- Dogecoin surged by 5% after hitting support at $0.1183.

- Whale activity and social volume coincided with recent volatility.

Dogecoin [DOGE] has experienced outstanding strength in the face of recent market volatility.

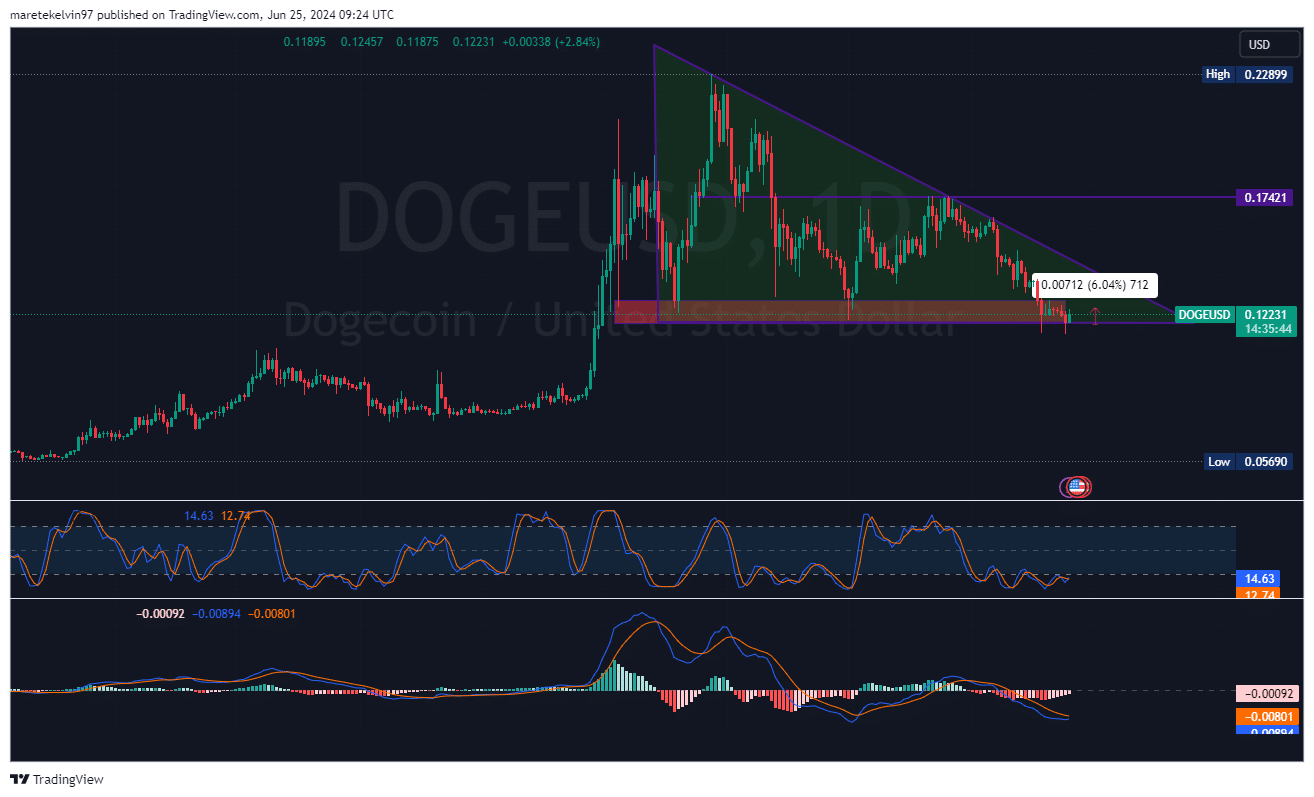

Following a 5% dip in the past 24 hours to the critical support level, Dogecoin witnessed a 5% pullback to its current price. This price action has caught investor attention, and rightfully so.

At press time, DOGE was testing a crucial support level at $0.1183. The bears and bulls were battling at this key level. A breakdown below this support level could pave the way for further price declines.

However, if the bulls win the battle, we could see a reversal and a potential upward surge.

As of writing, CoinMarketCap’s data priced Dogecoin at $0.1233. Its market cap grew by 4.91% to 17.86 billion in the last 24 hours, while its trading volume has surged by 10.54% to $863 million.

This gives more bullish market insights.

Source: TradingView

On the charts, the stochastic RSI (12.74) indicated an oversold zone. This was a sign that the level could be a critical longing point, which could form the basis for a price reversal.

Additionally, the MACD underlined fading bearish pressure across the market, too.

Whale activity, social volume spike

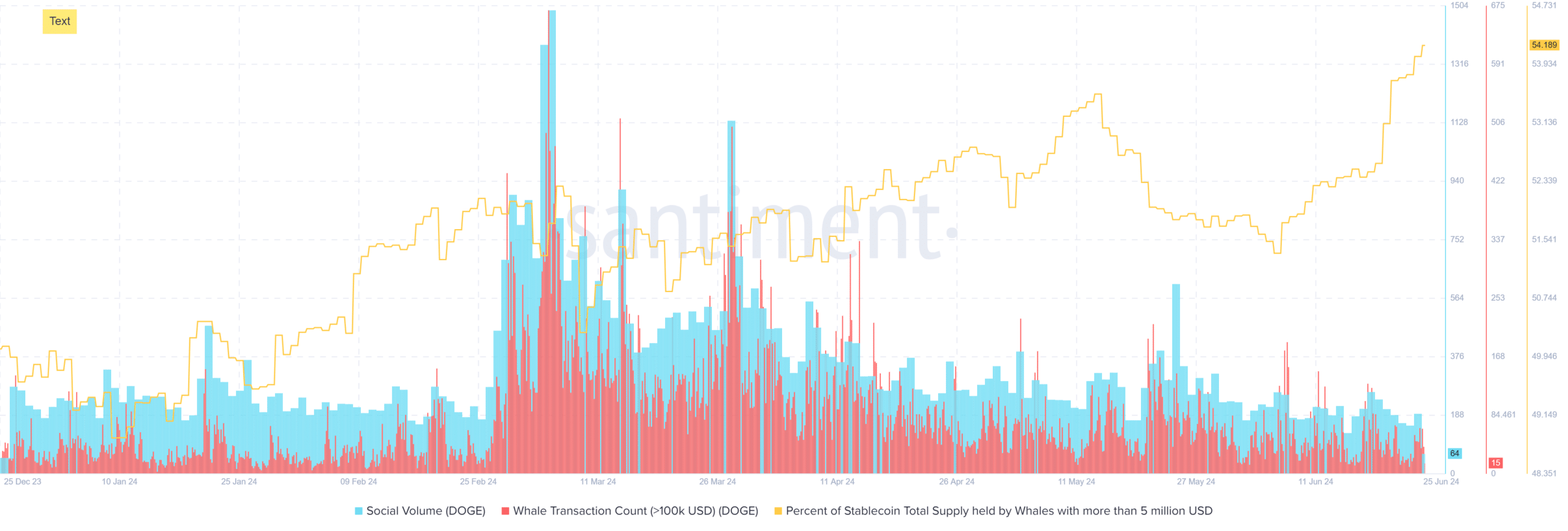

AMBCrypto analyzed Santiment’s social volume and whale activity data to evaluate the market direction. The data indicated an interesting correlation between the two.

There were several spikes in both volume and whale activity, coinciding with the recent price volatility. This implied that major investors may be influencing market sentiment and price action.

Source: Santiment

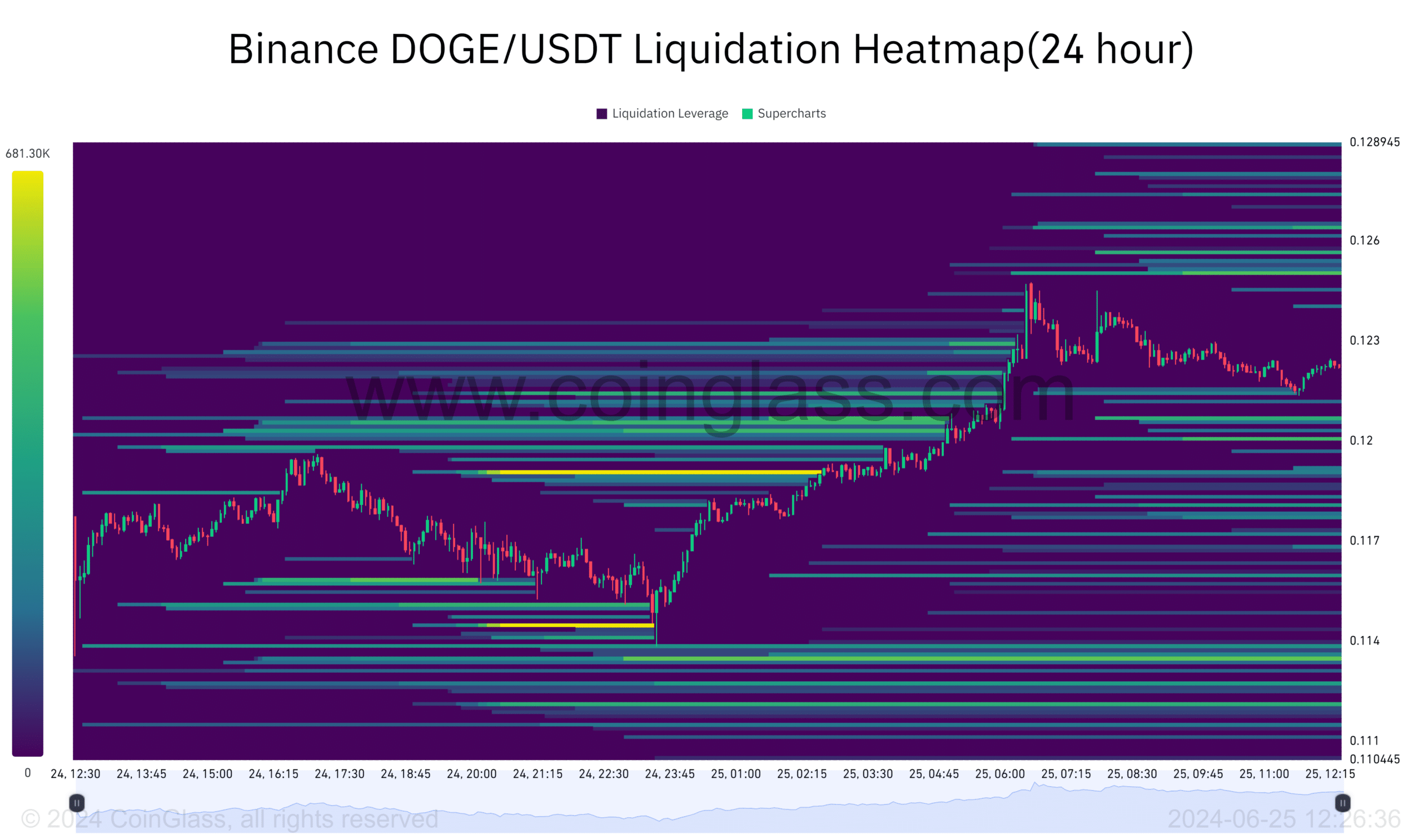

Coinglass’ liquidation heatmap painted a picture of market tension. Notably, there were clusters of liquidations around key price levels. This suggested that investors were taken off guard by the sudden price movement.

This volatility may lead to additional liquidation in both market directions.

Source: Coinglass

Is your portfolio green? Check out the DOGE Profit Calculator

What’s next for Dogecoin?

The Dogecoin price is at a crucial point. If DOGE can maintain its position above the $0.1183 resistance level, it might pave the way for further price surges.

However, if a breakdown below this resistance level may fuel a bearish momentum to potential lower support zones.

Be the first to comment