Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market experienced a notable recovery yesterday, showing gains across nearly all top 100 tokens by market cap. Despite this upward trend, significant liquidations totaling over $87 million occurred within the past 24 hours, primarily driven by $56 million in short positions, as reported by CoinGlass. Bitcoin (BTC) has risen by 2.45%, reaching $61,983, while Ethereum (ETH) increased by 1.88%, trading at $3,403.

These gains have led to significant liquidations, including approximately $30.9 million in long positions, underscoring the market’s volatility. This recovery comes after a recent decline, with Bitcoin dropping to as low as $59,780 on Monday. Analysts are now monitoring the activities of “accumulation whales,” large investors who may capitalize on lower prices to accumulate significant cryptocurrency assets.

Biggest Crypto Gainers Today – Top List

Today’s cryptoverse is a mosaic of investor feelings and market movements. With the Fear & Greed Index registering at 46, indicating cautious investor sentiment, the crypto market teeters on the edge. However, despite this, 62% of cryptocurrencies have surged in value over the last 24 hours, showcasing pockets of resilience and bullish momentum.

From Centrifuge’s robust 15.21% climb fueled by its innovative DeFi solutions to AIOZ Network’s impressive 13.54% rise driven by its cutting-edge Web3 infrastructure. Telcoin also saw a steady 6.22% increase, while JUST rose 4.37% within TRON’s DeFi ecosystem. These top gainers show a dynamic market responding to technological advancements and investor optimism.

1. Centrifuge (CFG)

Centrifuge is a decentralized asset financing protocol that connects decentralized finance (DeFi) with real-world assets (RWA). It aims to lower capital costs for small and mid-size enterprises (SMEs) and provide investors with stable income. By tokenizing real assets as collateral, Centrifuge enables access to DeFi liquidity via Tinlake, a decentralized lending protocol. It utilizes Polkadot for efficiency and cost-effectiveness, integrating with Ethereum to optimize liquidity pathways and support asset utilization within the decentralized ecosystem.

The network’s security relies on the Polkadot relay chain and a Nominated Proof-of-Stake (NPoS) mechanism. This selects data collators for processing and securely storing network data, ensuring high security and resilience against censorship.

Centrifuge’s native token, CFG, provides liquidity, rewards investors, and facilitates the conversion of RWA into NFTs through Tinlake. Additionally, the token is essential for transaction fees and incentivizing network participation.

With rising sentiment around tokenization, an RWA index is a great way for investors to gain exposure to this asset class.

There’s no better duo to pull this off than @indexcoop and @_Fortunafi.

We’re excited to be a part of it! https://t.co/YNRtANZSCd

— Centrifuge (@centrifuge) June 19, 2024

Currently valued at $0.553651, CFG has jumped 15.21% in the past 24 hours. Despite this surge, the gainer has low liquidity, with a volume-to-market cap ratio of 0.0047. The 14-day RSI is at 55.18, indicating neutral conditions, and the token has had 10 green days in the last 30, representing 33% of the month.

The price volatility over the past 30 days is low at 16%, and Centrifuge is trading 42.09% above its 200-day SMA of $0.38884. Over the past year, the token’s price has doubled, increasing by 100% and outpaced 61% of the top 100 crypto assets.

2. AIOZ Network (AIOZ)

AIOZ Network is a comprehensive infrastructure solution for Web3 storage, decentralized AI computation, live streaming, and video on demand (VOD). It leverages blockchain technology and peer-to-peer (P2P) networking to provide efficient, scalable, and decentralized services.

The platform aims to address the increasing demand for reliable and secure digital content delivery, which legacy infrastructures struggle to meet. By utilizing a network of AIOZ Edge Nodes, the platform ensures secure content delivery and incentivizes participants with $AIOZ tokens.

AIOZ Blockchain combines Cosmos’s robustness with compatibility with the Ethereum Virtual Machine (EVM). It uses the Tendermint core and a delegated Proof of Stake (dBFT) consensus mechanism to offer high transaction throughput, speed, and scalability with minimal fees. This multichain structure integrates seamlessly with other EVM and Cosmos-based chains, enabling fluid asset and data transfer across different blockchain ecosystems.

$AIOZ trading is now live @bitfinex:https://t.co/yqogJ26oj5

Special Trading fees for $AIOZ:

▪️ No fees for makers

▪️ 4 bps fees for takers

Explore @AIOZNetwork in #Bitfinex blog:https://t.co/5fbXhrMHN3$AIOZ https://t.co/2A3JufvbcM

— AIOZ Network (@AIOZNetwork) June 13, 2024

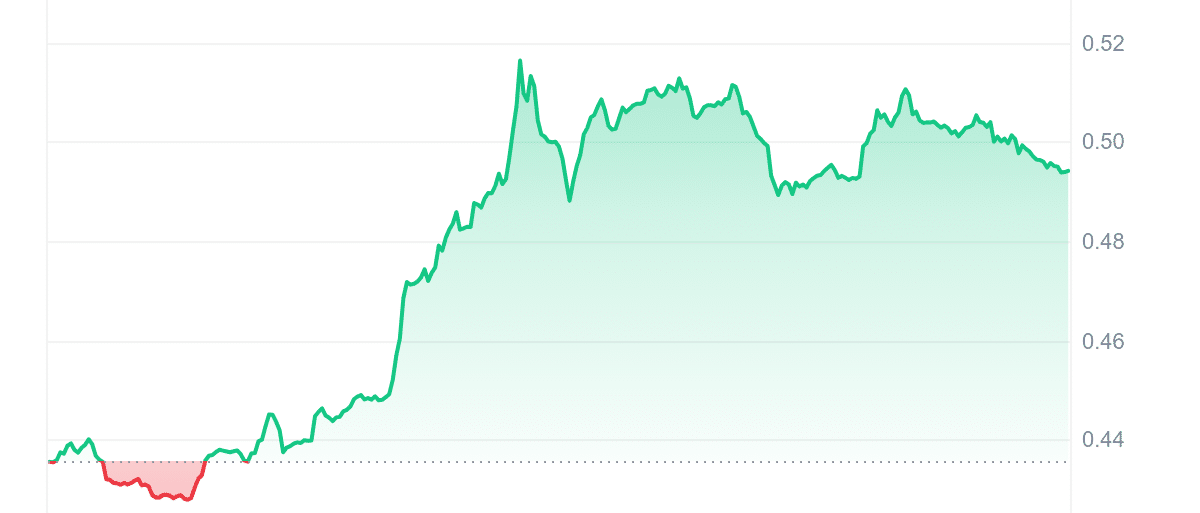

AIOZ is currently at $0.494788, up 13.54% in the last 24 hours. It has medium liquidity, indicated by a volume-to-market cap ratio of 0.0168. The 14-day RSI, at 48.22, suggests a neutral stance, implying potential sideways trading. Over the past 30 days, the token has had 8 green days (27%), indicating a challenging period.

However, its 30-day volatility is low at 18%, indicating reduced price fluctuations. Impressively, AIOZ Network is trading 1,079.34% above its 200-day SMA of $0.041955. Also, over the past year, the token has surged by 3,416%, outperforming 97% of the top 100 crypto assets by market cap.

3. WienerAI (WAI)

WienerAI has reached a significant milestone by surpassing $6 million in its presale. This achievement solidifies its role as a leading AI-driven meme coin in the crypto market. The project blends advanced technology with a whimsical wiener dog mascot, simplifying crypto trading. At its core is an AI-powered trading bot that navigates market complexities, offering optimized opportunities and insightful analysis.

Don’t be the one chasing your tail! 🐾

This is your chance to get into WienerAI before takeoff! 🌭🚀💰 pic.twitter.com/aSYEYDYPD3

— WienerAI (@WienerDogAI) June 25, 2024

The AI and crypto sectors are experiencing robust growth, with AI technologies projected to reach a $1.3 trillion market in the next decade. WienerAI stands out within the AI-themed cryptocurrency niche, valued at $32.86 billion. Its intuitive platform empowers traders with predictive tools and a straightforward interface, eliminating the need for extensive technical expertise.

During this presale, WienerAI tokens are priced attractively at $0.00072 each, offering early investors an advantageous entry point. This strategic pricing sets the stage for potential appreciation post-listing on a major exchange, enhancing WienerAI’s visibility and liquidity and boosting investor confidence in the project.

With 20% of its token supply allocated to staking, yielding a competitive 190% APY, WienerAI aims for sustained growth and early adopter rewards. The momentum of WienerAI’s presale underscores its emergence as a leader in AI-driven crypto, poised for continued expansion and innovation.

Visit Wienerai Presale

4. Telcoin (TEL)

Telcoin is the native medium of exchange, reserve asset, and protocol token of the Telcoin user-owned, decentralized financial platform. It enables end users to seamlessly access and power a global suite of user-owned, decentralized financial products. TEL incentives coordinate market participants, such as telecoms and active users, to provide value-added services to end users. The goal is to offer every mobile phone user globally fast, affordable, user-owned financial products.

Its launch product, Telcoin Remittances, offers high-speed, low-cost digital money transfers to mobile money platforms and e-wallets globally. The platform operates on the Ethereum blockchain, with TEL being an ERC-20 token. Security is enhanced through a 2-for-3 multi-signature Ethereum wallet, allowing users to store and transact assets without complex private key management.

When’s the last time you set foot in a bank? How many hours a day do you spend on your phone?

As our lives become increasingly digital, #Telcoin recognizes that financial services should reflect modern lifestyles and increased access to the internet. pic.twitter.com/ras348F1lg

— Telcoin (@telcoin) June 25, 2024

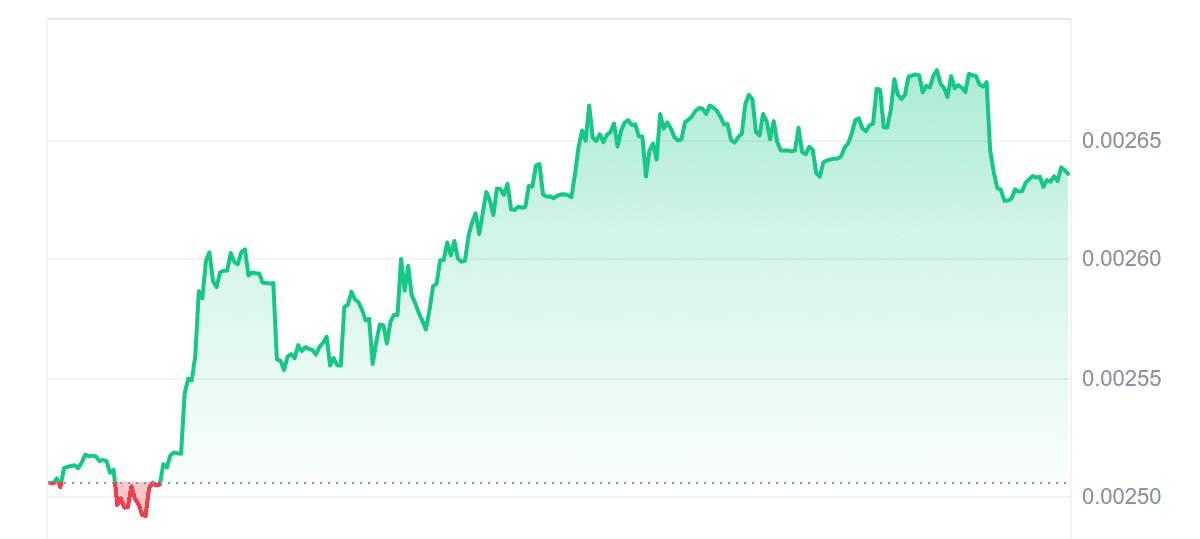

The current price of Telcoin is $0.002646, reflecting a 6.22% increase in the last 24 hours. Despite having low liquidity, with a volume-to-market cap ratio of 0.0022, Telcoin’s market cap stands at $233.28M, with a 24-hour trading volume of $516,206. The 14-day RSI is 54.75, indicating neutral momentum. Over the past 30 days, Telcoin has seen 12 green days, making up 40% of the period.

Telcoin’s 30-day volatility is relatively low at 14%, trading 47.92% above its 200-day SMA of $0.001789. Over the past year, Telcoin’s price has increased by 80%, outperforming 51% of the top 100 crypto assets by market cap. This consistent performance highlights Telcoin’s potential as a stable and promising crypto asset.

5. JUST (JST)

JUST operates as a DeFi ecosystem on the TRON blockchain, providing interconnected products to enhance financial accessibility and utility. It focuses on its flagship product, JustStable—a decentralized multi-collateral stablecoin lending platform. This platform allows users to collateralize assets like TRON (TRX) to mint USDJ stablecoins via collateralized debt positions (CDPs) pegged to the US dollar (USD). USDJ serves various roles within the ecosystem, facilitating transactions and enabling governance participation.

Beyond JustStable, JUST expands its offerings with JustLend, a TRON-powered money market protocol enabling liquidity provision and low-interest cryptocurrency loans. JustSwap is an automated market maker (AMM) platform for trustless TRC-20 token swaps. It enhances trading efficiency and liquidity on the TRON blockchain by facilitating the creation of liquidity pools.

TRON’s delegated proof-of-stake (dPOS) consensus mechanism bolsters the network’s security. Within this framework, elected super representatives validate transactions and maintain network integrity efficiently.

🔥#JustLendDAO is now offering supply APY over 11% for $JST

👉https://t.co/2GyoChYqEN https://t.co/mx0D0r6Tlf

— JUST Foundation (@DeFi_JUST) June 25, 2024

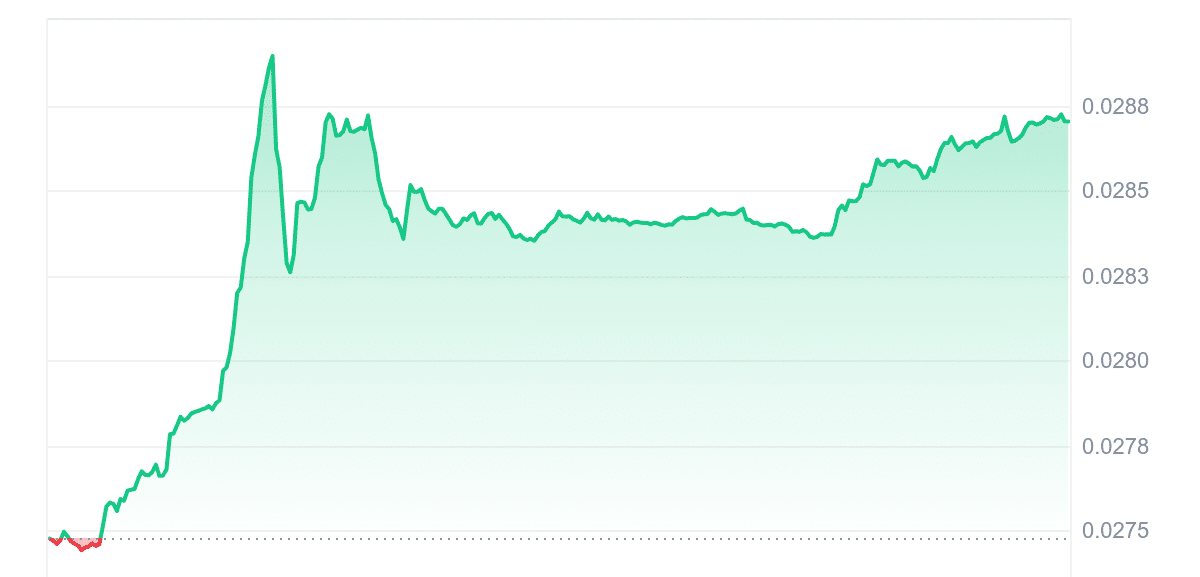

JST has demonstrated a steady price increase, trading at $0.028719 with a 4.37% rise in the last 24 hours. Its high liquidity ratio of 0.0915 and market cap of $284.32 million reflect active trading and investor interest. The token’s 14-day RSI of 50.56 indicates neutral market conditions, suggesting potential sideways movement.

Also, its 30-day volatility of 4% further indicates minimal price fluctuations. Trading above its 200-day SMA by 6.61% and showing a 31% increase over the past year, JUST has positioned itself as a stable performer in the DeFi sector.

Read More

PlayDoge (PLAY) – Newest ICO On BNB Chain

- 2D Virtual Doge Pet

- Play To Earn Meme Coin Fusion

- Staking & In-Game Token Rewards

- SolidProof Audited – playdoge.io

Join Our Telegram channel to stay up to date on breaking news coverage

Be the first to comment