- Aave has launched its V3 on the Ethereum network.

- AAVE token is seeing a decline in Open Interest, indicating a shift toward the bearish sentiment.

Following a go-ahead from its community members, leading decentralized lending and borrowing protocol Aave, on 27 January, deployed its third version, Aave V3 Ethereum pool (3.0.1), on the Ethereum network.

Big thank you to our Aave Fam! 🤍

For more details on the V3 ETH deployment and how to migrate your assets from V2 ➡️ V3, check out our latest blog here:https://t.co/2XMR7oN3ED

— Aave (@AaveAave) January 27, 2023

The deployment on Ethereum came almost a year after the third iteration of the borrowing and lending protocol was launched across six networks, including Polygon, Avalanche, Arbitrum, and Optimism, in March 2022.

Read Aave’s [AAVE] Price Prediction 2023-2024

According to Aave’s press release, the Aave V3 upgrade introduced the High-Efficiency Mode, also called “E-Mode.” With Aave’s “E-Mode, “users can borrow more by using collateral that is correlated to the asset they are depositing and borrowing, thereby improving capital efficiency.

Also, the V3 upgrade introduced gas optimization functions intended to reduce gas costs on the protocol by 25%.

Aave has had a good month so far

With increased borrowing and lending on Aave since the year began, its total value locked (TVL) has rallied, per data from DefiLlama. At $4.6 billion at press time, Aave’s TVL has grown by over 20% on a year-to-date basis.

Of its three deployments, Aave V2 has seen the most growth in TVL since the start of the trading year. At $4.04 billion at press time, the TVL on V2 has increased by 25% since the year began.

Conversely, Aave V3 has seen a 21% growth in TVL, while V1 has logged a 1% decline in TVL in the past 27 days.

Source: DefiLlama

With the general price correction in the cryptocurrency market, the network’s native token AAVE has rallied by 61% in the last month, data from CoinMarketCap showed. At the time of writing, the alt traded at $87.56.

How much are 1,10,100 AAVEs worth today?

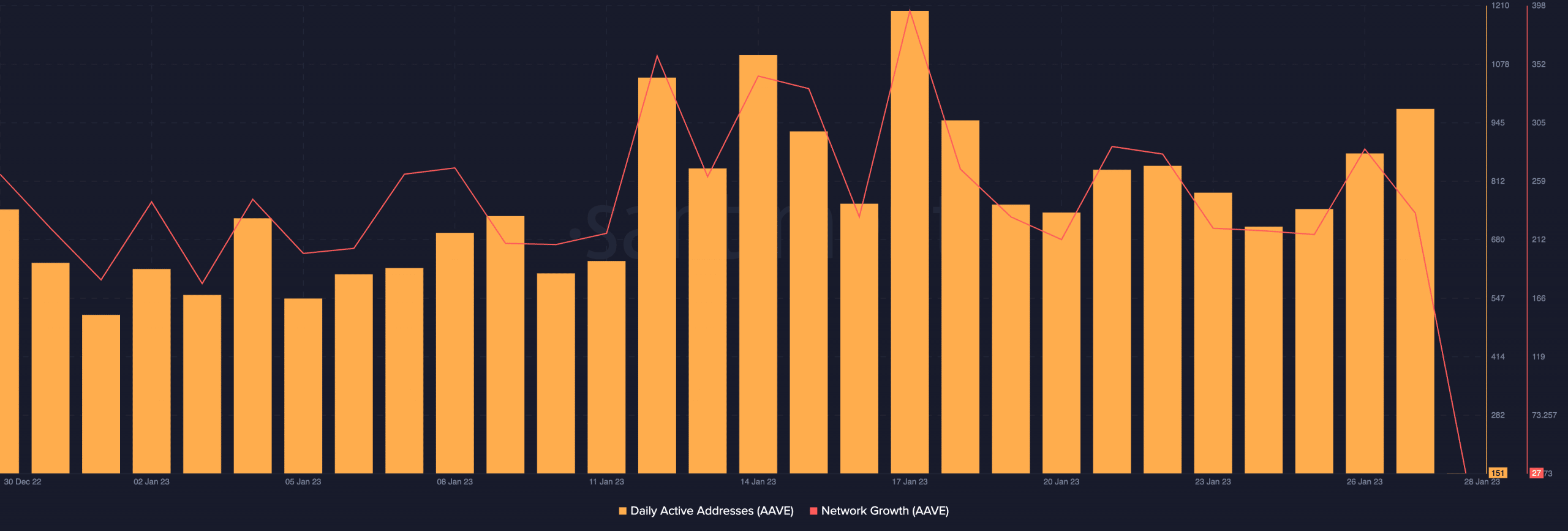

During the last 30 days, AAVE saw a significant increase in new demand as well as the daily count of unique wallet addresses involved in AAVE transactions. However, these peaked on 17 January, when traders began to close their open positions to trade profit.

Source: Santiment

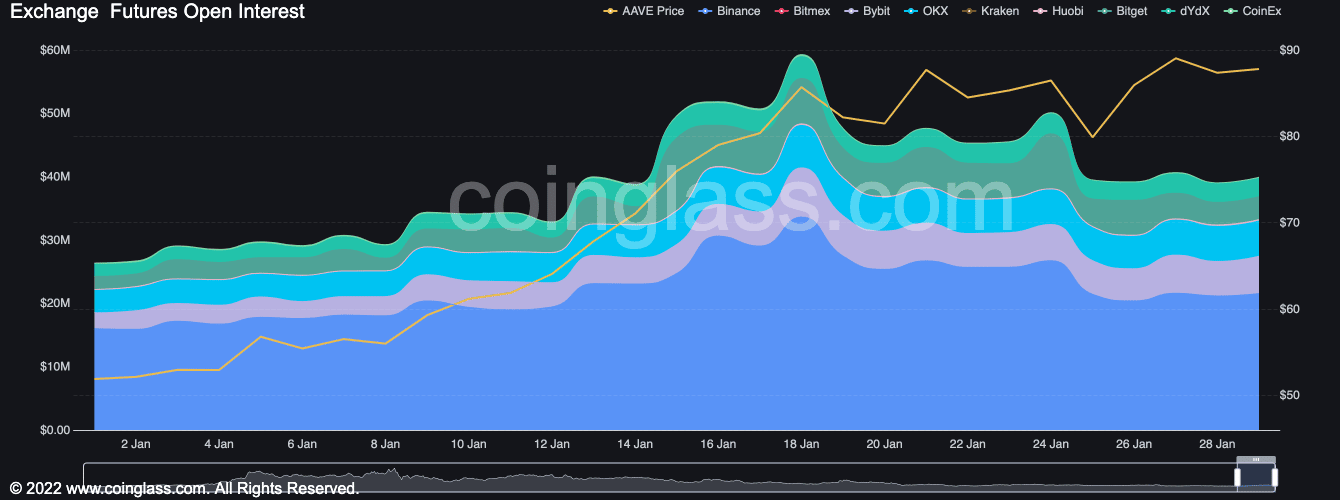

The decline in new addresses on the AAVE network and daily active addresses since 17 January coincided with a drop in the alt’s Open Interest, data from Coinglass revealed. Since then, AAVE’s Open Interest has fallen by 33%.

A decline in an asset’s Open Interest means that there is a decrease in the number of outstanding contracts or outstanding positions in the market for the asset.

In other words, it indicates that fewer traders are holding open positions suggesting a drop in market activity or a change in market sentiment.

Source: Coinglass

Be the first to comment