- As of 22 November, 6,928,951 CAKE tokens were burnt

- PancakeSwap’s RSI and stochastic were in oversold positions

PancakeSwap [CAKE] investors could have a reason to celebrate. According to CryptoQuant, CAKE’s Relative Strength Index (RSI) and stochastic were both at oversold positions, which was a major bullish signal.

Over the past few weeks, CAKE’s performance didn’t exactly align with investors’ interests, as it registered nearly negative 9% weekly losses. At press time, CAKE was trading at $3.65, with a market capitalization of more than $531.7 million. Furthermore, with this new development, things could look better for CAKE.

Read PancakeSwap’s [CAKE] Price Prediction 2023-2024

Source: CoinMarketCap

Investors can relax

CAKE managed to remain popular among cryptocurrencies, as it was the top BNBChain project in terms of social engagement, only behind RichQuack.

🎉 Top #BNBChain Projects with Highest Social Engagement🚀

🥇 $QUACK @RichQuack

🥈 $CAKE @PancakeSwap

🥉 $BABYDOGE @BabyDogeCoin$TWT @TrustWallet$FLOKI @RealFlokiInu$SFM @safemoon$SFUND @SeedifyFund$LEON @swapleonicorn$YOOSHI @yooshi_official$VINU @VitaInuCoin#BNB #WEB3 pic.twitter.com/CzuAjRFyML— BSCDaily (@bsc_daily) November 21, 2022

CAKE’s burn rate also witnessed a surge, which reflected the deflationary characteristics of the token. As of 22 November, 6,928,951 CAKE was burnt, which was worth $26 million.

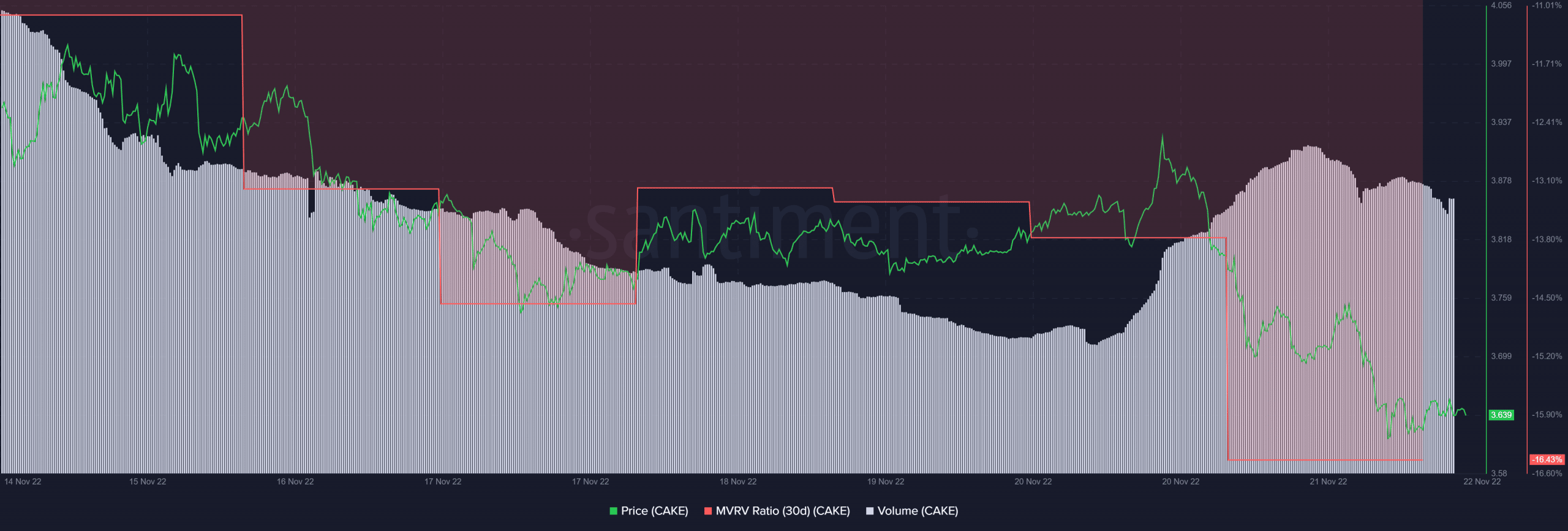

Furthermore, several on-chain metrics also looked promising for CAKE and suggested a price pump in the days to follow. For instance, PancakeSwap’s Market Value to Realized Value (MVRV) ratio was substantially down, which might be a possible market bottom indicator.

CAKE’s volume also registered an uptick lately, which too looked pretty optimistic for the token.

Source: Santiment

Despite showing promising developments on the charts, CAKE’s NFT ecosystem witnessed a slight downfall over the last week. As per Santiment’s data, CAKE’s total NFT trade count and NFT trade volume in USD kept decreasing over the past seven days. This could hinder CAKE’s growth in the days to come.

Furthermore, CAKE’s daily on-chain transactions in losses also registered a spike, painting a bearish picture.

Source: Santiment

Bulls that have a sweet tooth

A look at CAKE’s daily chart also revealed a somewhat bullish picture. Though the Moving Average Convergence Divergence (MACD)’s data indicated that the bears had the upper hand. This also displayed the possibility of a bullish crossover.

The Money Flow Index (MFI), after touching the oversold mark, registered a slight uptick, which looked positive for CAKE. However, the Chaikin Money Flow (CMF) was considerably down, which might cause trouble for CAKE in the coming days.

Source: TradingView

Be the first to comment