Fight Out of interest, considering it offers real-world rewards in return for performing exercise. The move-to-earn concept is exactly how it sounds – the more that somebody works out in the Fight Out ecosystem, the more they will make.

Rewards are paid in REPS, which can be used to purchase in-game assets, upgrades, personalized avatar wearables, merchandise, and more. REPS can also be exchanged for FGHT, which is the utility crypto backing the Fight Out ecosystem.

Upon scrutinizing the whitepaper, we were impressed to see that Fight Out is also aiming to partner with global gym chains, to incorporate its bespoke exercise machines and equipment. FGHT tokens can be purchased today at just $0.0166, before the presale price begins to increase. Do note that more than $3 million has already been raised, so investors will need to move fast.

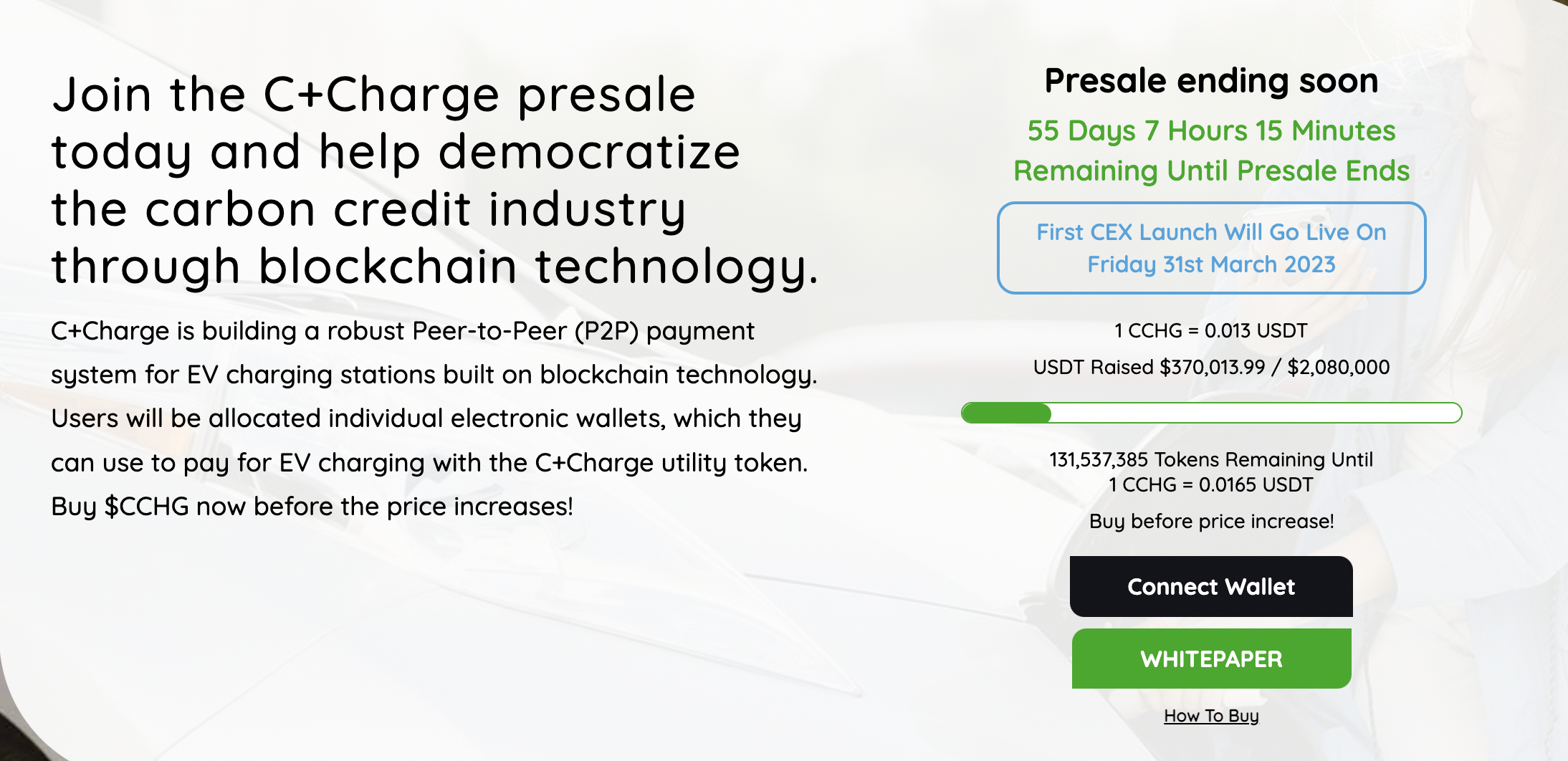

3. C+Charge (CCHG)

C+Charge is another contender when it comes to investing in high-quality presales at a huge discount. This project is arguably one of the most sustainable cryptocurrency investments to consider, not least because it is looking to reshape the current state of the EV market.

Currently, EV manufacturers – in addition to charging station networks, receive carbon credits for their sustainable practices. Carbon credits are sought-after by organizations that need to exceed permitted emissions, based on government regulations.

But with C+Charge, EV owners can finally get a stake in the carbon credit market – simply for charging their cars at a partnered station. The C+Charge app will not only track carbon credit earnings for EV owners, but highlight the nearest stations and which payment methods are accepted.

C+Charge has its own proprietary token – CCHG, which is set to become one of the most energy-efficient cryptocurrencies. Fortunately, the presale has just begun – so the best price possible of $0.013 per CCHG is still available. Once this batch has sold, the price will rise to $0.0165. This is yet another example of how presales offer an immediate upside for early investors.

4. Bitcoin (BTC)

Much of this guide has made reference to Bitcoin and for good reason – it is the original and largest cryptocurrency in the market, in terms of valuation. On the one hand, Bitcoin is already a multi-billion cryptocurrency, so there will arguably be less upside when compared to presale investments like MEMAG, Fight Out, and C+Charge.

However, Bitcoin, according to many, is still valued at a fraction of its true worth. Moreover, Bitcoin can still be purchased at a huge discount when compared to its previous peak. As of writing, this stands at approximately 68% below the former all-time high of $69,000.

Just remember, Bitcoin – like all cryptocurrencies, can be fractioned. As such, there is no requirement to invest thousands of dollars. Instead, investments of just a few dollars are supported by most crypto exchanges.

5. Ethereum (ETH)

The value proposition of Ethereum is very similar to Bitcoin. It is the second-largest cryptocurrency by market capitalization and thus – it already commands a significant valuation. However, Ethereum is the go-to smart contract blockchain of choice.

Its underlying network is used by thousands of other cryptocurrencies, otherwise known as ERC-20 tokens. Ethereum is also upgrading its framework to support faster, cheaper, and more scalable transactions.

This has the potential to take Ethereum to the next level. Ethereum is also available to buy at a huge discount, compared to previous peaks. As of writing, Ethereum is trading at about 70% below its former heights.

Should I Buy Cryptocurrency Now? Our Verdict

In summary, this guide has helped answer the question – is cryptocurrency a good investment?

We concluded that although cryptocurrencies are volatile and speculative, a well-rounded investment plan that consists of thorough research, diversification, and dollar-cost averaging can be fruitful in the long run.

We particularly like crypto presales that offer high-quality utility tokens before the primary exchange listing goes live, at a discount.

MEMAG is a great example here, with the play-and-earn gaming project currently offering its native token at a presale price of just $0.01.

FAQs

Is Cryptocurrency worth investing in 2023?

Although cryptocurrency won’t be for all investor types – especially those with a low tolerance for risk, there is no harm in gaining exposure to this industry with sensible amounts. The most important consideration is that investors never risk more than they can afford to lose.

Is crypto a good investment long term?

History suggests that high-quality crypto projects like Bitcoin and Ethereum are best viewed as long-term investments. When holding onto these cryptocurrencies rather than panic selling during a bear market, greater returns have been established.

Should I invest in crypto or stocks?

Neither crypto nor stocks represent a better investment – it’s all down to the individual goals and risk tolerance of the investor. With that said, a well-diversified portfolio will likely contain a broad range of stocks and crypto.

Can you make money with cryptocurrency?

Yes, it is impossible to make money with cryptocurrency. In fact, this is the primary objective of investing in this market. Those asking “Will cryptocurrency go up” will need to remember that like all assets, digital currencies go through bull and bear markets.

Should I buy cryptocurrency?

Like any investment decision, it is wise to consider both the upside potential and risk of loss before investing in cryptocurrencies. With that said, investors only need to allocate a small percentage of their wider portfolio to cryptocurrency to see notable returns in the long run.

Be the first to comment