Although the crypto space has gone through turbulent times in the last year, Bitget managed to grow and make great strides in building its brand, team, and business during this crypto winter. The platform expanded its services to the global Web3 market for the first time in 2022 and pushed its business development velocity beyond bounds, making them one of the fastest-growing exchanges with the best business momentum.

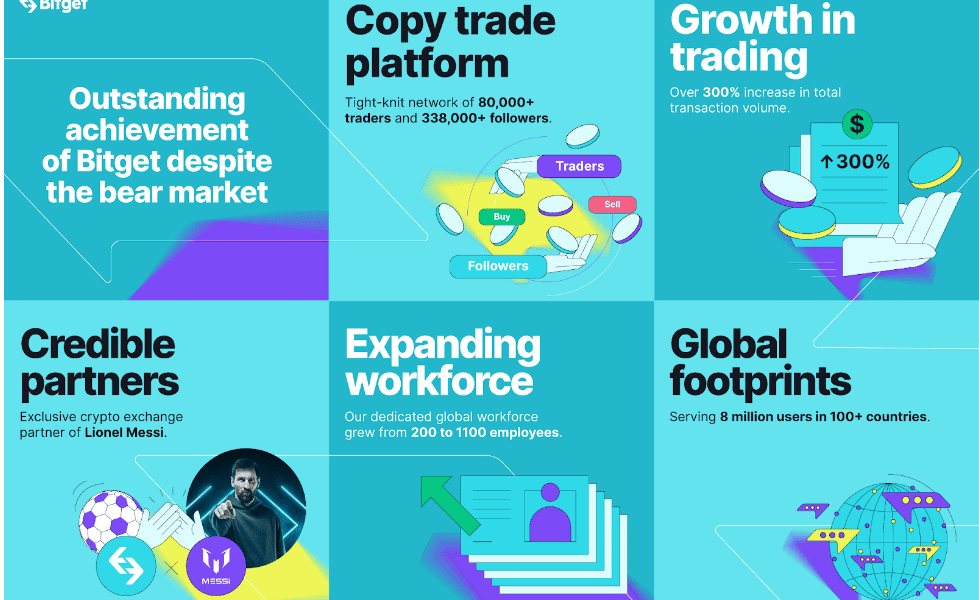

Taking a look at the recap, some of the major developments of the platform included increasing its workforce from barely 200 people to over 1100 employees, expanding its business operating sites from 2 meager locations to 12 operational establishments around the world, and also becoming the exclusive crypto exchange partner with Lionel Messi.

Growing in numbers

Initially, the Bitget platform focused on just serving their customers from a selected group of Asian countries alone. By the end of 2022, they acquired more than 8 million users in 100+ countries with footprints in Turkey, Southeast Asia, Europe, and Latin America.

The platform also saw a 300% increase in the total transaction volume with more than 4.2 million profitable trades. Taking a look at the on-chain data for the platform over 1000,000+ traders shared a profit of 9.7 million USD with their copy trading products.

According to the latest data shared by the TokenInsight report, Bitget’s market share increased dramatically from 3% to 11% after the collapse of the former second-largest exchange, FTX, which marked the single largest market share growth in the crypto derivatives sector. At the end of 2022, the top 10 exchanges’ total daily open interest had dropped by 27.1% from January and 41% from its peak in April of the same year. Bitget achieved a significant increase in open interest, from $841 million to $3.74 billion, representing a 344% total increase.

Perfecting copy trading

Over the course of the past 4 years, the platform has spent time and effort in perfecting its infrastructure and products for copy trading in order to give its users the most outstanding social trading experience.

One-click Copy Trade is their flagship social trading product that lets customers execute trades automatically, shadowing orders and strategies from experienced traders of their choice. This also streamlined the process of crypto trading to a single click doing away with the scope of making errors in price fluctuations and giving a good starting point for users to get into the game.

2022 also saw the launch of the Bitget Insights and Strategy Plaza, giving customers a chance to find ways of maximizing their yields. These features aim to help people choose the most lucrative trading methods to subscribe to.

Ensuring protection and safety for users

Bitget has achieved almost zero accidents despite the varying market conditions in the past 4 years. This has been the result of continuous monitoring and advancement in their IT and security system.

The platform has also launched a 300 million Protection Fund that won’t be used in the next 3 years unless there is an emergency. They also have a Merkle Tree Proof of Reserves tracking page that updates their snapshot monthly ensuring a 1:1 reserve ratio of customer funds. ‘Merkevalidator’ is their open-source tool available on GitHub that reveals their on-chain data on third-party platforms like Nansen, CoinGecko, and more.

Prioritizing retail users and working with KOLs

Bitget strives to put its retail users first, this shows in its approach to designing product attributes, interest protection mechanisms, and product thresholds. The retail users get better services and more favorable rates as the platform believe retail investors are an essential momentum driver in the development of the crypto space, unlike the traditional finance space.

Accumulating highly motivated Key Opinion Leaders (KOL) and affiliates have also been a priority for the platform. Currently, they have a network of over 100,000 close KOL partners worldwide. In partnership with these KOLs and KOCs (Key Opinion Consumers), they spread the most professional trading strategies and high-quality content.

Social trading is another crucial part of this system, Bitget has worked on forming a distinct development path that fits its characteristics and remains focused on its constant effort over the past 4 years.

Insights from the MD

Gracy Chen, the Managing Director of Bitget commented on her vision for the crypto industry in 2023 and stated that as macro liquidity continues to affect the crypto market, the interest rate spike is expected to slow down in 2023 gradually. Although it is uncertain as to when the interest rate cuts will happen, the impact of the Fed on the macro liquidity would also continue to affect investors’ expectations for the crypto market.

Additionally, she added, the number of locked positions in DeFi is expected to increase slowly in 2023. Regardless of the decline in the value of popular blockchain tokens, the number of active users and new wallet addresses on chains like Polygon, Ethereum, and BSC has been on a rise.

As more DeFi blue chips transform into the ecosystem’s infrastructure slowly, the lock-up volume and TVL of DeFi are also expected to be on a rise in 2023.

Chen also advised fellow builders to create a product with distinguishing qualities and become a leader in the field while also focusing on the security and protection of blockchain businesses. This should be done by ensuring that user funds are always available to them and withdrawable at their request. She also added that business decisions should be made from the consumer’s perspective always.

For more information on Bitget, please check out their official website.

Disclaimer: This is a paid post and should not be treated as news/advice.

Be the first to comment