- Pancakeswap ranked 2nd in the list of top BNB projects with highest social engagement

- Development activity and social dominance up

Pancakeswap [CAKE] recently made it to the list of top BNB projects with the highest social engagement, only behind QUACK. This was a promising development as it reflected CAKE’s popularity in the crypto industry.

🎉TOP #BNBCHAIN Projects with Highest Social Engagement🚀$QUACK @RichQuack$CAKE @PancakeSwap

$BABYDOGE @BabyDogeCoin$FLOKI @RealFlokiInu$SFM @safemoon$SFUND @SeedifyFund$SFP @iSafePal$YOOSHI @yooshi_official$DOME @Everdome_io$CATE @catecoin$VOLT @VoltInuOfficial#BNB🔥 pic.twitter.com/uu0FK5OWwQ— BSCDaily (@bsc_daily) November 14, 2022

A possible reason for this update could be CAKE’s new partnership with Celer Network. This new collaboration will now allow users to provide liquidity to Pancakeswap and harvest CAKE on the BNB Chain.

We are beyond thrilled with our partnership with @CelerNetwork.

Last month, we launched Cross-chain farming through their inter-chain messaging

— PancakeSwap 🥞 #BSC (@PancakeSwap) November 14, 2022

Most of the cryptocurrencies in the market struggled to increase their value over the last few weeks. Additionally, thanks to the bearish market, CAKE’s value also registered a decline. According to CoinMarketCap, CAKE registered a 15% weekly drop.

Furthermore, in line with the above-mentioned infromation, a few of the metrics also stood in favor of the buyers.

Read Pancakeswap’s [CAKE] Price Prediction 2023-24

A good buying opportunity?

CryptoQuant’s data revealed that CAKE’s stochastic was in an oversold positive. This could be a massive bullish signal, opening a new opportunity for investors to accumulate.

Not only that, but Santiment’s chart also indicated that things might turn in CAKE’s favor soon. CAKE’s development activity increased dramatically last week. This could be considered as a good sign because it indicated increased effort by developers to improve the network.

CAKE also remained quite popular in the community as its social dominance spiked lately.

Source: Santiment

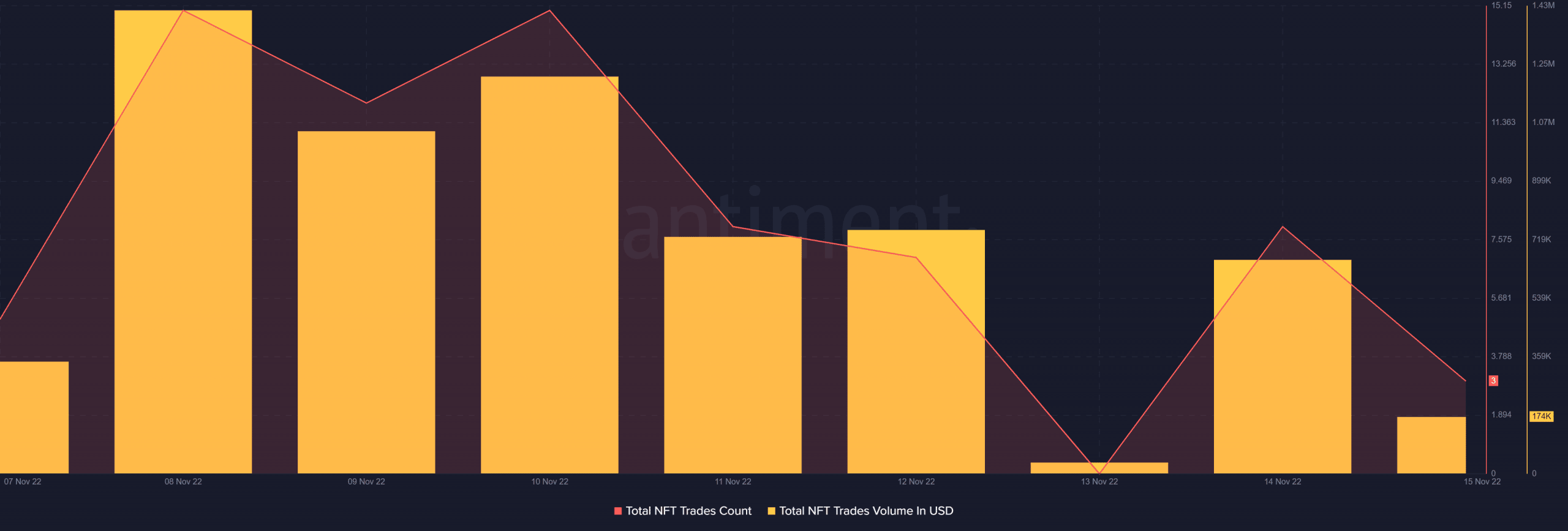

CAKE’s NFT space showed some interesting movement as its total NFT trade count along with trade volume in USD registered an uptick. However, later in the week, the trade count witnessed a decline.

Source: Santiment

Some unavoidable concerns

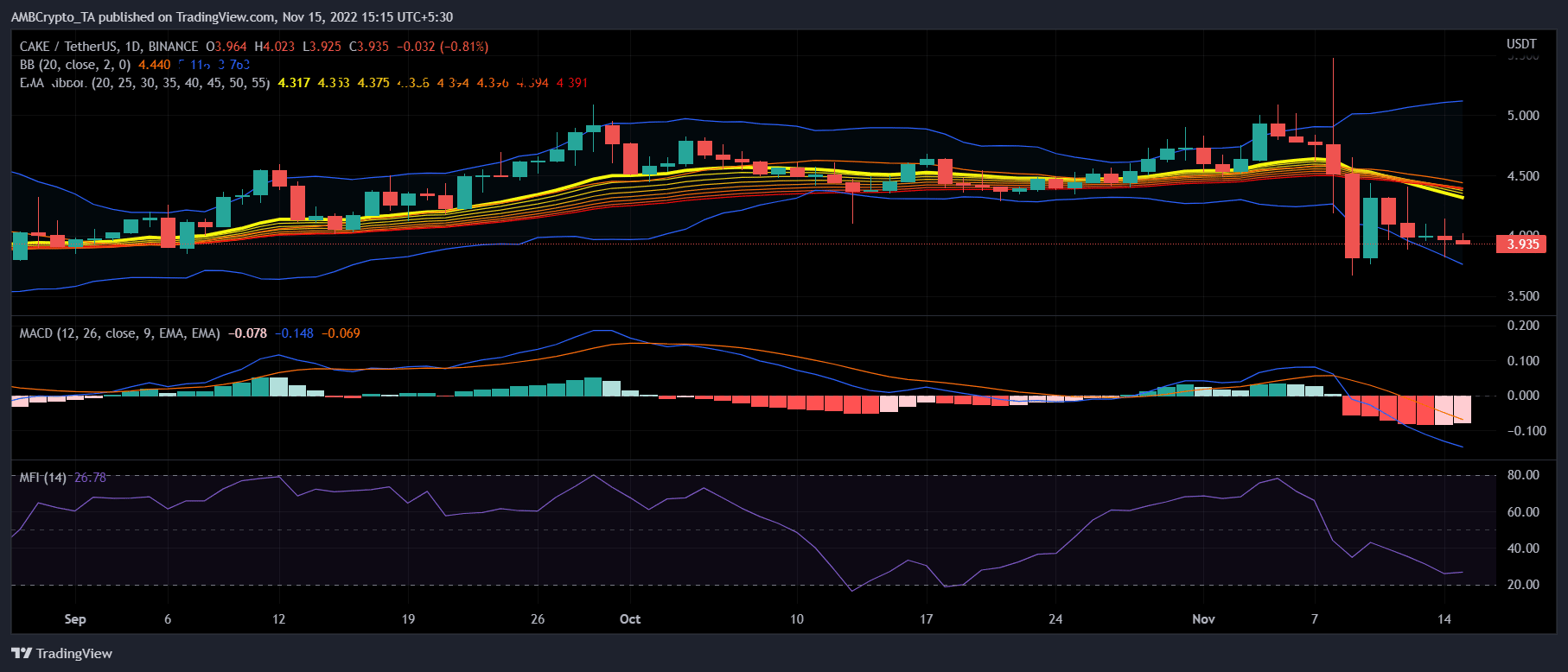

Despite the metrics being on CAKE’s side, market indicators revealed a completely different story. As per market indicators, bears had a massive advantage over the bulls in the market.

The Money Flow Index (MFI) was resting way below the neutral mark, a negative signal. The Moving Average Convergence Divergence (MACD)’s reading also complemented that of the Money Flow Index (MFI) and suggested sellers’ edge in the market.

The Exponential Moving Average (EMA) Ribbon displayed a bearish crossover, further increasing the chances of a continued downtrend in the coming days. All these indicators, when coupled with the Bollinger Bands findings., indicated that CAKE’s price was in a high volatility zone. This suggested that investors might have to strive a bit longer for better returns.

Source: TradingView

Be the first to comment